Listen on: Spotify | Apple Music | Google Podcast

Background

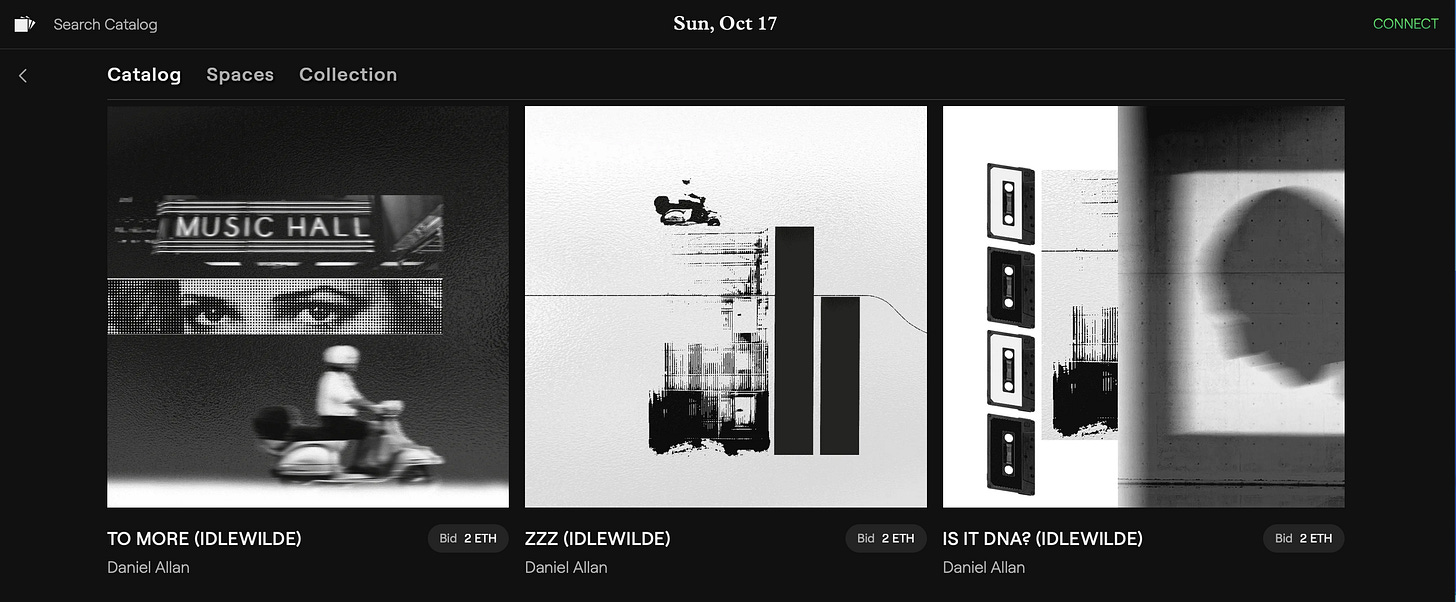

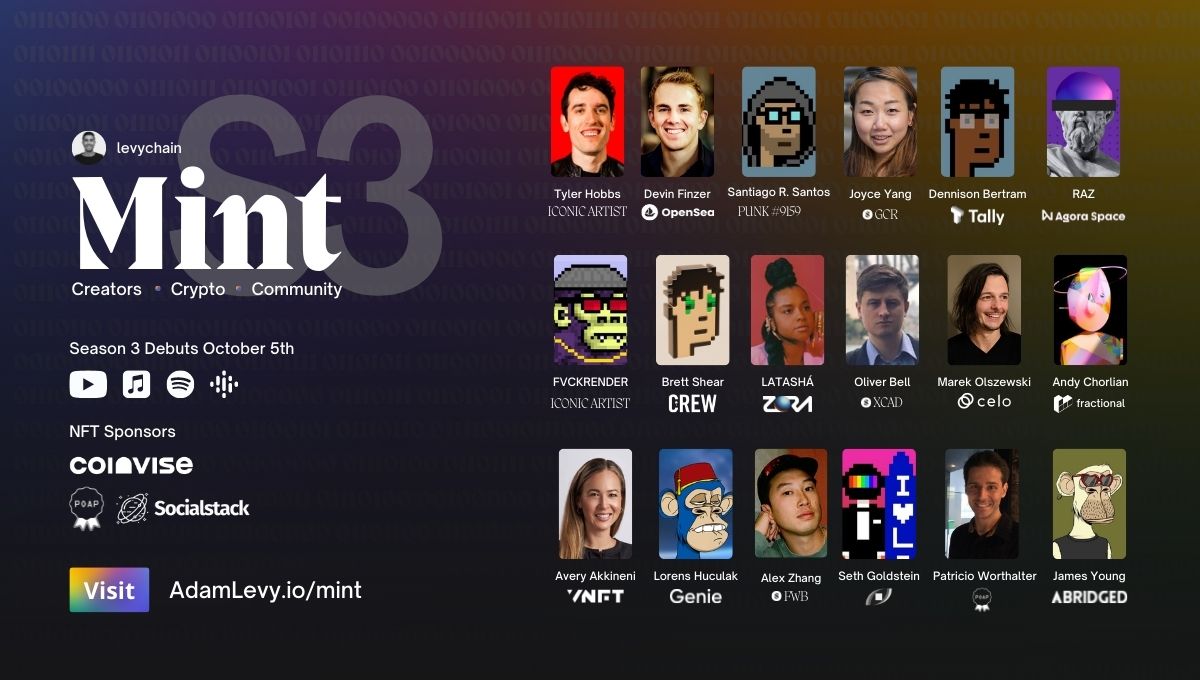

Mint Season 3 welcomes Santiago R. Santos, Owner of Punk #9159 🤖.

In this episode, we talk about:

- 0:00 – Intro

- 2:38 – Growing up in Mexico

- 6:05 – Life After ParaFi

- 10:30 – Getting Hooked on Crypto

- 17:22 – Defining an Investment Thesis

- 25:01 – The Future of Social Tokens

- 30:37 – The Creator Economy

- 36:33 – The Intersection of DeFi and NFTs

- 42:08 – Lifelong Learning

- 49:44 – What Will Eat Web 3.0?

- 56:26 – Outro

…and so much more.

Thank you to Season 3’s NFT sponsors!

1. Coinvise – https://coinvise.co/

2. POAP – https://poap.xyz/

3. Socialstack – https://socialstack.co/

Interested in becoming an NFT sponsor? Get in touch here!

Intro

All right, Santiago. Welcome to mint. How are you feeling, man? Thank you for being on.

Hey Adam. It’s great. Great to be here. Thanks for having me.

You got it, man. I think this is round two of our conversations. First time I chatted with you was on the last show of blockchain and booze, and here we are today on Mint. So let’s just jump right into it. Okay. Tell me a bit about yourself, but more specifically, what were you like before crypto?

Oh, wow. That’s a good question. About myself, I grew up in Mexico I guess. And to me that’s been a hallmark experience of understanding how broken the world is in many ways. I think a lot of people that come to crypto have a better appreciation of why things matter and why we’re building this. And so after that, I spent most of my time in finance, I studied game theory. And for me, when I discovered Bitcoin in 2012, what drew me was the Nakamoto consensus. I emailed all my game theory professors and said, wow, this is like a new chapter in game theory. We’ve got to update all our books. But of course, they dismissed it. But for me, it’s always been this idea of, what I obsessed about is friction. I just can’t stand it. When I go to the doctor, and I get to fill out 20 forms over and over again, or when I need to send a wire or when I need to travel, and I just generally think that that for me has been my framework for understanding investment opportunities. When I see friction, wherever it is, Then I sort of understand, okay, there ought to be a better way to do this or that. And I think like crypto, when anyone that has used a stable coin to send money, doesn’t want to go back to the sending wire transfer. And so for me, it’s sort of an inevitability that we’re moving in this direction. Anyone that is critical of crypto hasn’t used it. I think like, we’re trapped in the state of the world where it was just Bitcoin and you didn’t have a lot of usability in the systems. Whereas today, we are entering a state of the world where crypto applications are providing equal or more functionality across the board than traditional systems. And that’s, I think like any piece of technology that gets adopted it is successful, it needs to provide a 10 X better improvement. Places in crypto are faster, better, sometimes cheaper, but depending on how you define those things, it’s very subjective I understand that. But that’s me. And I know I am shifting toward giving you an answer that is related to crypto. Candidly, it’s been hard for me not to obsess about this stuff, because I think at a very primitive level, it pisses me the fuck off that, people that need it the most are hurt the most in a lot of these systems that have friction. When you think about money, people don’t have access to credit. People can’t charge exorbitant fees and to you an $8 wire transfer fee is not much, but you know, it is a lot for other people. And so you know, I think a lot of consumer surplus, a lot of benefit will come from crypto and it’s going to impact people that need it the most.

Growing up in Mexico

No look, I’m Jewish and the $8 fee for a transfer hurts my pocket. And I also like part of the business model of mint is since the get go, I always wanted to make all revenue on chain. So every single season I issue NFTs as sponsorships, and I also try to pay the people who help basically management in crypto, but all these like transaction fees eat up into that. So I still use Venmo sometimes, and I still use other platforms, but I hear you, but let’s, let’s revert back to a key word that you said, okay, friction, a core theme that you said really, really resonated with you growing up. And I guess my, my next question to you is like, what was it like growing up in the Santos household? Like where you, where you just like always trying to fix stuff, or you always you’re like, mom, dad, friction like I gotta fix this it doesn’t make sense? Like what was that like growing up?

Yeah. It’s funny because I just spent this weekend going back home. Yeah, I think so. I was the youngest two older sisters and I dunno, I do obsess about inefficiencies. I guess you’d have to ask my parents. I was probably a Royal pain in the ass. But I love to travel. I think understanding how different people view the world has really high credit for my parents because we didn’t have a lot of money growing up, but we did travel. The two buckets where we spent money with travel and education. And my parents were always there for me. And so I think like growing up in that environment allowed me to like, feel comfortable taking outsized risks, because I think ultimately you want to have a cradle where if shit really hits the fan, ultimately you have a support network that you can go back to and say, Hey, you know, you know I lost it all or whatever, but I think ultimately like you have a support network. And I think it’s super important. I’ve always felt really comfortable taking risks. Because for me, it’s like this idea that you can constantly reinvent yourself. Like you have the mental faculties to then say, you’re going to figure it out. And then look, , I’ve been riding crypto. At times I had been terribly wrong. I made a ton of mistakes, but I think the key hallmark and I always credit my parents for this is inspiring me, this idea of just doing stuff that I think matters and not being very complacent. And I think that’s where I just obsessed about when there’s friction. It’s part of this notion that I want to do stuff that one always matters and can have an impact. And two, I don’t think I’ve ever told anyone in a public context, but my middle sister is sick and she’s been sick for like eight years. And we didn’t really know what she had. She has a rare form of epilepsy. And going through that process, to me, was very difficult because it’s not like my sister is missing an arm or leg. She’s like there, but she’s not there. And so at the same time for me, it was really difficult because you’re left wondering it could have been me. Probabilistically genetically, like I don’t know, there might be some genetic expression that happened when she was growing up and just triggered this disease of sorts. And so I vividly remember, cause it was just happening when I was at a venture fund investing in like startups and software startups. And I said, does this really matter? Like, okay, do I want to go out and invest and find the next Salesforce? Like, trust me like software as a service has been huge. And it’s been a big transformation, but for me, I was doing crypto by night and I said, well, I’ve seen this entire world, and I think it’s going to have a massive impact on a lot of things. And to me that was like a big catalyst to saying, okay, I just really just want to focus all of my time because I don’t know how much time I have to the things that I think will ultimately matter the most because you know, like it it really centered me and put a lot of perspective into my life around you know, we’re incredibly lucky. And I think, when you see other people that are not, then it really kind of centered in line with my values and principles and how I dedicate my time.

Life After ParaFi

What a unique experience to have underneath your belt. Obviously I mean, health is number one, right? But how that kind of translates to how you approach investing and how you approach your professional life and how you value things. And the choices that you make and the teams that you contribute to, all these things kind of trickled down to who you were growing up, the experiences that you had and what you deem as valuable. And that also kind of pivots to my next point of you being at ParaFi for a while, and investing through ParaFi now, you left ParaFi. So I guess, what have you been up to post ParaFi?

Well, first of all, I had a great run at ParaFi. I mean, I think I’m super proud of what we did there. And you know, a lot of it is we think we built a fantastic team. Anya Nick Mika Ben was my partner and Adrian, like we really just grew the team. And when I joined, we were a team, we were in a we work in San Francisco and we had very little capital, but we have really strong backing from folks like Bain and KKR. And I think ultimately that was a really fun ride. We were, I think, the first vertically focused crypto fund. You know, most crypto funds are just very general, right? So we were not going to just invest broadly in crypto, but we are focused. We think that DeFi is going to be transformational, and we just sort of like focused on that. I credit a lot of our success to that because the founders knew that we were active users in these systems, like early beta testers. And so I think that was a fantastic ride. So what I’m doing now, I see this massive opportunity of a convergence of like three things, really like DAOs as a broader circle, within that you have like a metaverse or something that you have like very interesting stuff happening in NFT land, which is sort of the Trojan horse of crypto. Most people enter, they buy NFTs. Over the last eight years, I’ve tried to explain why crypto to people and it’s been difficult, but NFTs make it very relatable because people love collecting. And I think this is going to be an onboarding mechanism for millions. And then you have gaming attached to that. So what’s happening in Axie has been probably as you’re showing the world and even game studios of how powerful this can be, and then you have DeFi. And so I think there’s going to be a convergence of all these three worlds in the Metaverse, which we’re spending more time in the digital world. And so I’m excited about that. I’m investing as an angel, I’m advising people, helping teams and founders in any way that I can. And then, you know, maybe I’ll launch podcasts, who knows? I think where I want to focus more of my energy, part of my energy is creating just pure educational content without any agenda. I think it is helpful for people because unfortunately people get called up on stage on CNBC and Bloomberg are always talking about price. They are always talking in a very defensive context. I think when you inherently talk about crypto, most of the narrative has always been, we’re going to explode on Wall street as we know it. And we’re gonna like, you know, this very crypto punk attitude. And I think it’s defensive because we all know that, look, we’ve all been in these dinner conversations and Thanksgiving and what have you and people like, oh, this is a scam. This is drug money. This is silk road stuff. And it’s difficult to overcome that. The natural response would be very defensive when someone is constantly asking you questions, but I think generally more and more people are very interested now in crypto because of NFTs or gaming or what have you. And I think there’s an opportunity. All we need to do is just explain this technology for what it is, and go out and encourage people to use it and that’s it. We don’t need to do anything else. I don’t care if doge is a dollar or $5 who like, who fucking cares. Like when you talk about that, it really discredits us because when people see these charlatans and go on TV, naturally, it’s like, oh, this is like the guy that couldn’t get into investment banking that wasn’t successful in wall street ended up going crypto was lucky and now he thinks is a genius. And I think that that doesn’t serve as well because ultimately there’s a lot of really smart people here that don’t have the microphone, but that will be much better stewards of communicating this technology to the broader world.

So if you had a podcast, what would be your first episode? What do you think? What topic?

Oh, that’s great. I mean, isn’t that what you’re going through now? I don’t know you have more experience than I do on this, but I would probably bring on Ray Dalio. Someone that’s been critical about this stuff. But he’s sort of gone through the journey of being critical and skeptical. And now, as I understand, I have exposure to it and understand what went into that. And just talking about the hard stuff, like what took him so long. Maybe I’d bring on someone that is extremely critical a bit. I don’t know. I think those are the kinds of discussions that we need to have.

Getting Hooked on Crypto

Why did you hop on the bandwagon of crypto so quickly versus someone let’s say like Ray Dalio , who took his time kind of thing? Like what did you see that you think others missed early on?

I dunno for me, it was just playing with it. I think I said, this is interesting. It sounds a little crazy. Like I love Harry Potter, I guess. And so, like the magical internet money headline on Reddit forum, like really caught my attention. And then I said, well, I want to try this. Because again, I said remittances to me were an immediate use case for Bitcoin. I said I’m going to, I’m going to go out and try to buy like a bunch of Bitcoin and send it to like 20 people. And if they can convert it, I think it was 10 or 20, and if they can convert it to local currency Pesos then you’re immediately displacing the remittance flows. Like you kill Western unions of the world who are charging you know, 8-10%. And so to me, the hallmark of why I became increasingly interested in this technology is just playing with it, like using it. That’s what led me to DeFi early. That’s what led me to like stuff like Axie like gaming and NFTs. That was probably what was the most interesting to me. The other component is like open source, because I was investing in open source software at this venture fund. This was at a time where it was kind of like how do you monetize stuff that is inherently free. Because open source, like Linux, you just developed this piece of code and can be copied. And it’s very counterintuitive to say, how am I going to monetize something that, you know, is inherently free and open to the world. It sort of comes from like this archaic model, like IP and protection, but, but our thesis there was like a lot of value can be created. Stuff like Mongo or fresco and some of these systems, like red hat, are open source, but they provide value added services or they attract really smart people to develop stuff. And when I saw Ethereum, like to me, that was the aha. It was like, oh, okay. Open source software development is really powerful because it attracts smart people in this collaborative environment, just come and go. Particularly Linux, but you have two problems with that. One is continuity. Like, how do you actually pay these people and incentivize them to continue to develop? . A lot of traditional open-source development is being subsidized by people at Google and Facebook and Netflix that just have spare time, right? Google has this policy, people work on their pet projects for a day. A lot of it is going into open-source development. And the second one is like accruing value to contributors, right? Like mince himself didn’t actually make a lot of money building this system where the developers like Tim Berners Lee didn’t capture as much money as you would have thought, right? You would’ve said, oh, this, this supposed to be the richest guy in the world. Cause he just literally developed the internet, but it’s been like the top aggregators that accrued most value. And so when I saw Ethereum I just said, okay, this generalist smart contract platform can solve a lot of the problems with open source development. And I think what is most exciting is, I didn’t know what DeFi was going to be. The bet there was okay, well, really cool stuff happens in open source development. The pace of innovation and iteration is much, much faster. It’s compounding, and then when you layer on top of that really good token design and economics, then it just like is going to be explosive. And I think that I was lucky that I was in San Francisco at the time. I was investing in open-source software, and I saw it early on, because I’d just been investing by night and crypto and was obsessing about it. I guess the last point I would say is, to this day it is still very encouraging that most of the smartest people of a different era are highly critical of the space without really, truly taking time, I think as far as I understand it, when I talked to them about understanding this technology. And to me, it’s always been like, anytime someone really has a visceral reaction to something, it’s like, well, just probe there, right? Because like nothing is nothing is truly obvious in this world. I think I’ve said it before, but when you think something is obvious, it’s probably not. It’s your perception of it. And you probably do not understand it to the level of granularity because nothing truly is. I mean, at the end of the day, everything is in the state of probabilities. People love to think in binary terms, people love to dismiss stuff because it conflicts with their worldview or it conflicts with their portfolio and their bags or whatever. And I understand that you might not take an interest in something. And I understand that some people might say like buffet say, Hey, look, I, I’m not a technologist, so I’m not gonna invest in the internet. I’m just going to stick to my guns and just buy stuff that I eat and can touch and use every day, my crispy cream and all this stuff. That’s fine. I mean, he’s a great investor, but I think in this state of the world, I think new paradigm shifts are compressing. The state by which the world is changing is radically accelerating largely because of the internet, largely because we’re Uber connected now. And I think the pace of information is this being disseminated and created and then disseminated and an accelerating pace. And so new ideas get adopted and iterated much faster. And so there’s sort of this analogy, like if you were to put someone that was born in the 11th century, in the 16th century, and you just sort of tell him, teleport him to the 16th century, he would have been like, okay, kind of the world has changed a little bit. Like, you know, people kind of do the same stuff, but it largely would have been like, yeah, he would be surprised. But if you do the same, to someone that was born in like the 18th century, and you teleport that today, you’d probably have a heart attack because things are radically different. And I think that timescale of how things are even like your grandmother, or even your parents, it’s really hard for them to understand some of this stuff. It’s like, what do you mean you’re playing this virtual game and what do you mean about punks? Like, my parents were so critical when I was buying punks . I said, all you gotta understand is that like, you know, it’s just an image. And I think like that to me it’s been from first principles, it’s been what has guided my level of interest into probing into certain stuff, when people are really critical about something, because they probably don’t understand it. And there’s probably a lot of substance there. And it’s sort of the analogy of like, if you remember bookstores like Barnes and noble when you walk in there, you naturally like have an affinity towards walking towards aisles that you love, whether it’s comic books or fiction or nonfiction. But you know that there’s people that are spending time in other aisles. . Like there are people that are in that corner of the bookstore that you’ve never ventured out to. And you kind of wonder, like, why are people there? There’s clearly some value that other people are seeing. So wouldn’t it be in your best interest to just occasionally just go up there, ask people questions, like, what do you like here? And then if you don’t like it, it’s okay. You can go back your aisle, but I think there’s a ton of value in just constantly having that intellectual curiosity to venturing into a particular aisle at the bookstore and the library, but you’ve never allowed yourself to go into, because you never know. You might love Stephen King or you might love comic books, or you might love non-fiction, but allowing yourself to be in a position in sort of this frontier. It is sometimes uncomfortable to venture into places where you have no experience. And I think a lot of people will experience that in crypto. They come to this world and there’s all these topics and lingo, and it can be really daunting. But nonetheless, like anyone from the outside in must be realizing at this point. Okay. There’s really smart people here. Okay. There’s a lot of value being created. If you’re an artist looking at NFTs, you’re saying I probably should have an NFT strategy.

Defining an Investment Thesis

You know, when I walk into Barnes and noble. The first aisle I gravitate to is Starbucks. That’s where my fat ass goes to get like a blueberry muffin. Like you gravitate towards the comic books, I gravitate towards the blueberry muffins. Now all jokes aside. I want to talk more about I guess like you’re investing strategy. The more I consume your content, the more I listen to you on podcasts, the more I read your tweets. You have a very philosophical approach, I think, to the investments that you make. But also you’re very strategic. And beyond being a stellar writer on Twitter and not to toot your horn, but you do a good job conveying thoughts really clearly. What are some principles you live by as an investor? And we talked a little bit about this with your sister, right? But I want to dive a little bit more into it. Like what are some core foundations you hold yourself accountable to, if any, before making a bet?

Yeah. It’s a great question. First and foremost, it’s stuff that I can see myself using. I love to invest in something I can use. And so that’s one. The second one is, just always finding one or two or three or whatever it is, things that I can help a team with. And if I can’t see that, then I tell them, look, if you’re better off taking money from someone else. So I always want to understand ways that I can help a founder. And a lot of times I just come to them and say, Hey, look, these are the things that I can probably help you with. And these are the things that I can’t help you with. And so there’s alignment. Those are the best relationships. I was talking about this the other day and yesterday tweeted about this. It’s sort of like this idea of diversification and I think for me, it’s served me well just to be more concentrated. And this is not about the quantity of investments. It’s really dramatically focused on things that I think will have, on a relative basis. You always have to think about where my capital is going to be optimized. And so you know, I like not spreading myself too thin. I mean, at ParaFi we were focused on DeFi. Today, I’m increasingly focused on investing a lot in games and NFTs, and still DeFi, but for me it’s been just helpful to know the people that come to me or I go to them understanding the things that I’m investing in, because there’s a lot of leverage that I get for just being very focused on a particular theme and observing trends and how the space is evolving and then leveraging that across. And it’s not sharing insights between protocols. It’s just more so from that vantage point, just being in a position where I can observe what actually is going on. And so that serves me well. So those are sort of the main things that I tell founders. At the core of it is again, you know, it needs to have impact. I think that’s been the case for most crypto investments. I think a lot of times understanding what motivates a founder is super important. Like why are they building? And getting to know them before I make an investment. Because a lot of times, you know, it’s unclear if a founder is going to grind it out through a bear market. And I just want to always see what really motivates them. And I think the founders I’ve had the privilege to back, I think a lot of, most of them, if not all of them have this growing desire to. It’s pretty awesome to be in my position where I get to talk to people that have thought about problems for their entire life and have way more experience in domain expertise. And then it’s you know, just super encouraging to hear them say, Hey, look, I want to truly transform how, you know, banks operate. Or how derivatives work or what have you. And so yeah, those are probably some of the main things.

So you see yourself using it. That’s one principle, the level of impact that it has. The founder’s conviction and their belief and their underlying like motivation and inspiration to solve that problem. Those are like the three main kinds of takeaways that I got, but they know you’ve been investing since early 2012. And being a good investor is kind of revisiting your thesis in altering different variables. From 2012, to like where we are today, one, when was the last time you revisited that thesis and how has that kind of, how has that thesis or hypothesis kind of evolved over time?

Yeah, all the time. Because when you think in probabilities, you inherently need to constantly process new information and update your thinking, right? This goes back to, I never think in binary terms. There is a state of the world if bitcoin is not successful at all, because, you know, who knows how the security budget of Bitcoin is going to work after a certain point where block rewards diminish. So, naturally, I think, you know, you constantly need to think about that. And there is a version of this world where Ethereum is not as successful. There’s also not a zero sum game, I think, in all this space. There’s going to be a lot of value created. So thinking in maximalist terms, I’ve never had it. I’ve had inclinations naturally where I’m investing a lot into the Ethereum ecosystem. Now Solana, and it’s mostly Solana and Ethereum, but you always need to constantly think in probabilities. So, yeah, I made a lot of mistakes. I think the key learning, for instance, in 2017, I was investing in a lot of things like higher up the stack protocols and applications, a lot of which had dependencies, meaning without a, without a highly credible throughput, layer one. Well, a lot of social use cases are not going to work because it’s super expensive. So that’s one example where like, there’s this idea, Hey, let’s just decentralize everything. No, you don’t have to decentralize everything. Cause you need a wonder, like what are you actually gaining? And does it really matter? It works for money, right. The only reason you want to have DeFi is because it minimizes counterparty risk. And that is super valuable to a financial participant, right? Like you know, not relying on a middleman that is going to approve stuff ,that’s going to take time and has counterparty risk because that matters. And so having a highly transparent financial system, that is extremely valuable because the stakes are high. But should you be creating a decentralized Uber? I don’t know. Decentralized Airbnb? I don’t know. Can some of those applications borrow some elements of crypto? Probably. And so I think those were some of the mistakes I made in 2017 was just investing in stuff that went too far ahead of its time . And the reason I kind of then understood that and probably stayed away from a lot of them was because it had a lot of dependencies. You need to have a place where you can store these files correctly. So you need to have something like IPFS and it wasn’t around. You needed to have an L two that could credibly support a lot of transactions, you didn’t have that. Or something like a more throughput blockchain like Solana, which didn’t exist. And so I think like, for me, it’s been investing in stuff that is gaining traction. Like, you know, what drew me to NFTs and revisited that and gaming was just seeing it. It was hard to dismiss the level of attraction something like Axie is getting or yield Guild was getting. And so for me, if I were to just distill it in one is just, you know, in this space, it’s great because you can join the discord channels and understand on chain, how things are working or not working and how much traction they’re getting. All you need to do is probe, and what’s super fascinating is like this data exists and is available to anyone. And so one of the learnings I had was like coming into the space from church, from markets, like I was at JP Morgan and then just investing in venture, which is super competitive asset classes. You sort of think that like, all the opportunities are already arbed out. There’s someone that has better information than you. And so that skepticism for me was kind of difficult to overcome because sometimes I look at something and say, wow, like, how is it that no one has thought about this before? Or why am I not the consensus here? Like, what am I missing? And ultimately I just came to the conclusion that a lot of people don’t do the work. Even though the data is paradoxically, like just open there for anyone to observe. Like how many people actually like using chain analytics? And like, to me, that’s just incredible, right? You’re not relying on the SEC like 10 K 10 QS. Like all this data is perfectly transparent, available to anyone at assess and inspect. All you gotta do is look. And so to me, like a long winded answer, I don’t invest in stuff that I struggled to see any remote traction or has too many dependencies because the opportunity cost is that there is stuff that is getting a ton of traction and just is out of favor or like people haven’t discovered it. And so in the juxtaposition of these two worlds, stuff that, like Cardano, that has never shipped or just shipped for a long time you’re sort of wondering, like, why these things have any value or have any traction. And whereas you have this entire world and ecosystem that is exploding in usage and traction. And so that really just has sharpened my view on where I put my capital.

The Future of Social Tokens

You’re very much at the type of person that says, just look at the data. Like I don’t invest with emotion rather with logic and rationale. And I know other people make investment decisions based on what their gut tells them. And I think it’s interesting to hear everybody’s point of view. One thing you brought up that’s super interesting, and this kind of takes me back. I’m not going to quote the date. Before the roads, there were the cars, and everybody built the vehicles that drove on dirt before building the highways and the foundation that allowed for a smoother finish. And it feels like we’re first now building the roads, the infrastructure layers like IPFS like Ethereum, all these platforms that are composable and could be built on top of, and now we’re like seeing the rise of the cars and all these different cars being built to use these roads, you know? And I think it’s super applicable to kind of your, your analogy of, we gave people the foundation, right? Let’s see what they do with it. And I’ll bet on the ones that align with my thesis as an investor. I want to take the conversation now to social tokens. And the reason why I want to talk about social tokens, it’s a topic that I bring up with everyone on the podcast. It’s why mint exists. It’s the impetus of where crypto meets the creator, in my opinion, along with enough NFTs along with DAOs , et cetera, et cetera. But I quit my job at DraperGoren Holm, because I had the opportunity to do a social token for a DJ. Okay. And we put it on the back burner because just the tools and platforms weren’t necessarily there to bring it to life, but it got me thinking of social tokens as an alternative investment class. And particularly the first thing that comes to mind is like, FWB. Okay. So I wanna, read a couple of stats from someone the top performing social tokens that I came across and get your opinion on something. So Allie coin which is the coin of Allie McPherson. She was on episode one season, one of Mint. December, 2020, her token hovered around 20 cents. And with its recent peak hitting $53 in September, 2021. Play coin, David play, season one, episode 10, I think of Mint, April 22nd, 2021, started at around $4.50, and now it’s hovering around $40. FWB which I’m looking back to may 20 20 hovered around $6.50 and is now comfortably today October fifth at around $130. Forefront is another good example and the list goes on and on and on. So these social tokens are like an alternative investment class one, how do you feel about them? And second, how do you feel about them kind of playing a more significant role in a hedge funds portfolio in the future? Do you see that happening over time?

Yeah. How’s this social token any different than Facebook equity or Twitter? I mean, it’s just sort of like an aggregation, right? Facebook is doing the aggregation. Everyone’s posting stuff because they’ve created this platform where I’m incentivized to tweet because, you know, I want to get my word out and connect with other people, but at the end of the day, like what drives human activities is this idea of like connecting with other people and blockchains are great coordination mechanisms. And now you’re sort of going direct to your audience. Why wouldn’t you? And I think COVID has been an accelerant to that. People wonder why hasn’t this happened before? So the question that you’re always going to ask yourself, what do I know and why hasn’t this happened before? Or what do I know that others don’t? And I think the key insight for me is like talking to creators and saying, look, they were really hurting from COVID and, I think you needed to have a catalyst like that for them to understand, look, I can’t have real world concerts. I can’t promote my brand in the physical world, but there’s this ability to capture value, with my supporters in a very direct way. And I think that’s super powerful. And I think it’s going to transform how we think about you know, all kinds of industries, but broadly entertainment and media, right? And the same way that YouTube and Spotify came to truly disrupt the entertainment world, and they had to adapt, I think in this case, if you’re a creator, you’re an artist, you know, you have the distribution of the internet. Because again, web 3.0 connects to that, and then you can go direct. Let’s talk about the benefits. You have all the data, right? You can incentivize your early supporters with NFTs that are just digital records of someone saying, Hey, I was here early and I was supporting Calvin Harris or I was, you know, early into Frank Ocean, whatever. And you can mint that NFT around that. You can even give them some of your revenue. Right. You can give them access to certain stuff. And so I think it’s been really interesting, this inversion of how you first create a community and then you build applications and services around that versus to your point around building the road like layer one infrastructure. Like layer one development has been, you have to kind of build something to allow for these state transitions and recording stuff on the blockchain with trust and the ability guarantees that incentivize this whole stack of applications built on top. But that was a very discreet way of developing products in crypto, which is why you kind of have to build it for people to come. Now you have this idea of creating really powerful communities and looking at Bored Ape yacht club. Incredible, right? They’ve first started with a mint and like of just these four dates and then they partnered and created all these different services. Why? Because they have all the attention of users, like 50% or more of people are coming in without any reason, and have never held crypto before, but they’re buying these apes because they’re cute. And now it has access to other stuff. And social tokens are no different. In my mind, it’s this idea of, I own my brand and you created Mint because you want to own your brand. And I think that’s super powerful. Personally, unfortunately I think social networks are going to realize and recognize that, you know, they should’ve probably been more generous to their users, especially early users that have created a ton of value. And I think things are inherently, there’s a lot of friction there and a lot of discontent.

The Creator Economy

What do you kind of see the future of creators and the creative economy in general spiraling towards? And I only bring that up because your last point of social networks will realize that they should have favored their earliest creators much better. I think there’s one platform in particular, that’s doing this like Tik TOK and the most relevant example that comes to mind that they’ve done just to give more context is I remember early on when a lot of early creators were picking up traction, they started sending them care packages, you know, show appreciation. This is like a package that was shipped to them, that they invested money into that they invested time to curate for this individual, you know? So whether it be through a token or whether it be an act of kindness, these types of collaborations, this type of recognition, I think, is forming much better on Tik TOK than Instagram or Twitter, for example. But what do you see this next wave of the creator economy kind of spiraling towards?

Yeah, I mean, I think we’re just in the very early stages of this explosion of creating social value and capturing this Goodwill that exists. You know, when you think about the popularity of, for instance, sneakers of Nike, like a lot of it is tied to, I don’t know, like Jordans, right? Like Michael Jordan sure, he got endorsements, and he got paid a ton, but still, I mean, I think if you’re not Michael Jordan, if you’re just a really talented developer or a creator then you just go direct and just say, Hey, you know you know, ultimately think about how many people haven’t been discovered, just because they don’t have access to these gatekeepers or the algorithm doesn’t push them up up the stack. It’s really hard, right? It’s really hard to get discovered or it has been. But now you’re sort of seeing in the NFT world where so many people are just being discovered like Fewocious. And, you know, Beeple has been doing a lot for a long time, but like there’s this whole set of artists that are coming and minting NFTs, creating and uploading their art and getting a ton of traction. And so I think like, you know, it starts with just creating art. It’s art with artists maybe issuing their own token. I think what’s going to be super interesting is what else do you do with that? You know, board ape has been, I think one of the more impressive projects that has iterated very quickly on layer on services to their, their core engaged community. But if you’re an artist you know, like, I don’t know, Justin 3LAU has been sort of at the forefront of this and try to experiment and do this since 2017. He’s now come a long way. I think of like perhaps sharing revenue like royalties to the fan base and early adopters. And so I think more and more like NFTs will be the cookies of web three. It will allow you to understand who your core early believers are and fan bases, and then use that mechanism to stitch together the metaverse and the mainstays. If you’re going to have a concert in LA. You know, as opposed to relying on Ticketmaster, then you might just give access to like friends with benefits which has done extremely well and crypto conferences, right. You can go to their events and they did in Miami and Paris. And so I think the use cases are vast, right? It could really be anyone, right. It could be a writer. I don’t want to just say it’s just an artist, like a painter, if you will, it could be a musician, a writer, anything like that.

I think part of people owning their creator economy comes with the element of the level of liquidity, the amount of value that’s captured through, whether it be their NFTs, whether it be through their social token, and something that’s obviously super familiar to you is DeFi lending, DeFi , borrowing , you’re an avid supporter of AAVE and a bunch of other protocols. What do you think about creator economies and these like micro social networks building out their own peer-to-peer lending and borrowing networks? Does that make sense at all?

Yeah. So what you’re saying is like the ability to borrow and lend money against these social tokens?

Exactly. But do so in a way where communities trust one another. And they trust the people in those communities. And for example, I may be more reluctant to take a loan from someone in FWB that I’ve interacted with, you know, online rather than like, I don’t know, going on AAVE for example. And not to say that I don’t trust AAVE or what they’re building. I think from a more normie point of view, these things are so hard to understand at a higher level that when you live and breathe in these communities, you become so part of them and so ingrained in them that it opens up opportunities for new DeFi products, right?

Yeah. I mean, basically what you’re describing is the reputation layer, which is now missing in DeFi. Because everything is over collateralized and that ‘s not the optimal solution, right? Like you know, in the traditional world you have under collateralized loans because you have a credit score and their credit can be enforced through violence. Like there’s recourse. And so, you know, you can go to a bank and borrow money without over collateralizing, putting, you know, 120% then borrow, a fresh amount. and so you’re right. I mean, I think social tokens are another component by which you might say, Hey, there’s a lot of richness in your wallet address and things that you’ve, you’ve done or not have done, for instance, have you ever been liquidated? Have you ever sold a token? Have you, you know, whatever. Right. And so I think if you inspect that and you inspect the activity, there’s a lot of value there. Think of it as like a DeFi passport. Other, there are folks that are trying to do this, which there is a lot of data that you can use to construct a credit profile or create a reputation layer, right? Because if you have a wallet address at six years old, for instance, or whatever, there’s a lot of richness there. And if you have a way to look at them all the better, right? Because it really starts creating a rounded profile of who the person or entity is behind that wallet, even though you don’t know their identity. But you know, actions speak louder than words, and so whatever they’ve done on chain can be used to offer them incentives and perhaps better terms, lower interest rate, or better terms on the loan. And so I think we’re going to see, to your point, a lot of social tokens and NFTs, be used as mechanisms to really understand who your counterparty is and this like pseudo anonymous or fully anonymous world, and then offer a bunch of services on that. And so yeah, this is why I think these two worlds or three worlds are going to converge really naturally.

The Intersection of DeFi and NFTs

Speaking of NFTs, the conversations around DeFi and NFTs have been pretty loud on Twitter, I’d say, I think you could agree. What are some of the less familiar use cases around the intersection of DeFi and NFTs that kind of excites you?

I mean, I think most people are really focused on the visualization of the metadata behind the NFT. Like at the end of the day, a punk, all these things that are like being minted have some underlying metadata to them, but you know, like the visual representation of it is very obvious to people. All they see is a nice punk or horrible punk or whatever. But the true value is in the metadata. And when you think about it, it starts with art, but the general logic behind an NFT can be used for any sort of illiquid asset, whether it be a parcel of land in Miami or Hong Kong or accounts receivable invoice from a particular company, all you need to do is again, understand the taxonomy of the data. So I think it starts with art, but it’s proving a use case of saying you take any sort of discreet non fungible thing, and then you create more liquidity to that. So for instance, you know, you just NFT a bunch of parcels of land in Miami. Well, okay. I understand that an apartment in Brickell might be different, but like it’s not one-on-one to an apartment in an adjacent building in Brickell. But you know, you have reasonable data. And the ability to then piece that together and say like, this is no different than like mortgage backed securities. Which in theory, you know, it should work. The problem that in 2008, not to get too technical is, you know, you just were using really bad data around correlation. But what we have learned from NFTs is that, the minute you create sort of like a base floor punk, not every punk is different, but at the same time, it has certain attributes that allow you to construct an index. So for base punk and a base punk should be worth at least X. So there’s a floor around that, because there’s a lot of data behind that. And so mortgage backed securities is an example or an insurance contract is an example. Well, they’re all discreet, but at the same time, they have very overlapping shared properties that allow you to then construct an index or create financial products like mortgage backed securities. And what does that do? That removes friction because it increases the volume and how you can freely trade these things, right? Even if you fractionalize this NFT , like it creates just more volume and velocity and transactions, right? And that creates a better price, discovery, and better price discovery that allows you to, you know, understand how liquid or illiquid an asset is, and then create credit terms around that and create money markets around them. So you start seeing how all of this can work. Anytime you wonder like, Hey, I’m just going to have to ask how easy it is for a company to get liquidity on their accounts receivable. Well, there’s a whole pocket of the market in Wall Street that buys these things at cents on the dollar, but there’s inefficiencies. Whereas, if you could fractionalize pieces of that, then it just creates a more fluid market. And so I think we’re going to see an explosion of using NFTs to bring more liquidity and price discovery to illiquid assets. Just things that don’t get traded as much, because, you know, you can only buy one piece of an apartment. Well, maybe you can just buy a fractional of that. It goes in the same suit for a lot of things, right. I’m just using real estate because it’s perhaps more relatable to a lot of people.

I want to talk about more of one of the more recent, big headlines that hit NFTs recently with Tik TOK entering the space, and one of your investments being immutable X, supporting that entire wave in which we can confidently say if they do it correctly and the audience on Tik TOK corresponds that it’s going to be one of the catalysts for NFT adoption. And just to give more context for those who are listening, Tik Tok is taking its own play on selling NBA top shot inspired moments on immutable X, which is, correct me if I’m wrong, a layer two of Ethereum, right? And Tik TOK kind of coins it owns the videos that broke the internet. So you were an early investor in immutable. What’s your take on why Tik Tok decided to use immutable over a competitor, like flow , for example? And it’s an indirect competitor. I don’t think it’s a direct competitor, but let’s say someone likes a flow because there was a lot of talk around that on Twitter.

Yeah. I think you have to understand, like what drew me to immutable was it’s a team that understands how painful it is to build on the layer one. So Robby and the team built gods on chain, which was, I think for a long time, one of the highest grossing NFT projects, but it was very expensive. So through that experience, they said, Hey, let’s build a layer two that is specific and very well catered to NFTs and gaming applications. And so you know, I think ultimately each layer 2, starkware, like you know, like arbitrum, optimism, and immutable X have certain trade-offs. And again, immutable X is using starkware technology to build, I think one of the more specific blockchain layer two for NFTs and gaming. And so I think ultimately like if you’re aTik Tok , you can say, Hey, I can deploy on Solana perhaps I can deploy on flow. And I can deploy on immutable X. And I think, you know, to this day, like you just benefit from the security guarantees of Ethereum which is one of the more, if not the more battle-tested networks out there, absent Bitcoin. And then I think it’s in you tapping into the community and user base of Ethereum. And I think that’s ultimately perhaps how others decided to deploy on Ethereum and use Ethereum, and enable USDC transfers. Because Ethereum has been battle-tested, it has more Lindy effect that has more developers behind it, and so, that is sort of my bullish case for Ethereum. If you look at the number of developers and activity, it’s not to say that other ecosystems are not growing, but Ethereum continues to be king in that perspective.

Lifelong Learning

I want to pivot because we only have so much time left, and talk more about personal questions. How you developed as an individual as an investor, as just like a human in crypto. So what is one lesson that’s taken you the longest to learn during your time in the space?

Hmm, that’s a really good question. So what is one lesson that is taking me longer to understand in this space? I think it’s this impatience that I feel, I think others feel too. It’s really hard to be in a position where you think that, you know, it’s probably going to sound like I’m contradicting myself because to me, this technology is increasingly obvious, it’s just a matter of when it’s going to be deployed, when it’s going to be adopted. And it’s sort of hard that once you discover crypto and you start using it, and you understand the potential that it might have, just being a little bit more patient in how these things will take to get true mainstream adoption, because I still think we’re super early. We’re all kind of beta testers. But it is difficult because when you juxtapose that with how a lot of world problems that exist today, And you’re saying, well, goddammit, what is it going to take for more people to realize that, you know, the economy is not growing there’s all these different problems, like during COVID. People are getting checks in the mail or not getting them, or like, it was just delayed for three weeks. And that means a lot of people are dying. Right. Because if you’re not getting a check-in in the mail, there’s just a better way to do this. Take all the wallets and the entire population and stream these payments to them and make it conditional. They can only spend it in X or Y. Like universal basic income is something that I’m super fascinated about. I think it solves a lot of the world’s problems. Like at this intersection with automation, you know, a lot of jobs are gonna be displaced, and you’re going to have to retrain and give employment to a lot of people that are just going to go on to work because the machine will do certain roles better than a human. I think universal basic income is the solution to a lot of things. And I think crypto uniquely enables that. I sometimes need to remind myself to be more patient, and serve that as sort of motivation to try to educate and try to expose the benefits of this technology to more and more people. But it can be difficult at times because you know, the world is not necessarily a great spot and in a number of ways, it’s also an in a beautiful spot because there’s a lot of technology and there’s this, you know, pockets of the world that are seeing incredible innovations, like in healthcare biotech, like and crypto. But, you know, there’s many things in this world that are broken, and how do you live knowing that at least from my perspective that you have the key to a lot of these things, and you kind of see the door, but there’s like three bouncers that are like there and blocking you. And it’s really frustrating. It really is very frustrating. Especially when those announcers don’t care and don’t take any interest in understanding how this technology can be used. A lot of it is politicians, but I think ultimately things will sort themselves out because I think in this century, I’ve said it, there will be the countries and the places that were more crypto friendly will come out far ahead than the countries that resisted it. And look, I don’t want to go as far as saying like the separation of money and state, is that going to happen? Is that going to be a thing? It’s probably not going to go down as easily as we think. Like, you know, you look at the separation of church and state, there’s a lot of revolutions attached to that. You know, the separation of money and state that, you know, a non sovereign store value like Ethereum or Bitcoin or some other asset, a social token. The only function of the state at that point becomes, you know, serving some sort of governance and maybe security, but I think it’s going to be difficult. The optimist in me says, well, we just keep pounding the table, just going to create better content, go meet these people, understand their interests. But yeah, it can be frustrating. I don’t know if you felt that, but it can be very frustrating at times to have key decision makers take no interest in crypto and just speak out of their ass without truly understanding how this technology can impact a lot of their constituents.

Yeah, no, I hear you. Next question is, if you could tokenize Hogwarts, where would you start and why? What blockchain would use?

Wow, best question, by the way, as you know, I love Harry Potter. I mean, I love Gryffendor naturally, so I would probably just, you know, tokenize Gryffendor. I love the castle too. I have that Lego Harry Potter like castle. Each house should have a social token. but Gryffendor would probably crush because it’s the best house in my opinion. So I would probably tokenize that maybe even wands , but I think Gryffendor, I would start with Gryffindor and just make it a social token. If you meet certain parameters, then you are part of Gryffendor. And so like have a test, but you know, there’s like these tests online that you can take and it tells you if you’re a Griffendor or not at the sorting hat test, which is by the way better than Myers-Briggs and all this random stuff, like personality traits, astrology, whatever. I just think like, everything you need to know is if you’re a Griffendor, or not. And if you’re Gryffindor you get access to this token. So I would do that.

I feel like you’re, I feel like your Tinder bio is just something like which team are you on? And that’s how, you know, if you’re a match or not.

Totally. Compatibility is if you’re a Griffendor first year non-mogol, if you are, which means you’re in crypto, then are you Gryffendor and if you’re Gryffendor then all the better.

Good answer. If you were a ghost in the metaverse, what location do you think you would haunt?

Hmm, that’s a great question. I don’t know. There’s all these different worlds that are like coming about, so I don’t want to pick one, but I guess I’m really excited about alluvium they have launched, but they’re creating this beautiful world that reminds me a lot of like the games that I grew up with. So I would lurk in these worlds and see that. The other is likeDecentraland. Maybe it would be interesting, like the main hub. And it’s an easy answer because you’re going to see a lot of activity going through there. So I just think that if the level of activity in Decentraland, like main Square, there will be a point where it will probably get more eyeballs than Times Square in the next 20 years. And so if you’re just lurking there, you’re going to probably see a lot of really interesting stuff happen. And who advertised there. Like we’re probably going to see real brands advertise in these Metaverse , like main squares, because like, you know, you get a lot of eyeballs. So I would just kind of lurk in that place.

You missed the most obvious answer, the Aaveverse, what do you mean? Everyone’s a ghost and the Aaveverse.

Oh, that’s true. Stani might kill me for not saying that, but that is very true. So I’ll be floating AAVE ghosts in these metaverses.

Nice, nice, nice. So that’s the location you would haunt but who would you haunt in the metaverse if you could haunt someone as a ghost in the metaverse? You’re like Adam, where are these questions coming from?

Like kill them? Wow.

Just like spooking them. No, man. We’re not trying to kill anybody here. This is not that.

I’m a friendly person. Yeah, I see. Sorry. Hmm. I don’t know. If there is a Voldemort version in the metaverse, I would just probably like to spook them, whoever that may be. And maybe it’s a crypto personality that is Voldemort. Maybe like Craig Wright or whoever, but I dunno.

Good question. I don’t know. Yeah, I actually haven’t even thought about that. I was kind of hoping you’d lay the foundation. Give me a second. Who, who would I haunt in the metaverse? I’d probably haunt Mark Zuckerberg, probably.

Assuming he’s there.

What Will Eat Web 3.0?

Assuming he’s there, right? Assuming that his vision for the metaverse kind of becomes a reality if and when. I’d spook him and probably a lot of other people in crypto would spook him too out of love. Out of love. Final question. I’m a big fan of watching the history and the growth of the internet and realizing and seeing the development of its different stages, and I like to break them up into three. And I may be too generalizing it, but web 1.0 was super early on. It was like the birth, the Genesis of the internet. It was read only, there wasn’t much activity and utility that you can kind of develop other than really communicating. Then we had the introduction of web 2.0, which ate web 1.0 built on top of web 1.0 . And you had more social networks. You had the Uber of, you had all these internet companies building really interesting products and services online. And now we’re entering into this world of web 3.0 , which many argue is going to eat web 2.0. And the web 3.0 is all about ownership. Web 3.0 is all about the distribution of money at the speed of light of information online, right? And all these core components that allow people to own pieces of the internet. What do you think will eat web 3.0?

Hmm. I don’t really know. I mean, I want to say the reasons why web 3.0 might not really truly scale. Like is this scalability? I think for me, I sometimes wonder, Hey, like, do people care about decentralization? I don’t know. Like I do. But if it comes at the expense of X or Y then, you know, I was sort of left wondering when I look at Binance Smart Chain level of adoption, it’s like, okay, well, do users actually care about stuff? So it’s just for me a healthy reminder to say, and I’m deflecting because I actually don’t know what, what comes next after web 3.0? In so many ways, it’s like, what is web 3.0? And what is our definition of web 3.0 today? It might change dramatically. Because you know, you really have to just understand. I think for me, it constantly is questioning what people care about. Because users drive options, and if you don’t have adoption, then no one really cares. You know, sometimes the best technology doesn’t win. When you look at VHS Betamax, it was far superior technology, just, you had better marketing, you had better adoption by the porn industry of VHS standard and that made it you know, the best standard and MP3 is no different. It wasn’t like the best standard, but it just had the best support behind it. And sometimes I wonder how this world will evolve. You know, I think and it ultimately starts with, you know, what people care most about. So my answer would be the definition of what we think of web 3.0 is probably going to be very different in the next year or 2, 5, 10. So for me to tell you what comes next after web 3.0, assumes that I understand web 3.0 is, which I don’t think I understand fully. Because it is moving very quickly and it means so many different things for people. A lot of people just think web 3.0 is just gaming. A lot of other people say it’s just DeFi and, I think that’s what’s most exciting about this world, which is, this metaverse that we call it, is going to encompass so many different things. But what is clear to me, is I think for better or for worse, the operating standard of a lot of things is going to radically change. It’s sort of like, I think we are going through that email moment of crypto. Before email no one really understood why the internet was useful, and then ultimately email made it so pervasive. Everyone is using email. Every single business, every single person uses email because it allows us to connect in a more fluid way. And at the end of the day, we are very social beings and love to connect. And so I think it’s just finding those ways that are allowing us to connect and transfer value, not just monetary value, but just value. Social tokens, DeFi, like just money in more fluid and interesting ways. And ultimately that will probably be expressed in so many different ways, that is both daunting, and I think it will get really weird. The minority report will probably be pale in comparison, but it’s moving really fast, and that’s what’s most exciting. What the metaverse and web 3.0 was a year ago is much different than what it is today. And so, yeah.

You know, I like to think about this question and I ask this to almost everybody on the show. If you look at what people kind of preach and communicate about web 3.0 and how that compares to web 2.0 where web 2.0 is gated. Web 3.0 is borderless. Web 2.0 is centralized. Web 3.0 is decentralized, right? Web 2.0 is controlled and managed by a select group of people that get to see and quote unquote manipulation or use data to their advantage. Everything is public in web 3.0. And I try to think of those types of characteristics and like, what’s the extreme side of that. Like if everything were to be on chain, if everything were to be decentralized, if everything were to be borderless, right? What’s the downside of that? And what will try to fix that, you know? So I don’t know. I dunno. Just something to think about.

I’ll say, I wrote about this a long time ago. Just growing up in Mexico for me, like this idea of human migration, I don’t understand it. Like why are we confined to man made boundaries? And the downside of that is you see places like Africa that were just chopped up like a sandbox by Europeans and like candidly, a lot of the problems that you see in Africa today is because there’s these man-made boundaries. And ultimately what’s most exciting is the idea, I think we are moving to a place where countries will become less important. I think communities will start in their world and then permeate to the physical world. Like you look at e-sports. I don’t have any affiliation to my national team. Like if there’s a soccer team of crypto, that’d be my team, you know? So, you know what I mean? Like the younger generations are really going to just think about nationalism or whatever that means like attached to open source communities that are very fluid. All we need to solve is being able to easily migrate, and when you have the ability to port over money, that is non sovereign, like Bitcoin, and then you can go anywhere in the world. That’s where I think you will see a shift in how we organize as humans. And the communities that we form like cities. A city like New York is more like London than what it is from Plano Texas. But somehow we think about the United States. It goes to the last point, the early point you were saying, which is that there are shared values and principles that ultimately align us and coordinate us as humans. I think we’re going back to that, where that becomes the primary, like gravitational pull to wherever you may go. And it’s not, you go to a particular country. It’s not that you go to a particular jurisdiction, because you’re going to where you really want to be aligned with people that share the same values and principles. That like reorganization, I think will create a lot of value, and that’s what like, is probably most exciting about web 3.0.

Outro

Love it, man. I think that’s a perfect place to end off. Before I let you go, shill yourself. Where can we find you? Where can we find punk 91 59? Take it away.

I’m in the metaverse naturally. I’ll probably go to a few conferences. ETH Lisbon and then a few others. So you can find me there naturally, but easier just on Twitter @santiagoroel and yeah.

Thank you so much.

Thank you. Thank you for having me. It’s always great to be here and really appreciate the time.