Listen on: Spotify | Apple Music | Google Podcast

Background

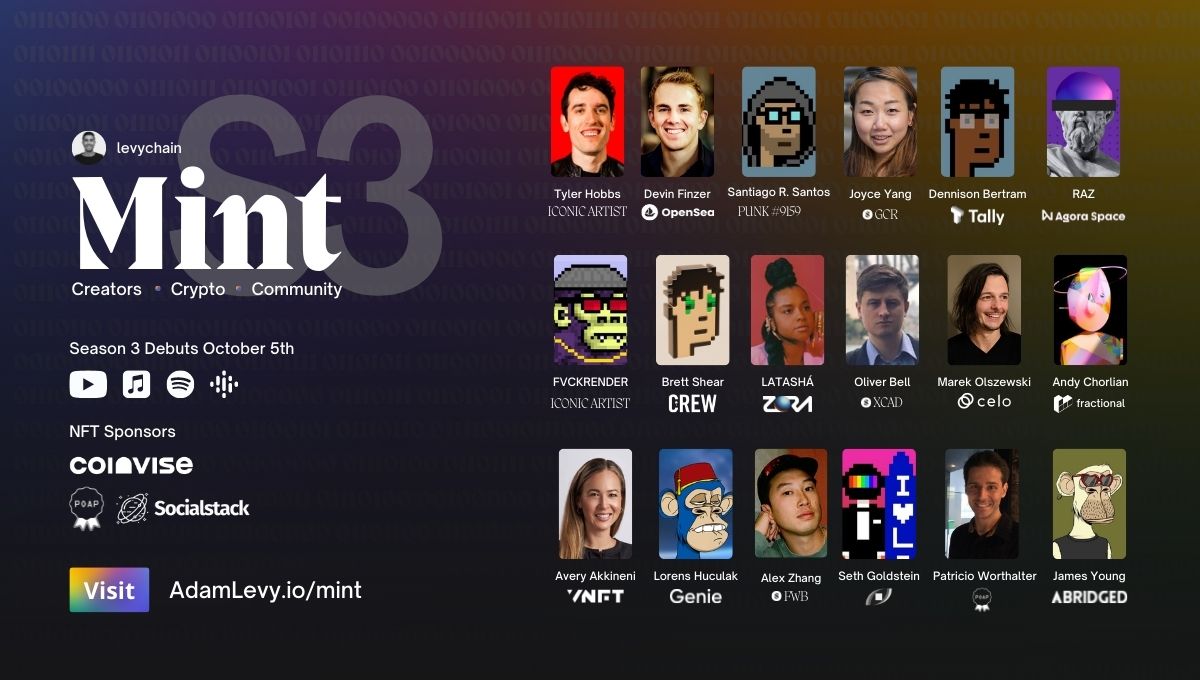

Mint Season 3 episode 1 welcomes the President of Vayner NFT Avery Akkineni. She leads the company’s mission to build long-term strategic NFT projects for the world’s leading intellectual property owners serving brands, celebrities, athletes and associations looking to incentivize and reward brand advocacy and customer loyalty.

In this episode, we talk about:

- 0:00 – Intro

- 1:39 – From Google to VaynerMedia

- 4:18 – VaynerNFTs

- 8:37 – The Vayner Group

- 11:57 – Defining Web 3.0

- 13:08 -NFTs and Intellectual Property

- 25:48 -How NFTs Lead to Enhanced D2C Models

- 35:20 – Creating Mutual Value Through Collaboration

- 40:11 – Outro – Closing Out

…and so much more.

Thank you to Season 2’s NFT sponsors!

1. Coinvise – https://coinvise.co/

2. POAP – https://poap.xyz/

3. Socialstack – https://socialstack.co/

Interested in becoming an NFT sponsor? Get in touch here!

Tell me about yourself. What were you doing before crypto? And like, what are you doing now?

Awesome. So I’m originally from Nashville, Tennessee, Southeast part of the United States. Music City. Amazing place to grow up, and I moved to California for university, and I loved it there. I thought it was amazing. I started my career in marketing at Target corporate, where I worked in the Southern California division. And after that, I had this incredible opportunity in 2011 to go work at Google, which was a major dream job for me at the time. And I learned so much and stayed there for like seven years. And during the course of my time at Google, we launched a bunch of awesome products and a bunch of amazing campaigns. The company grew and grew and grew. And I also kind of came in touch with the Vayner team and Gary, and I was really impressed with what they were doing. So much so that I jumped from Google to join Vayner, which was a little bit of a crazy thing at the time. But ultimately, it was a really exciting move for me. And I’ve been at Vayner for about four years, helping to lead our media team. I moved to Singapore to open our Asia Pacific offices. And then I just came back here in July to open up our Vayner NFT practice. I’m currently in Miami, but we’re, we’re all over the United States.

Nice. So how was it jumping from Google, like an insane corporation with thousands upon thousands upon thousands of employees, to, well, how big was Vayner when you joined? How many people was it?

Several hundred. So it was a medium-sized company. Going from a company that had, you know, hundreds of thousands to hundreds was a big adjustment just in terms of how we like to operationalize at Google versus kind of being more of an emerging company who is really different. But one thing that I loved, and this is something that, you know, everyone decides for themselves, but for me, I was really interested in being in a place where your work and every person really matters. Every person’s work sort of shapes the future of the company in a much more dramatic way when you’re working at a smaller-sized company. You get better access to executive leadership. You know, you can really see what your work is building in a really direct fashion, which is awesome. And at Google, it’s just such a big place. And like, you know, it’s billions of dollars per second; basically, it’s a bit of a different ball game. So I really appreciated the ability to take on sort of a more direct role, where you see your impact pretty fast.

When you pivoted into Vayner, what were some of like, I guess the biggest shockers moving from such a big corporation to, I wouldn’t call it boutique, but Gary himself was such a powerhouse. And it still is at that time, moving from that end to that and like, what was that?

Well, everybody thought I was crazy. Especially since, you know, when your brand side is often perceived to be like the good side of it and going agency side is not very common for brand people. So everyone was like, whoa, are you serious? But I was really excited about it and excited to learn. I think that’s one thing that you’ve really got at an agency, and the way that Gary runs Vayner is so fundamentally, hugely different from how other agencies operate. And I was excited about that. So I think a lot of people might have questioned that decision because I was going from a really stable thing to, you know, still a relatively unknown company at the time. Certainly, it’s nowhere near this. Vayner is nowhere near the size and the scale of Google yet. But I knew it was the right decision for me, and I appreciated the opportunity to learn from people who were really at the time; Vayner were known to be experts in the social media space. It’s a place that Gary stakes a lot of his career. He really built his personal brand on social media, on YouTube, on Twitter, on Instagram. And then we were helping our clients, who were mostly enterprise brands, to build sort of their social presence. So I wanted to learn about social. I wanted to get really hands-on with it and kind of learn from the best of the best as it related to social.

Adam: You know, one thing that I love about Gary’s story, particularly, just because we’re talking about Gary is he’s a type of person that experiments on the personal level before scaling it to other people. He verifies and proves that he can do it. And he’s the example of that and then makes the example for other people. And we saw that with social media, and now we saw that with NFTs and that insane campaign with VeeFriends. Starting Vayner NFT, and doing that for others and taking those learnings, taking those principles and applying it to mainstream corporations or whatever that the customer is at the end of the day.

So I guess my next question too is why NFTs for you? Like, what is it about the medium of NFTs that gets you fired up?

Yeah, it’s a good question. And Adam, I appreciate that you can just see, like, you can read our strategy, like a book, right? Like it’s the same way that, you know, we put Gary on Tik TOK first, then we start doing it for brands. Like, you know, that’s kind of our rinse and repeat formula is using Gary as our first test case to make sure we understand the media before we go and, you know, help other brands do the same thing. And I think that level of practitioners hip is really rare when you look at the professional services ecosystem, you know, consultants and most ad agencies, they’re not like doing it themselves, like putting their money on this. And I think that’s helped us stand out. But for me, it’s a good question. So I’ve been investing, you know, on a personal level in crypto for many years, I lived in San Francisco for quite a long time, and it was pretty normal. And I remember sort of the first boom of Bitcoin being an exciting time. And obviously, that you know, it goes into ebbs and flows. But I’ve been personally interested in that. And I remember, you know, in maybe 2017, my friend first telling you about Ethereum and how that was going to be like the next big thing. And he was definitely right. So shout out to this guy, Oren Barak. And yeah, so I, I was a little bit interested in that. I think NFTs, it’s more like reading the consumer adoption cycle. I think we’ve seen this type of thing happen before many times in Web 1.0 and Web 2.0, and it’s happening for Web 3.0. And if any of your listeners are familiar with this sort of like market adoption curve kind of goes like this and it starts, you know, like there’s the early minority, then you get into early adopters, and there’s the early majority, the late majority. And then it gets into the laggards, and you can see a lot of this like fundamental tech setup is happening now for there to be a really massive shift in the way that consumers use the internet. NFTs, I think are just one part of Web 3.0. We called it VaynerNFTs because we think it’s a big part. And we think, you know, it’s, it’s something that people can understand. People understand collectibles. It’s kind of started with collectibles. But this is going to be much bigger than just collectible NFTs. And I think how I got into it was, I started talking to Gary about NFTs, like almost a year ago now. And when he was first kicking around the concept for VeeFriends and creating a community around his values and his doodles. But, more importantly than that was just understanding and seeing all of the variables in place that I think are going to drive a huge consumer trend. And I saw that before, like I mentioned, I worked at Google and when I started working there in 2011, like, it wasn’t like everyone Googles, everything. Like it was still like, this was a startup, and this was a new thing. And, you know, people would say like, oh, You know, they didn’t believe in it the same way that you do now. Even email, like Gmail was like a new thing, which now, of course, it’s so prevalent, it’s just so everywhere. But I think I had done a good job of sort of understanding that’s where things were headed. And I started to see how Google was building something, and that’s why I wanted to be a part of it. And then you know, Google made an acquisition of a company called DoubleClick. In, in sort of the late 20 teens, and I was on that team as well. And it was all about programmatic media, which is basically just using machine learning and AI to automate a lot of manual tasks. So I went to that. I saw that as being a huge change in the way that people bought media to do it more transparently and more fairly, and all these things. And then I wanted to go do social media, cause I thought that was also another thing that was really changing, which is why I joined Vayner. And now I say this with NFTs. So I think, you know, in my career, I’ve really tried to understand where consumer adoption is going as it relates to sort of consumer technology and, and then hopefully, you know, catch the right trend at the right time to see if I can help contribute in my own small way to being part of something that fundamentally makes people’s lives better.

Talk to me a bit about the branches at Vayner. So there’s VaynerMedia. There’s VaynerNFTS. What else is there at Vayner? Fill in the blank.

Yeah. So VaynerX is our kind of holding company for all of the inner companies. And Gary himself has other companies outside that interacts, which could be like a Resy where Gary’s the Co-founder or Empathy Wines that Gary is also a co-founder at. And so Gary himself is probably the CEO of like a hundred businesses, but a lot of them are in Vayner X. VaynerX is very heavily Vayner media in terms of just number of staff perspective. But we also have a company called gallery media group, which does publishing. So we have a site called pure wow or 1:37 PM that is focused on lifestyle. Some focused on women, some focused on male content. So there’s Gallery Media Group. You also have Vayner productions, which is a production studio. We have a huge studio in Long Island City where we help, you know, shoot commercials and have directors and editing and all that stuff. So more of a traditional production house. Then we have Vayner speakers, which is an amazing group of speakers.

Adam: The only reason I jumped into that is because Vayner is like the one-stop destination, right? Like there’s all these different branches. And Gary’s like really good at jumping on these trends and realizing what’s important and making an example of himself before or licensing it or whatever scaling it, you know, to many other people. And now that Vayner NFTs is not just another branch of that, but it’s such a core component. All these other branches, I feel like fit into this greater vision of what’s to come. Do you know what I mean? And I see this, like when a brand comes to you guys and like, all right, what’s our media strategy. Well, the media strategy comprises many things. It’s not just the media. It’s also production. It’s also this, and it’s also NFTs now. And you guys have all those vehicles under one roof.

That’s exactly right. Yeah. We can do many different things in house. Everything from, we have Vayner talent to Vayner speakers, to Vayner productions, to VaynerMedia where, yeah, we want to be the one-stop-shop for modern marketers and modern communications.

The problem that you guys are set to solve at VaynerNFTs, what is that? What is it exactly like what’s missing in the world that Vayner is like, this is where we come into place?

I think there is no other NFT consultancy that does what we’re doing. To my knowledge, I think we’re the first NFT agency. I’m sure there’s going to be a lot, but we’re probably the first mover. What you see in the NFT space is there’s a lot of technology solutions. So it’s like you can work with dapper on what they’ve built, or you could work with open sea and just mint directly there. But there isn’t a consultancy that exists today outside of Vayner, whose role is solely to focus on helping intellectual property owners navigate the world of NFTs. It’s just too new. So you know that the more traditional consultancies and advertising agencies and marketing firms haven’t yet dedicated a practice just to help this happen. I’m sure that they will, but I think the role we play is really that strategic partner to help understand what’s the right tech stack. What’s the right strategy with the right launch? What’s the right creative? Bring all that stuff together for awesome NFT projects that are not just for today and not as part of a marketing effort, but really as, as an NFT program, that’s designed to be successful, not just in, in 40 days, but in 40 years.

No, that makes a lot of sense. At Vayner, how do you guys kind of define Web 3.0? What does that look like from your point of view?

It’s a great question. And you know, I think that what it looks like right now, like connecting your wallet in the top right-hand side, is just such a little tiny part of it. That’s what it looks like today. What that’s gonna look like in the future is authenticating your access in various ways, much more blockchain-enabled than it is now. Think with the fundamental principles of decentralization being much more prevalent than they are in today’s sort of Web 2.0 world, which is pretty centralized. I can’t predict exactly what Web 3.0 is going to look like, but we see, you know, a huge future, probably not in the next year, but in the next few years around the metaverse I think there’s a lot that can happen with AR that still hasn’t happened. It’s really cool, but so few people use it right now that it’s just not even mainstream enough to really drive any massive behavior shifts. But yeah, I think that, you know, crypto is gonna be a big part of it. Blockchain is going to be a big part of it and NFTs will be a part of it, the metaverse will be a part of it. But it’s just, you know, fundamental, huge evolution of the way that people communicate and the way that people use what we see as the internet.

You know, one of the main things that got me excited personally about Web 3.0 is the ability to own. And this layer of what this gentleman, Jesse Walden, coins as the ownership economy and how tokenized assets allow people to basically be co-owners of the products and platforms that they use. And if you look at the traditional sense of Web 2.0, Web 2.5, is people are the products of the platform, versus the owners of the platform, like there’s starting to be in Web 3.0. Do you think that’s going to be like a point of hesitation, a point of friction when brands start to kind of understand, like, wait a minute, the people that we’ve been selling to and trying to provide products and services for now, they need to, co-own the things that we provide them value for, do you think that will resonate well? Do you think there’ll be some friction with that? And I only bring that up because it’s such a core primitive to like crypto, it’s such a core primitive to Web 3.0 as a whole. It’s such a corporate motive to NFTs. Buying into an artist, let’s say from an art point of view and following them, not only on their social timeline, but also having co-ownership in their assets and the things that they produce.

Do you think this concept of ownership is going to translate well in the corporate world, for example?

Yeah. You know, it’s a relevant comment. And there are some products, some really successful NFT projects where you do co-own, but there are somewhere you don’t. Like you don’t have the IP rights to a CryptoPunk, like Larva Labs does. You know there are cases where what you’re saying is definitely true, but there are also cases where it isn’t. I think that co-ownership is more of participation. And of course, it’s important for brands to be thoughtful about the way that they’re entering the space and that they do so in the right way. But branding fundamentally like that’s just a consumer behavior, right? Like the reason that people are going to pay 40 ETH for a Bored ape is that that’s the new hot brand. That’s the Nike of the profile pack world. So I still think a lot of the principles that built value for brands in consumer goods as an example; you see that exact same consumer trend happening in the world of NFTs already. So I think brands just have to be smart around the way that they think about their IP and the value that they can bring to users. Because you know, if you’re into gaming, you’re with this space, Adam, you know, wearables, people are spending more for a Gucci virtual bag than they are for a real bag. So I think that, ownership, there’s a way to create value for both parties, which I think would always be our goal, right? Like, do I think that Gucci is going to be licensing their IP, and they’re not a client of ours, so I’ve no idea, but I don’t think it would be licensing their IP to every person who buys an NFT. But I think they would be limiting the number of pieces that they create to create rarity and scarcity and value which would then appreciate. And that still is valuable to the holders of that. But, you know, maybe some brands will be smart and very forward-thinking and license out some of their IP, but a lot of them are also multi-billion dollar companies and even like their own IP structures are set up in a crazy complicated way, global companies where you know, subsidiaries own certain things. So it’ll be interesting to see how that happens, but I don’t think that joint ownership of brand IP is a necessary requirement for brands to enter the space successfully.

Adam: Interesting. You know, you’re seeing a lot of the ownership model kind of take place with defi protocols, people owning governance tokens, and voting on the future direction of a decentralized organization. Obviously, you’re also seeing artists issue their own art NFTs and merely just buying that piece of IP for the sake of buying it like they would buy any art piece. I don’t own the artist, rather I just buy to enjoy, you know, buy, to collect, buy to flip kind of thing. So there’s definitely multiple worlds and Web 3.0 has yet to be defined exactly. All we’re seeing is that it has to do with the next evolution of where digital is going.

I want to jump into more of the Vayner side of things even. What are you guys most excited about? Like what’s getting you guys going?

Well, what we’re excited about this afternoon is, you know, the demo that the Twitter engineer put up, we thought that was pretty fun. And you know, I’m excited to see what other social platforms do to follow. I think what we’re most excited about is the fact that it’s super day one and, you know, people are like, oh, we missed the boat on this. And that it’s like the boat, the boat hasn’t even like-it’s not even in the water. It literally felt like building the boat. Like, don’t worry, you didn’t. Because it’s so super early and that makes us excited because we can contest a lot of things. And some of the things we do have been slam dunks, and some haven’t, and that’s okay. And, you know, we get better every day, and we learn what’s resonating, and what’s also resonated a few months ago that doesn’t resonate anymore, and we have to stay sharp on these things. I’m excited and my team is excited around the potential that NFT provides both for celebrities, for brands, for IP owners, for new IP. There are just so many different things that you can do as part of the smart contract, and we’re excited how early we are and how much there still is to figure out because it gives us a lot to do and a lot to think about. And yeah, we love following the news. We’ve got you know, just this awesome squad of people who are super into the NFT space and really genuinely care about the community and, and how to get NFTs in the hands of more people. And the reason I bring up sort of the Twitter demo of, you know, they were doing like a demo showing how you could verify your profile picture and that that was your own avatar. It’s pretty cool because it’s not just going to be Twitter. It’s going to be Instagram. It’s going to be Tik Tok. It’s going to be like other social platforms will follow. Like Mark Zuckerberg has been very open about his designs on building the metaverse, whatever that means. I think that right now there’s such a relatively small group of like, you know, people flipping on Open Sea it’s, you know, 200,000 is like the latest estimate for sort of active users. And we know there’s 10 million out of another, which is just great. Still a very, very, very small number. We’re excited for that number to be sort of 200,000, 200 million and then 2 billion, you know, there’s just so much more to go. We want to spread NFTs to the world.

So who are the ideal customers you see rallying into the NFT side that come to help? Is it big corporations? Is it individual internet personalities? Is it celebrities? Like who’s coming to you right now?

Okay. A lot of people are coming to us. I think our sweet spot and where we can probably drive the most value is helping current IP holders, whether they are athletes, mainstream, celebrities, influencers, people of interest creators, helping them understand of course brands, helping them understand the world of NFTs today, and then what might make sense for them on how to launch a program. Like, you know, what we did with Gary’s was one example, but what we did with Nastya , who’s the most followed YouTuber in the world, even though she’s seven years old, was a completely different program that was designed for her fans. And, you know, if you look at the artificial project that was designed for high-end art collectors, versus what we did for the US Open, which was designed for tennis fans, like there isn’t really a one-size-fits-all approach. And you know, I think that helping IP owners understand the space and then navigate it is really our role. But primarily like enterprise folks, I think we’re sort of caught up fast to help enterprise folks. And, because we have had a lot of demand, we’re kind of prioritizing those who’ve been in the Vayner network, like friends of Vayner are getting first dibs on us since we are still only about 30 people. So we have to prioritize where we feel we can really make an impact.

Yeah, that makes sense. So from all these people that are coming to you, let’s say you’re focusing first on the Vayner family. What are some of the biggest, I guess, questions and or misconceptions that they have before entering the space?

Yes, the questions are, where do we start? They will hear about what an NFT is and say, oh my God, we have to call Gary and the Vayner guys. We have to do something with them. And then, you know, I think misconceptions are, people don’t understand the amount of work and thought that it takes to really strategically launch an NFC program just because you’re a celebrity and you have 50 million followers doesn’t mean we can do an NFT launch next week. The reason VeeFriends has been so successful is if you look at, I mean, you can look at the floor in June or anywhere. Like that has built over time, that wasn’t something that was like a super hot initial drop. Yes. The initial drop was solid, but the value is really created on the backend and on secondary, even though it’s only been a few months. So I think that’s a misconception. If you’re a big name or someone, you know, a household name, that this will be a success. There’s plenty of celebrity and brand NFT drops that have been a total flop, and we are trying to help advise at least friends of Vayner; even if they don’t do it with us, we can be friendly and help them think about the space in the right way. Because the thing about the blockchain, the beauty and the curse of the blockchain is everyone can see it. Everybody knows. So it’s important to be really thoughtful around it and make sure that your first impression is strong because it does matter.

Adam: Yeah, but how do you teach that thoughtfulness? When it’s so easy to fall short of all the cash grabs that are happening in the scams that are happening, that are setting a bitter taste a little bit. Obviously, there’s a big picture here. This is a big opportunity. How do you guys find yourself educating these people to say that this is a long-term play? Like Gary makes it explicitly vividly known that this is a 45-year, what’s his number that he throws out there, 49, 39-year plan? Do you know what I mean?

How do you communicate that same feeling, that same emotion, that same level of long-term thinking to these corporations or celebrities or brands that are trying to issue NFTs?

Yeah. Transparently, I show examples. I show like, Hey, this works, this is how this worked. This is how this works. These are like 10 successes across categories, across music, sports, art, you know, whatever. And then we show some notable successes, and you’re like, “Hey, like actually, the same week that Coca-Cola dropped an NFT and sold it for 600 grand, another very, very, very well-known American brand dropped an NFT that sold for $600”. So there’s like a huge spectrum. And you can see the difference and the thought that needs to go into it in order for it to hit. Because I think particularly on the celeb side, they’ll just be like, “Hey, I’m doing an NFT. I want to get $20 million from this”. It’s like in order to get $20 million, you have to really invest and like to educate your community. And these are parts that we need to go to. And I mean, there’s a lot of operationalization that goes into launching an NFT if you are an established company. Because there’s no consumer regulation, there’s anti-money laundering. There is, you know, potentially needing the ability to pay in credit card versus cryptocurrency. There is the requirement that you’re actually holding a wallet that’s holding that key. Yeah, there’s real thought that needs to go into that. And I think that’s also another thing that we spend a lot of time doing is building the right operational infrastructure for some of these projects to be successful in 45 years. So I think with Gary’s project, it’s a little bit, you know, we’re not a publicly-traded company, it’s not the same level of scrutiny, and yeah, we have a little bit more flexibility than some of our partners who are much bigger international entities that you know, of course require a lot of diligence behind every partner they’re working with. And there’s, unfortunately, some nefarious stuff that does happen. And we want to make sure they’re super clear about that because there are some real risks.

You guys are increasingly working with more of the mainstream crowd that’s trying to transition into this new crypto-cool kids club, you know? When do you imagine we’re going to see the majority of fortune 500 companies either holding an NFT, issuing an NFT or holding some type of crypto asset on their balance sheet?

Maybe five years.

Why five years? Because some people like to put things in a 5 to 10 years time frame. Why are you leaning more on the five years?

I think that there will need to be maybe one or two players that drive a big shift in consumers. If consumers are there, companies will get there. Like if this becomes a thing where a lot of consumers care, then the companies will have to support it. And you do see some companies taking cryptocurrency already. It’s just a space where there isn’t a lot of precedent when it comes to law. And I mean, you probably know too, taxation. It’s not very clear right now. So when councils and legal teams are doing due diligence, it’s hard to have a very clear direction of this. It’s not black and white necessarily. Consumer adoption will need to drive it to a point where there is clear sort of legal guidance and companies can be set up to do this. I definitely think they will like a hundred percent. And then it also, you know, starts little by little the same way, like companies started their social media pages or their websites. Like it starts a little by little and then, then they start selling e-com, and you know, now it’s a supernormal thing, but even 10 years ago, it wasn’t.

Adam: Yeah. You know, I can’t wait until corporations and big brands like the Nike’s of the world start realizing the potential of opening and issuing token gated communities. Right. So once they have their assets in place, and then they’re creating micro-communities or macro communities around these assets and the people that invested into, whatever it is they sold, you know? And I think down the line, Like obviously we saw at least like shifts in how people use social media, whether it was from Instagram to Snapchat, to Tik Tok. And now, these new digital assets are proving to be interesting ways to not only foster but create new communities and introduce new people to your brand. And they’re doing that by having token-gated Discords, right. And issuing proposals and having their consumers or their customers vote on things for the brand, you know, and having a more of an active voice.

I forgot where I read this, but there were some stats, and you’d probably know way better than I do, so please correct me if I’m wrong. But brands are increasingly after having a direct to consumer experience, and really capitalizing on that intimate level of relationship that they can form. And I think NFTs are the medium and the primitive to do that. Would you agree, would you disagree? How do you feel about that?

I couldn’t agree more with you. So direct to consumer, just for it to give like a little context, the people who, who might be listening, there are a number of, I think in the last five years, there’s been a big shift to brands going more directly to consumers. But if you think about it in the past, like say you were buying a mattress, you would go to the mattress store, and you would try out many different brands, and then you would buy it from the mattress store. Or if you’re buying, you know, a bag of Halloween candy, you got it from the grocery store. And you were, you know, buying many different things and paying the grocery store. So if you think about it, if you were actually a mattress brand or Halloween candy brand, you weren’t actually in direct communication with your consumer. That transaction happened through a sort of intermediary, which would be their mattress store, the grocery store. And then that started to break down. Right? You see a lot of direct-to-consumer everything, whether it’s a vitamin brand or a skincare brand. Some of those types of brands started this revolution where, Hey, you can save 40%. You can save that grocery store margin, or you can save that mattress store margin and also get better pricing and also learn way more about your consumers directly if you have that relationship with them. So this then sparked a kind of mass movement for not just niche brands, but like bigger corporations to not only sell through retailers. But to sell directly to consumers where they could often, you know, have a better understanding of what their consumers wanted and blah, blah, blah. And there were some, a better experience because then, oh, your mattress ripped, you can go directly back to people who made it, not to some intermediary. So that was really cool and NFTs. That’s like the perfect place to not just have that relationship, but have it an authenticated way that’s transparent and sort of provable that you have purchased this on the blockchain. And I think loyalty programs that are powered by NFTs are certainly going to become way more mainstream because loyalty like I remember I was like in the Britney Spears fan club and I was like 10 right, posters, nails. And that behavior isn’t new, it’s a behavior that’s existed forever, but now you can authenticate that with NFTs and have, instead of shipping posters, you can say, Hey, download this link or join this virtual concert or whatever, and have that token game, which is just such a smarter way to do it. I think the same way with like, you know, loyalty programs like savings cards or whatever. Like you can do all of that through NFTs. And because everything is going to be powered by smart contracts, it’s just so much more scalable and efficient.

Adam: It’s almost as if, like, if you’re already talking about Britney Spears, which part of me wants to film an entire episode of understanding, like your love for Brittney stare. All of these like big media music, publishers, and recording record labels that manage all these artists. You know, I think it’s going to get to a point where they need to start waking up and realize there’s a level of fandom that comes from NFTs and that I was able to buy a juice world NFT while he was still on sound cloud, and prove that I was a juice world fan before he became juice world and develop that level of fandom, that provability and showcasing my love for something. That’s the equivalent of you buying a Brittany Spears poster, but now you’re able to prove it. Beyond just like crippling beyond just like getting old and the color fading. That lives immutably on a shared ledger on a shared internet network that’s literally taking over the world, right? And I think like all of these utility-driven use cases are things that brands are gonna wake up to. And I think there are reasons why we saw it kind of develop on the individual artists’ level, but like really talented graphic designers. And now we’re seeing that shift into the music scene in artists, tokenizing their albums and issuing shares of their songs or fundraising for EPs.

Where are NFTs going to go next? And how are brands going to like, take that and hold it by the neck, for example, you know, and like make the lead and make the noise around that? Do you have any thoughts on that?

Yeah. So I think the first thing that brands need to shift into doing is instead of one-off drops, which is what you see a lot of today, it’s like, Hey, one job. Like, we’re just doing this as a campaign. I think it starts with fundamentally launching an NFT program, which is designed for long-term success. And like, you can use Adam Bomb as a reference. Cause it’s probably like the first brand who’s done something, it’s part of the hundreds, which is a streetwear brand. To me, they’re the first actual brand that is launching a full-on program. You’ve seen a lot of flirting dabbling, but this is like an actual, you know, committed program. And you can see it on their site. You get access to things like the t-shirt. You actually do have ownership if, you know, your bomb is put on a piece of merchandise, you actually get a commercial rupture of that and some cool stuff that’s a little bit more in that line. I think you’ll see a lot of that. Dropping an initial NFT program. That’s kind of the key that can give you access to different things. And brands have access to a lot of cool shit. Like they sponsor leagues, they get free tickets. They have celebrity endorsement partnerships. They have new flavors that they launch. And I think a lot of that they can tie up in the value of the NFT. And you know, you might be a huge fan of Juice WRLD. Some people are a huge fan of bud light. You know, people love it. And you know, if that’s a way for you to reward your community and give to people who are in on stuff. You know, I’ve worked for brands for my whole career. And like people line up, like, you know, they sleep outside, like in the wet storms. I was going to say, yeah, people do that for I-phones. And like everybody knows that people like to wait outside for Black Friday sales, like in the sleet, people line up around the block when like we’re launching new flavors for different brands. So I feel like that is awesome. If you have the token, then you get first access, which is already a huge value. And then you can get special perks. Like when we have an extra club level, Or, you know, we can create so much value on the backend. It’s so much more beyond just the primary sale. And I think that’s what you’ll see brands do is realize that we have like, Hey, you want to have Leo Messi do a private chat with you. Like, that’s something we could give to a holder. You know, if a brand is sponsoring him, there are 1,000,001 ways we can create value for our holders.

Adam: Yeah. Like, think about that in a function. Let’s say Budweiser was to do a collab with Messi, and only the top 1% of Budweiser NFT holders would get access to this secret group chat that would unlock that only them and Messi could join, and then they would be in that group chat, and then that channel would close, and they’d be back into the greater sense of the discord server, you know? Like unlocking perks and utility and levels of access based on your level of membership and your level of, I guess, stake in the community is definitely something that I’m excited to see brands go out and do. And it’s almost as if these NFTs, like there are layers to this. They peel like an onion. And I think many people are going to be experiencing NFTs as a top-level funnel of getting people just to have a membership badge. A level of loyalty, a level of rewards that then kind of funnels them down into more purchasing layers and upselling them within the ecosystem. I saw this prevail primarily with this guy. His name is Mad Dog Jones. He did a really cool NFT drop, and he was the first person I saw to do this, where he had one drop on Nifty gateway, and then he did a special drop just for his NFT holders that only they could buy, if they had these certain tokens in their wallet, they get access to it. And it’s almost like he was bundling them in more and more and more, more and more.

How do you think brands are going to be approaching their web3 funnel?

You can look at what we did with Gary’s project, which isn’t necessarily a funnel. I mean, because we are sort of communicating that on the outside. It was like, Hey, do you want to FaceTime frog or a core? And obviously, there’s a price differential there, but there’s an access differential as well. And we did various ones. Some are courtside, which is like, you can go to a game courtside with Gary, and some are hangout Hawk, where you can be on a group hangout. So I love the way you put that with the onion and the tiers. Cause I think we think about it a lot the same way. Like we know that not everyone will be able to pay for courtside, and even a VeeFriend, in general, is a big investment. But yeah, I think that that’s probably the right way to think about it. We often think in three tiers it’s like core, which is basically maybe you get the collectible and some kind of group-level then there’s maybe the rare which would be, you get some kind of access. You get some kind of perk that’s a little bit more rare and unusual. And then of course there’s the ultra-rare. One of the ones that are, you know, really incredible experiences that money can’t buy kind of thing.

Yeah. How do you imagine the evolution of creator-to-brand collaboration? For being over time with the adoption of these digital assets? And just to add a little bit more to that, let’s say from the point of view of creators, we’re seeing a trend of them tokenizing themselves and launching their own creator coins, and building their own micro-economies within their communities. How do you imagine brands kind of taking advantage of these influencer circles or influencer communities and shilling their products into these micro-groups?

So, I wouldn’t say taking advantage. We never want to take advantage. We want to create.

Adam: That’s not the right word. You’re right.

Create mutual value. And I’ll just give you one reference that we can speak to you of what my advisor Tom Sachs did. You know the Tom Sachs like rocket factory project is amazing, but it has like 10,000 followers, versus you have like Budweiser, which has millions. So I think that the right collaborations come when it’s of value to both parties, and it’s like, okay, great. You get a lot of distribution, and you get a lot more reach, you know, a lot more awareness for your product in a more mainstream level, if you do some kind of collaboration. And that one was natural because like the rocket literally said Budweiser on it and that wasn’t planned. It was just like something that happened and it kind of tied. So I think that’s one example, and I think of brands the same way that we did Peeps. Like okay, Pepsi with peeps. You know, that was just like a fun thing. I think co-marketing works. It always has. And always will. And when you’re able to bring both creators together to co-create something cool, that’s when it’s the most valuable and fun. And you got value for those existing communities. I think the smart way to do it would be also like, great, so you should be giving a value to the existing token holders, that’s like the joint thing, and then you can launch your own thing and maybe get some credibility in the space. I think that’s a really smart and really strategic way for brands to enter the space and build that authentic connection and credibility, rather than just launching a cringey drop that, you know, sells for 0.2 ETH on Open Sea.

One thing that I kind of see happening down the line is all these creator communities that have their fan bases that are co-owners of the community itself that have some form of a voice in determining the path of that community. I think we’re going to see buy-in from brands that they’re going to buy into their tokens. They’re going to buy and have a heavy stake into their market caps, for example, and be core contributors in developing their communities. And I think this is a really strategic play for brands who have a lot of money, but how can people do this? Like how can brands do this if they’re like a startup, and they’re trying to tap into these micro-economies and these micro-communities? They’re niche, but powerful within themselves. What do you think is a good approach?

I think it’s almost easier if you’re a startup cause you don’t have a, you know, to worry about being a publicly-traded company and all the shit that goes along with that. I think if you’re a startup, I would be thinking much more like, how can I make NFTs part of my core business from the get-go. Not like how I can retrofit my multi-hundred-year-old business to now include NFTs. I would think like great, I wouldn’t even launch a loyalty program that wasn’t based on NFTs. Like, I’d be like, okay, awesome, my tickets are going to be based on NFTs. This is how I’m going to fundraise. This is how I’m going to have my loyalty programming. I think if you’re forward-thinking you can embed NFTs into your business much more proactively versus reactively. So it’s an incredibly exciting time for startups to think about NFTs and, you know, set yourselves up to take crypto, immediately. And set up collaborations with different NFT groups already. And there’s so many cool things that you can do. I would be super jazzed to be at a startup right now if I was passionate about NFTs because you can really build that in at the forefront versus trying to fit it into an old school model.

I want to pivot for a minute and talk about this $25 million fund that you guys set up at VaynerNFT. Can you talk to me more about that? What are those millions of dollars going to go towards? Are you guys investing in startups that are pushing the needle forward? Like where’s that going?

Yeah. So that is actually outside of Vayner NFT. That is the Vayner fund which is an important clarification. But I think that actually, that’s provided us with a lot of interesting understanding of the market and access. There’s a guy called Phil Toronto who runs that fund for Gary. But, like you said before, we kind of are a one-stop-shop. So, sometimes people will be pitching me something. I’m like, Hey, you guys should talk to the Vayner fund or vice versa, right? Like they hear an interesting pitch or a solution, and they’re like, Hey, you should talk to VaynerNFT because they might be able to use what you guys are building and partner with you. So I think that Gary is a very successful angel investor, and there’s no secret about that. He likes to be in on things very early and help sort of shape the direction of it. And I think through his investments, Gary gets a really good sense of what works, what doesn’t. He believes in investing in founders that he thinks are game-changers at an early stage, and yeah. I think it’s 25 million in some NFT programs has been quite exciting and something that Gary will probably continue growing with Phil, but slightly outside of the VaynerNFT world.

Cool. I love to hear it. I’m excited for you guys. It’s an exciting time to be in the space. I’m glad to see all the energy and positive vibes coming and from your team. The success that you guys have had, I’m here for it, you know, so I keep at it. Before I let you go, can you let us know where we can find you where we can learn more? If people wanted to do something with VaynerNFT, where could they go? Give me the whole spiel.

Awesome. So I’m Avery Akkineni. Long last name, but you can find me on Twitter, on LinkedIn, on Instagram, Discord, all the places. So that’s me. And VaynerNFT is VaynerNFT.co. You can find us at our website. You can find us on Twitter. You can find us on Discord. You can find us on Instagram. So, reach us in whatever form of DM is convenient for you, email, all that. We are happy to explore new partnerships. Whether some of your listeners have an NFT program that they’re looking to find people to work with or brands or celebrities, we’re happy to help. And yeah, super excited to be on your podcast, Adam. I love your stuff. I love what you guys are up to and am honored to be here. Thank you all for taking the time to listen.