Listen on: Spotify | Apple Podcast | Google Podcast

Background

Mint Season 2 episode 13 welcomes Rafa, a community builder, Web3 operations contributor, and an active supporter of local artisans in Puerto Rico. Currently, he’s most active in web3 communities like ForeFront and creator cabins.

In this episode, we talk about:

- The biggest recaps from MetaCartel’s MCON

- How can DAOs nurture a space for experimentation

- How to narrow the gap between passive and active contributors?

- What DAO-related problems would he like to see tools or platforms solve?

- His idea around Contribution Zones

- How creators should be approaching their DAOs

- Tourist tracks for DAOs

Links

Contribution Zones: https://ff.mirror.xyz/UJa9qpbbYftlN4xMOD9W3TBgeJS3gxK8ec4FKUJFhuM

Thank you to Season 2’s NFT sponsors!

1. Coinvise – https://coinvise.co/

2. POAP – https://poap.xyz/

3. Socialstack – https://socialstack.co/

4. Celo – https://celo.org/

5. PrimeDAO – https://www.prime.xyz/

Interested in becoming an NFT sponsor? Get in touch here!

All right, guys. Here we are MCON, we’re doing a post recap of MCON. With me, I have an OG DAO contributor who was quite active across multiple communities, including forefront, including creator, cabin. His name is Rafa. Welcome Rafa, how are you doing?

It’s great to be here. It’s been a long week and you know, we’re in the stretch. I think it’s time to digest a little bit about all the different conversations that we’ve had at MCON this week.

So before we get into MCON, give me a quick brief about yourself. Who the hell are you, what were you doing before crypto and DAOs and kind of where are you now?

So as you said, my name is Rafa. I’m Rafa the builder on Twitter. And I’ve actually been practicing organization design and studying organization design for the better part of the last decade. And so I worked in manufacturing for a little bit. I worked in consulting, strategy consulting and most recently in human resources technology for Web 2.0. But I’ve always been quite, I guess, dissatisfied with the type of contract that employees have and the fact that it’s mostly a model about resource management and value extraction from resources. Where I would want to be able to see something more about reciprocity and being able to create value together. And so through that conversation and through some experience and building in real life communities in London, I was looking towards the future of the creator economy and how, you know, you collaborate on Instagram nowadays. And what that future of collaboration looks like. And that ended up here in crypto and in DAO land.

So tell me, tell me about the past communities that you built while you were in London. What do those look like and how do they kind of relate to what’s happening with DAOs right now?

Yeah so, I met one of my good friends in London about eight years ago. And one of the things that as a young adult is you move to a new city and you want to make new friends. And What no one had told me was the fact that you can actually make friends quite consistently and you can make deep friendships and you can create a community of friends by consistently showing up and by just creating events. It sounds very obvious in retrospect you know, all you needed to do was host a couple of dinners that I learned from my friend who kind of was doing it in London, and I realized that you can build a community around people who just want to be friends together and can become a source of support for each other. So in London, we intentionally build a community of just folks who wanted to spend time together. We hosted a book club, for example, for a while, and a community group to about a group of, I’d say about 200 people.

Why do you think you’ve naturally drifted towards organizational design? What is it about it that kind of like gets you going?

Oh, there’s a good story here. So, my first internship my parents wanted to teach me the value of work.

I feel like that’s like a core principle that any family tries to instill in them.

Yeah. And, you know, coming from a family in Puerto Rico, they called my uncle who had a hardware store where they make doors and sell doors back in Puerto Rico. And they said, you know, you’re going to work there this summer for essentially minimum wage. They did pay me a little bit more than minimum wage and my job was to count screws. So what that meant was I had to spend eight hours a day taking this huge bag of screws and putting them in little baskets of a hundred screws each. And I had to do this manually. So I had to pick up the screws and I had to put them in little baggies and I’m sitting there and, you know, eight hours I’m in the basement. And I go to my uncle and I say, you know, why don’t we weigh them? You know? It’s not just an inefficient. It’s also the probability of me making a mistake is extremely high. So I could increase the accuracy and increase my speed and doing it. And my uncle is like, no, like you’re here to work and you need to learn how to work. And I like go back and I continue counting. And I’m like, How is this producing any sort of value for this company? How is this company profitable? How is my uncle making money? Because if they’re spending an entire full-time equivalent of me down here in the basement, which I also thought was a complete waste of my interest in, for example, business development. But put that aside, I was like, this doesn’t make any sense. And there was a bunch of other people on the payroll and I just kept on asking, why is this like the case? And I still can’t get that question out of my mind. So I kind of followed my nose on that. And every single job that I’ve had is continuing to understand, you know, how do humans organize and like actually create value.

Interesting. You know, when you look back into your career and you try to piece the moments that influenced you the most. And obviously in the moment you kind of question, like how the hell does this make sense at all? But those core experiences end up making you like who you are today, you know? And you’re counting all those nails, like, how is that equivalent to organizational behavior and DAOs right? And how does that kind of pertain to how people work in a decentralized manner? Have you found those similarities? Like what is the correlation?

I think what kind of takes you from point A to point B is that, one of the things that I realized and this is part of the book club in London and part of conversations and also just human relationships in general. If you sit back, there’s two different types of decisions that I think humans make. One type of decision is intended. This is roughly speaking and this is a false binary, but let’s go through the theoretical exercise for a second. One is intentional which means you wake up and you make a decision, right? You have another type of decision, which is script based. You’re thirsty. You go get a glass of water. You didn’t make that decision. You just went and got a glass of water, right? Similar to that, there’s a thousand other scripts in life that you can choose to follow or not, and you can choose to analyze them or not. So, getting a job and going to college is a script. It’s a community script, making sure you don’t drop out of high school is a script. Actually dropping out of high school is also a different type of script that you could follow, right? And these are tied to different cultural components and community environments that reinforce certain scripts that you have. Now where I’m going with this is that when one of the scripts that we don’t challenge enough is actually the employment script. So we have a social construct where you must get a job and you must get paid. And the majority of the value extracted in that partnership actually goes to a central institution. And that is a tax, and not in a bad way, that is a necessary tax to be able to manage transaction costs. That makes sense. And that script makes sense because as an individual, if I try to do something and I didn’t have the distribution power, or I didn’t have access to the right technology, then the probability of my failure as an individual is actually very high. So what are my options? I can go high risk, high reward, right? That’s entrepreneurship. Or I can work for another company which has already solved the transaction coordination problem. Now that script is actually outdated. And why DAOs exist today is because we’ve realized that that script, that acceptance of that specific coordination distribution tax, actually no longer is the case. As an individual, the creator economy is coming through because an individual has access to the right technology. And the transaction costs are low enough that your probability of success, of finding a niche market and monetizing, is actually much higher than most people realize. It might take 7,500 tweets to find a niche, but if you tweet enough about the same topic, you develop the audience, or you find it. Whether the audience exists or not, that transaction process happens. And then you can monetize the value that you’re actually producing. That means that me counting screws, which was a transaction cost. I’m working for an employer. If I tried to count screws by myself, I would have to find everybody that wanted their screws counted, which might take a lot of time. I might have to tell them how I’m going to count screws. And by the way, I’m going to have to charge them a lot more than minimum wage because it would cost too much to do. So all of that doesn’t work. It’s better to be on the payroll. And I might be at a loss as an individual, but overall the company might still be profitable.

So, what is it about the decentralization part of organizations that helps kind of fit with your theory of scripts?

So, what happens is, when you start thinking about what you can do as an alternative. There are new models that emerge, right? And you know, one potential model is actually the creator economy as a freelancer, right? The decentralization component is a new script, which is now evolving. And the script goes like this. A group of people can get together on the internet and make money. That’s it. That’s the script. That’s a new one though, that didn’t exist in the public conversation in a long time. And I would say, as we say on Twitter, it’s still early. But that script is really grabbing people’s attention. You know, there’s a bit of a hopium is how people describe it because there’s so much opportunity, people say, hold on, I have an alternative to employment. And so now employment can go under scrutiny. And decentralization, where a group of people can get together on the internet to produce value, actually becomes an attractive alternative to it.

Talking about people getting together. MCON. First of all, how was MCON for you? I know behind the scenes you were telling me like, wow, what a conference, but tell me a little bit more.

So I recently quit my web 2.0 job. I wrote an article about why I made that transition. I talk a little bit about some of what we spoke about here and I aped into it. I was like, look, if I’m going to go do this, I’m just going to go full in. And so a couple of weeks back it wasn’t even a week I bought my tickets, you know, maybe. You know, two weeks, like a week before the conference. I emailed some people and I was like, I’m going to go, we’re just going to go this, full on. And the conference was so much more than what I expected it to be. And I think the driver of that kind of energy, because really it was great for the community to provide itself some validation to each other for the work and what they’ve done for so long. You know, there’s a lot of perseverance here that has gone into it. I can’t really count myself in, not yet, you know, I’m still new. But it was really wonderful. It’s something really magical to be surrounded by what I would call community stewards, who have a vision of cooperative development and have a vision of creating generational wealth across individual communities. It’s really inspiring.

Adam: I’ll tell you my experience at MCON. I used to produce a lot of events. Many, many events like the last two years, and now I’m finding myself attending more events. And MCON was one of those gatherings where one, the selective group of people that came, was strategically done in a way where you could have like high quality caliber people. And you just felt just like the dumbest person in the room all the time. And you’re listening to these conversations and you’re listening to the people behind them, and you’re listening to how critically people are thinking about this stuff in their free time. It just makes everything fun. That’s why they called it MCON.fun.

So what were some of the biggest takeaways for you from MCON beyond the partying?

I just want to mention one point, you talked about the caliber of the person that was attending. I think part of that is actually the pandemic. It’s like the people who came were the people who paid the tax, the pilgrims, one might call them. And like any pilgrimage, you know, you go to burning, man, it takes effort to get there and to participate. And so I think one of the things that MCON did, I know the community is small to begin with, so you have like a group of hardcore people. But I think part of this is the pilgrims got together, right? They came together for a specific vision and they came to lend tribute to, you know, the vision and the community development that it has and it needs to be serious fun for someone to say, I will be a Pilgrim, right. It takes time.

You know, one of the most memorable points for me, this was on day 3. So yesterday on Friday, you know, you step outside of the woods brewing company and you just see like a circle of people just sitting in the middle of the street, you know, Ideating on like DAO philosophy and talking about the future of the organization, the future of collaboration on the internet, tokenomics, mechanism design.

Do you know how that started that circle on the floor? So a couple folks on telegram got together and since Friday didn’t have any programming it was just a group of five people on telegram that said, Hey, let’s get together at the chili pad. So Meta Cartel’s kinda like pad and let’s discuss it. But you know, when I got to the event center and I was like, I was like, why are we going to the chili pad? Like, why doesn’t everybody come here? So I texted the telegram group. It was an executive decision. We’re doing it here. So we sit down and there’s like six people there to start and we start having a conversation and then more people join. One at one at a time. And then we’re like, well, we don’t have enough space on the table. So let’s start sitting down and we sit down and more people join. And then people start crowding around and they start listening and they decide to contribute. And actually that is exactly how decentralized organizations work. It’s exactly the same way. You get a core group of people who just want to do something. But you do it in public and you’re not necessarily loud about it, but you’re consistent about it. Talk about it for a while. And other people start listening and they start contributing and you see people move through this concept of like contribution zones. We’re going to lurk. I’m watching from afar. There’s something going on there. I get a little bit closer. I decide to invest a bit of my time or resources in it. And then I might decide to contribute or to listen and maybe participate or signal as we might say, and then determine a specific course of action and actually then to get involved in production.

What would you say are like some of the biggest alpha takeaways that you think you picked up from MCON?

For those who are listening, I don’t know if you’ve come across this concept of what alpha is, but it’s, you know, the hot topics and like the good insight. There’s a couple of different ones. Like actually I read a Twitter thread about this this morning. I think a couple of things stood out. The first is like the level of ambition is really high, but it’s ambition from a group of people who are humble and honest about what they’re trying to actually get. That’s really impressive. And like there’s a lot of insight that actually comes from that discussion because the principles that these people are using to think about product development, to think about community development is not a, “I’m going to create wealth”. You know, you might go to a startup conference where they’re going to talk about cash flow and talk about runway and talk about, you know, how can I get a bigger multiplier on my evaluation. I didn’t hear a single conversation about valuation discussions and that’s because the valuation is not the end goal. The end goal is actually creating a movement of people who believe that there is an alternative script. An alternative way to actually produce value in the world, which is not competitive, it’s collaborative.

How do you think we scale this movement without diluting its value?

So during the circle yesterday, this was a very, very important topic of discussion. Because what makes the magic and what gives you the energy today is actually a fact that you have this ethos, you have these vibes, right? It’s all about vibes here. I’m mostly here for the vibes. I’m like, how do you scale vibes? Startups actually talk about this quite often. They say, how do I scale culture? At five people, I have a founding team. I’m like, tight-knit squad. You know, how do I scale culture?

And the only way to do it is with memes.

You joke, but that is the answer. The answer is you scale it with memetic information that reinforces a specific value system. You can introduce new memes and they can introduce new metaphors. I really like thinking about the language that’s actually used. And during the circle, we talked about the importance of developing a common lexicon of vocabulary and values that we want to use. Doctrines one might say, I don’t know if anybody here is familiar with Wordly maps, but he’s another person who works on strategy and or design very, very well known and talks about doctrine. So one of the first components of any type of collective collaboration process is, we need to be able to understand each other. And with a new Dao ecosystem, or I prefer to call them digital native organizations because some are not autonomous or some are not decentralized, but they’re all like internet natives. We don’t have a common lexicon yet. Here’s an example of what I just said. Like, what is a Dao? What is all this coordination for? What is our compensation structure? What counts as a token or an NFT? Like what is a contributor? And we’re in the process of that emergence in terms of both a value system, which we’re trying to identify without locking ourselves in place, because you know, self-referential problem here. And the operational process so that people who want to participate in this process, we’re going to have a tsunami of people joining us soon enough. They are already coming. And how do we help people maintain the same conversation, the same value system using the same language and foundational processes.

Adam: I want to pivot for a minute, because you’re a DAO contributor across multiple communities, right? Between forefront, between creator cabins, I want to kind of pivot into your time at forefront and bring up two or I guess one primary article that you recently published on behalf of forefront, talking about contribution zones, which really stood out to me. And I don’t think it got enough attention. So this is me putting it on blast and giving it more light.

or those who don’t know what forefront is, how would you summarize forefront and like an elevator pitch?

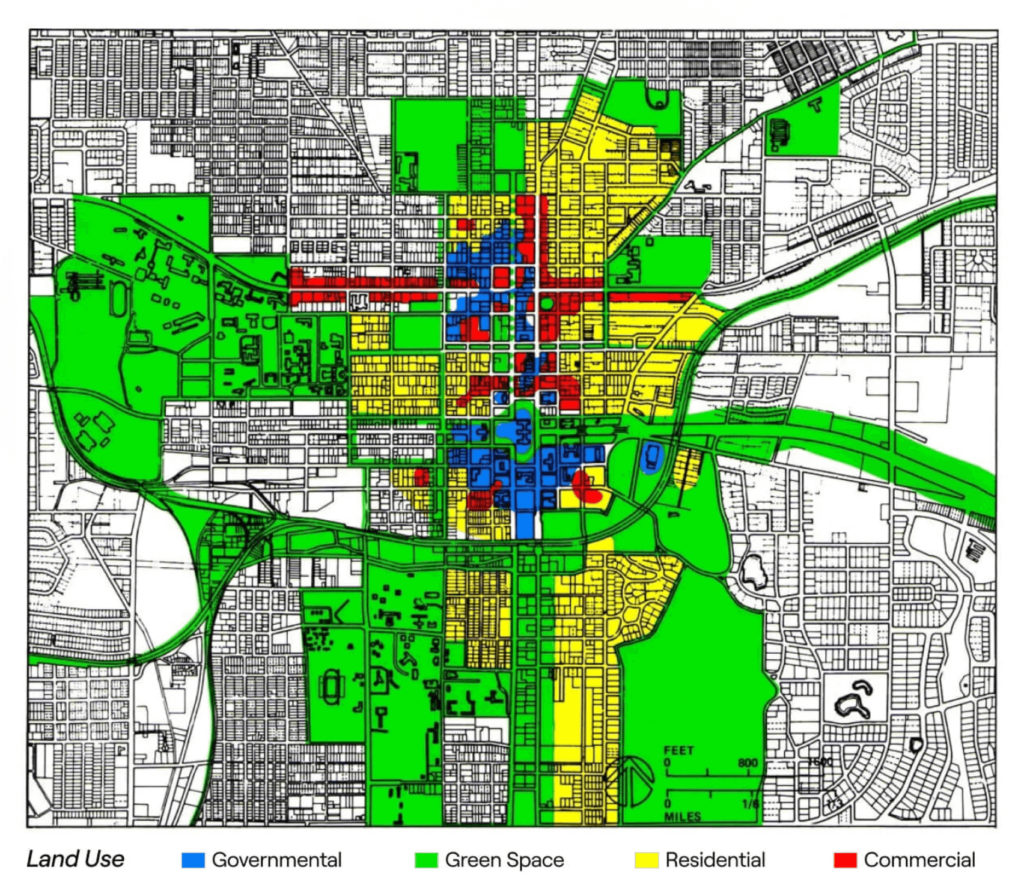

Forefront is the port of entry to web 3.0 is how we want to describe it. I say we as, you know, forefront but the truth of the matter is, you know, this is like quite emergent. Now, what does a port of entry mean? It means that we want people to be able to go to forefront , get the right resources, be able to find the right DAO for them or the right social token or social engagement. And so forefront is kind of like a content first organization where we’re publishing doing research with regards to different organizations online and right now trying to help other social organizations partner with each other. We think all these organizations are digital native, or just as cities, right? The metaverse.

Adam: There’s a really cool graphic that you guys put together and I’ll put it in the show notes for everyone that’s listening. Like this was the first time I got to visualize a DAO right. And do so in a way where it felt relatable from the architecture of a city. And I think you guys did this so strategically and so beautifully and the color coding makes it all. So right now, just for those who are listening, and go to Adam levy.io/blog, and you’ll be able to see the image, but there’s four colors, blue, green, yellow, and red. And blue is governmental green is space yellow is residential and red is commercial and it looks like it’s the architecture of basically a city in first off Tallahassee. This is Tallahassee. That was my first question. And second, what is going on here?

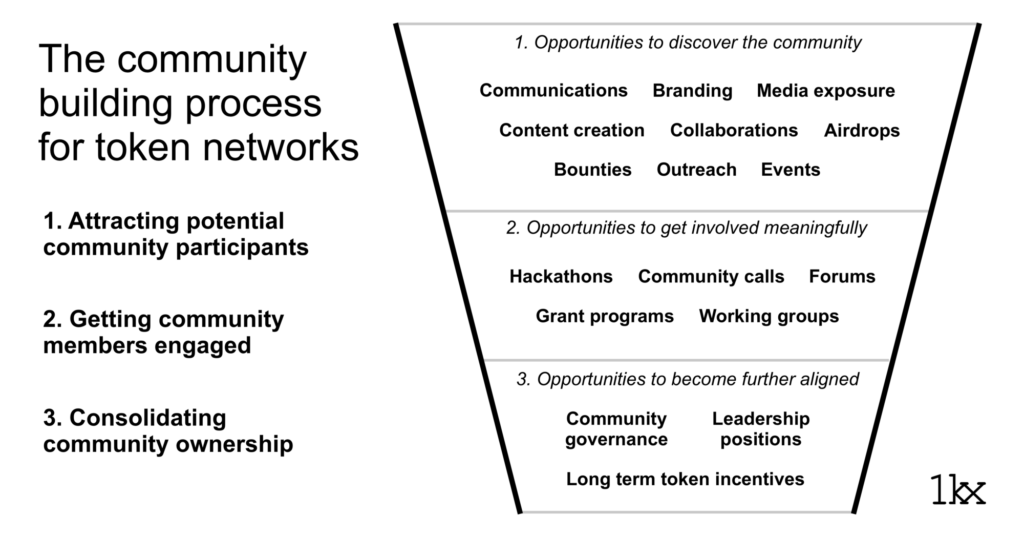

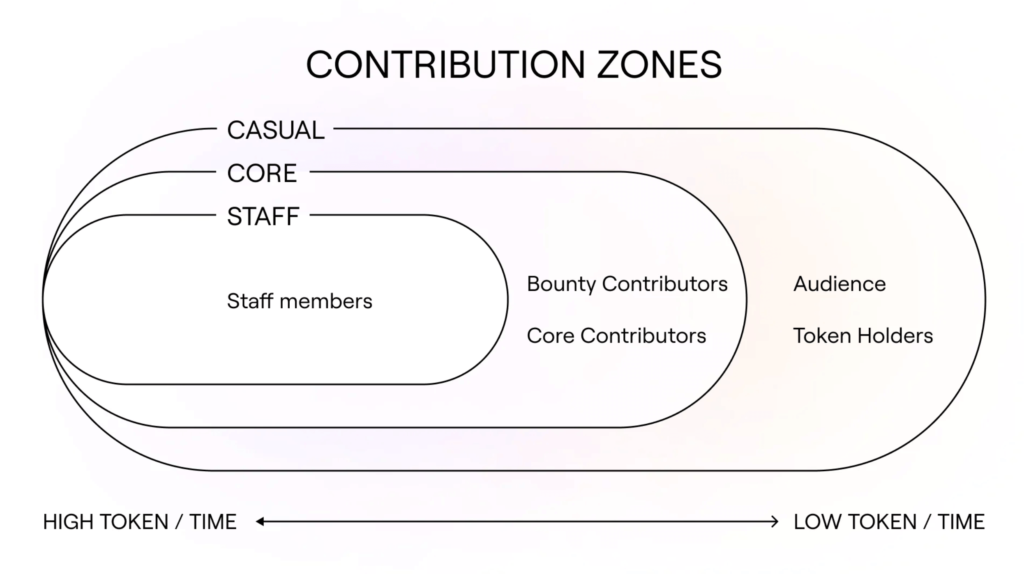

Let’s talk more about Contribution Zones. How did you kind of come to the idea of color-coding specific areas that specific color. So give me, give me the rundown. What’s going on over here?

So I read this book recently. Well, not right. Not recently, that’s a lie. I, I had this book, which was recommended to me by Ben Kat, who does like ribbon farm and breaking smart, and some other blogs. And I sent him a direct message and he’s like this really big guy. I love the work that he does, really forward thinker. And I said, Hey, if you were going to recommend one book on the org design or like a couple, what would you recommend? And he recommended two. He said it looked like a state and he recommended another one called images of organizations. And within that book, the author talks about how, depending on the language and the perspective that we do, we can envision organizations as different types of entities, whether machine we can say like operational effectiveness of an organization, right? If you’re thinking about a metaphor of a machine that has specific inputs and outputs, or you can think about it as a brain and talk about learning loops or as a series of other entities. That book really kind of I guess made me realize that organizations can be essentially whatever we describe them to be. And when I was thinking about digital organizations, I was thinking about this pattern of people getting together. You know, if you go to different discord channels, you know, they’ve got the chit chat channel and it feels like you’re walking around a neighborhood. And you move between discord channels into another, and people talk about teleportation, but that’s what ‘s happening. You’re teleporting yourself from one digital city to another. And so, when I was thinking about that, there was a question in forefront, which is, we need to figure out, how are we going to pay people? Like, how are we going to talk about different members? Because different members are contributing in different ways. And then these two ideas just kind of collided and said, well if the digital city has different neighborhoods, well, maybe there’s different zones that people are participating in. A commercial zone or a residential zone. And I was like, but maybe there’s different levels of commitment and engagement than that we have. And maybe each person then flows through different contribution zones in different neighborhoods. And maybe I’m a lurker, downtown, not really going anywhere, but I’m just a tourist. I’m just hanging out. That’s one level of commitment in a specific area of your digital city. Versus maybe you’re an active contributor in the suburb where your home is. You know, you’re part of the board, and you’re actually doing specific work and you’re committed for a specific amount of time or for a specific project. And so then, when we started thinking about what language we want to use to describe these digital organizations. I really wanted to stay away from thinking about them as machines with inputs and outputs, because that’s actually not how they work. They’re too complicated for that. They’re these like organisms where they react to a specific environment. But you know, we also need to be pragmatic and make it simple enough for people to understand kind of what’s happening. And I was probably lucky and inspired. And just like these ideas kind of collided. And suddenly you can see them, right. It was quite eye opening to write the article because as I was writing it, I was transforming the way that I was viewing the online landscape.

These contribution zones are very much like operating models. Right? How can DAOs kind of nurture a space for experimentation to find that right you know, contribution zone, that right operating model? How do you think about that?

So, in forefront, what we identified was that we had three main I think contributions zones, right? You had three levels of participation. One when you’re watching one that you’re actually doing and one which you’re actually maybe enacting the community needs. So being more like a steward. And this might be common across many DAOs, but it actually might not be similar to what you’d describe. It might be different because a DAO or a digital native org that you’re working with, may actually have a command and control model. Where you have a very central group of people then delegating work to others. Maybe your organization is closed and you don’t really have lurkers, or you might be recruiting people specifically to work in the digital environment. So how do you explore your digital city and the digital city that you’re creating? Well, it’s similar to moving into a new city. What do you do when you move into a new city? You walk around.

Like Europe, you’re more like around people. It’s different culture. I feel like I’m in LA. Ok, Meetup.com.

You look for people, you look for things to do and similar to any type of digital city, you have different layers to it and different different meshes of environments, right? You have in, in Europe specifically, you have the tourist track, right? You have this in the states. You can go all through New York and see only the tourist stuff. Go to Times Square, Logan Square, you know, and you’re going to get overpriced, terrible merchandise, and it will be the New York experience. It’s terrible, but it’s true. That’s the tourist trap. Right? And in digital cities you have it similar, you have different layers. You have local neighborhoods. When you’re thinking about your digital city, number one, I’m not for central planning, so don’t try to design your city. You don’t do that. Similar to how cities are encouraged to grow. You can actually define specific zones of specific types of work. So you plant seeds in terms of it. I think listening for these specific signals and during a tour of your own city that you’ve been creating and reflecting on how people are engaging is the best way to actually learn. And it’s emergent, you know, New York is not the same New York it was 50 years ago. And your digital city is not going to be the same digital city next month. I mean, we’re moving at a way different pace, right?

Let’s pick apart this tourist track for a second. Because just to recap you, New York, you could take the tourist track and see all the very like low quality, but what everybody else sees. Like it’s high quality, but there’s more to New York beyond just the tourist track. Do DAOs need a tourist track? And if they do, how do you even design a tourist track for DAOs?

That’s a great question. I don’t know. It ‘s just gut.

Do you know what I’m imagining right now? I’m imagining myself going online and having, like in LA, and all these micro DAOs, you know, and being able to navigate through them and kind of pick apart just the higher level takeaways. That’s what I would consider like a tourist track, you know?

But what are the monuments? You want to go see the monuments?

Yeah, exactly. You know, but what does that look like in a DAO?

I don’t think we know yet. I mean, at MCON here, we spent like all these days and one of the hot topics was actually onboarding. And this actually relates to that type of onboarding experience, which is when you visit one of these digital cities and you’re trying to figure out where do you want to move in whatever engagement level that you would be interested in having, what information do you show and who do you want to attract? Tourist tracks attract tourists. Do you want your DAO filled with tourists? Maybe because maybe your DAO sells DAO merchandise, and maybe you want tourists to come and hang out and drop and buy an NFT and then leave. And not bother you anymore.

It’s almost as if these DAOs will have like galleries comprised of user NFTs. And the tourist track is literally understanding the culture of each DAO and navigating through each micro museum. You know what I mean?

That’s one of the many, many different ways that you could create a certain type of experience for a specific type of person. Or I prefer to call them agents that come into the DAO.

You know what I’m thinking right now, like what’s the Hollywood tour bus moment? Like what does it look and feel like?

And does it provide value? And do you want it? Does your community want that type of experience? In forefront, one of the things that we’ve been talking about is there’s so many people coming into a server, but they don’t necessarily know where to go. And similar to a new city, which has buzz, you know, you got a gold rush going. And all the people are like coming in and they’re saying, I found forefront and I found the blog. I came here and it turns out that we don’t have well-paid rural roads yet. And people are like crowding in different places and asking the shopkeepers, Hey, I want to move in. And the shopkeepers are like, well, number one, do you know what you’re moving in for? Like, when they’re like, no, you haven’t told me. They’re like, yeah, we probably would just take my money. And they’re like, I just want to spend my time here. Like, what can I do to help you? And the shopkeeper is like, look, I’m really busy right now. I’m making some shoes. Like I have a lot of shoes to make for the people who are already here and you want to hang out, like, why don’t you go make some shoes? And they’re like, I don’t know how to make shoes. And they’re like, will you teach me how to make shoes? And so the shopkeepers are trying to balance now between their own internal production, but also onboarding the new people who are coming in.

It’s almost as if you need to develop micro apprenticeship programs, you know, people just like watching, like the Shoemaker making shoes right. And learning from them. And what does that look like?

You don’t want to sacrifice. Like, there’s a big balance here between like automation and like actual human empathy and engagement and belonging. Part of the reason why digital organizations are so specialist is because people are actually finding a source of purpose in participating in this different script. And so it comes back like I help run a nonprofit in Puerto Rico, which is called Obras Del Pais and we do micro documentaries for artists. And we’ve learned a lot about how artisans also engage and bring people in and onboard them. But similar to the artisans, the people who are really full-time in DAO land. They’re like craftspeople, this is n’t automated work. This is community management and community stewardship. Takes time, you know, to take that raw material, just like a group of people and turn it into a source of value and production. You build a community in real life. You’re not going to get a community in a week, no matter how hard you try and how much hazing you do to, you know, have them bond. It takes years of consistent conversation to get to different layers of participation.

Adam: And you know, the equivalent of entering that shop to talk to the shopkeeper who’s making the shoes is, and I would take this again. I’m looking at the contribution zone article that you wrote, and again, I’ll reference it in the show notes. Every single person that’s entering the shop starts as a casual contributor. And if they want to start helping build the shoes, then they become a core contributor. And then what if they want to open their own store? Then they become staff.

And moving through, I think though, there’s an important distinction here. It’s easy to conflate contribution zones with a career ladder. And that’s actually not the case at all. So contribution zones are supposed to be personalized preferences. So maybe I am a casual contributor because maybe I don’t want to have my own store. I don’t want to commit over a period of time. And it’s really important to differentiate between career level, which is an old script of a traditional organization, versus what we talk about in contributors zones, which is a personalized experience within that digital city, which is for you. As an individual and your preferences and needs and opportunities.

That makes sense. One thing that I continuously see across DAOs is there’s a lot of like active contributors and passive contributors. How do you narrow that gap? How do you get more people in the store? And how do you develop it in a way where the Shoemaker there’s a ton of them that the system welcomes and allows, you know, but also encourages, you know what I mean? I feel like it’s a fundamental problem across many digital organizations that have the token, retail is going to ultimately speculate on it. And we saw it a lot with friends with benefits recently when they did their raise, you know, and it reached to about 200 a token. Retail investors seeing the opportunity and et cetera, et cetera, even now with forefront, and they did their private quote unquote raise. You know the select raise.

How do you narrow that gap between passive and active holders?

So I think you’re actually referencing here another traditional script, which is growth as a primary objective. That’s not necessarily needed. And maybe you don’t want to narrow that gap. Maybe you just want to have a bunch of low level contributors and you wanna make it hard to become core and stuff because you don’t want that many.

That’s a new perspective that I heard.

Yeah, growth is not the end game. It’s actually just purpose and mission and tailoring and creating a community, a city that provides you a specific experience. There’s a lot of small towns that don’t want to become a city. There’s a lot of cities that don’t want to become a mega-metropolis. And like that I think we collectively, as we move into digital native organizations, we need to be quite conscious of the fact of chasing growth or capital, valued development for the sake of it. And kind of realize that maybe we don’t want any of that. Now, in most cases it looks like if you’re founding a city, you do want to get some staff and some contributors, right? So narrowing that gap is still important for specific areas. I actually think this is going to come back to pods. I mean, chase and I joke about pods and it’s a joke, pods, pods, pods. But I think the answer is that the unit of maturity actually is not from an agent perspective as an individual. It’s actually maturing via different squads or small groups of people or becoming more involved and committed together over a period of time. And you might move between one group and another. You might be part of multiple groups, but I think it’s going to be similar to the cohort-based courses and that’s what we’re seeing, and there’s this really great book about it called ” situated learning”, and a legitimate peripheral participation that talks about this. That is about getting better at contributing. And we can provide people tools to become better contributors, and we can give them new scripts to become better contributors. I think part of what we need to do right now is let that emerge a little bit because we’re not, I think there’s no hard-coded answers yet.

One thing that I’m really excited about with the development of DAOs is the increase in development in tools and platforms that will help better organize DAOs, better communicate between peer to peer. What are some of the biggest problems that you see needing to be solved right now with tools and platforms that could be solved with tools and platforms or products, for example. Anything that comes to mind?

I mean, I think this is such a new environment, there’s this, like, you can pick any product and go at it. So think about how much software a standard startup uses today. And they use a ton directly and even more so indirectly. Each piece of software that they use uses another hundred pieces of software in each of those hundred, like use another hundred. If you look at the marketing advertisement landscape, like HR has hundreds of products. Like the hundreds of products that are named, not even like that someone put on a map, like how many data analytics tools that you have? But I do think that there’s a common trend here. I actually had this conversation a couple of days ago with Meta dreamer and we were talking about product development for digital native organizations. And I think there is a paradigm shift that’s happening because operational tooling in web 2.0 has traditionally been much more about the input process. I’m oversimplifying this. I’m sure this isn’t true across the board. Let’s just do a mental experiment for a second. But you use Salesforce or let’s say HubSpot. And you input data into HubSpot, right? In digital native organizations, there’s something a little bit different going on, which is the software is built around the information feed, which exists. So collab land, you don’t input information to collab land. Collab land reads your wallet. So it reads your transaction feed. And I think we’re going to see a major operational change in which we’re going to have all this like a new toolkit, which is going to read the information and the conversations that we’re having, and then provide value on top of it. Kind of like how we have discord bots.

You know, the most relevant example of this startup that I met at MCON, they ‘re in FWB. I’m blanking on their product name. I see the logo in my head, but the takeaway is they’re trying to develop tooling for treasury management. They want to help DAOs identify things like, what’s an employee cost or like a member cost. What’s an expense cost, you know, what’s an overhead cost. Merely based on the snapshot proposals that get accepted.

You’re not asking someone to come in and input the numbers in an Excel spreadsheet. That’s the previous approach. We had to input information. And like, so the new products that we’re developing, and so to get to your question before, which is what operational opportunities we have. I mean, all of them. You have all of them. You have all of the opportunities. You have opportunities for scheduling and calendar management, where it’s reading your agreements on calendars and like pinging you and telling you, Hey, by the way, you have a conflict at that time with a different discord or a different digital city. You’ve already committed to teleporting to this other digital city at that time. Would you like to delegate this to someone else? What do you like me to record the meeting and send it to you? Not reschedule. Like what type of participation would you like to have? Since you are already committed to be in person in this other environment?

My mind is blown right now. Is that already happening by the way, do those tools exist?

I don’t think so. And if you want to have a conversation about this, like the primitives have changed. Like I tweeted this earlier, primitives always change. You know, your engagement with reality is always off. I don’t really see the world, right? I see a projection of the world as it is. But there is something really, really important, which is our foundational coordination mechanism is no longer data input. It’s actually data synthesis, the data exists and we’re producing it. And we now have an opportunity to build a completely new toolkit, and operating model, which is not based on me moving from one interface to another. But having these programs read the engagements that we’re already doing, read the chain, read the ledger, and then make recommendations and help you produce value.

That’s deep. That’s a new perspective I’ve yet to come across.

Well, and this is the, you know, when people ask me, why did you quit your job? I said, because you can’t unsee this. You can go back to building a product like Salesforce, asking salespeople to input information when you know that the future is going to be based on sales people getting nudges based on transaction profiles that are automatically generated. And, you know, every single engagement is going to be recorded. And you know, you’re going to live in these digital cities. And the salesperson is going to move from one digital city to another and create audiences of purchasing, not like single point of control decision making. Like you see this change and you’re like, am I going to wait? Am I going to build this for the next five to 10 years for an enterprise solution? By the way, they’re obviously going to make a lot of money. Like I’m sure they’re going to make a lot of money. That industry is not going to go anywhere. Web 2.0, I’m sorry, folks, hot take here, it’s going to be here forever. But we do have a new economic model, which is going to be developed in parallel. We still have traditional manufacturing. And like there’s still some farms that, you know, have people picking fruit. You can still have old models of work and maybe those aren’t good examples, but you still have old models and new models of work. The world has not been digitized completely. And in the same way that the world has not moved to digital transformation as the enterprise says we haven’t done the mobile transformation. We’ll have an AI transformation. Yeah, we’ll have collective intelligence or digital city transformation. They’ll pay McKinsey for it.

I don’t know if McKinsey could do it. They’ll create, like graphics for what they need to know.

They need to know the top five leadership skills, which is like the DAOist. You know, top five leadership skills. Executive retreat to learn about community stewardship, you know, the way that we had the same way that we have servant leadership.

Is that how we know we’ve reached the top? When we see shit like that?

I mean, I don’t know, man. Like, the world is weird. I don’t think we’re going to understand when we’ve hit the top. I mean, what’s happening is a mass migration of people from one ecosystem to another one, the same way everyone went to tech. And we’re going to see a massive wave of people moving from corporate to tech and now from tech to digital cities and it will self-select. And like, yeah, it’s, it’s hard to unsee the pattern and to see the opportunity. And to say we can build something new and it doesn’t need to be exploitative. I mean, exploitation is never right. You should never do it. But we have an opportunity to, instead of extracting value from an audience to create a community value together. Grow the pie as a foundation.

So many things unfold here, to dive deeper. I want to end off with two more questions. What we’re talking about right now is I’d argue is a bit philosophical, right? We have yet to see an organization really execute on this. How does this tie back into creators and how does this kind of tie back into them monetizing or being stripped away portion of their efforts across web 2.5 web 2.0 platforms, right? How can they adopt this next era with their communities that are inherently web 2.0?

I think, yeah, that’s a, that’s a really good question. I mean, right now we still have like a bunch of gatekeepers. Right? You pay the tax, the YouTube tax, Facebook tax, like Snapchat tax, Tik Tok, tax, all taxes. Because you still have gatekeeping. But there are different ways. I mean, you’re seeing it with the NFT landscape where people are making their entire year’s salary worth of YouTube ads in days by putting their video up on glass.xyz. I really love this. Someone told me years ago we were having a conversation, we were talking about paying for a blog. We were like, no one’s going to pay for a blog. I don’t know how long ago this was. This was like five, 10 years ago. No, one’s going to pay for a blog. It’s just words on the internet. Like, it’s your opinion. We’re going to pay for your opinion. And then the next time it was like, no, one’s going to pay for a blog post. Like who’s to pay for a blog, you have a subscription service. It’s like, one’s going to pay for it. And then Mira shows up and people are buying blog posts and the next conversation would be no one will pay for your paragraph and no one will pay for your sentence. And the reality is that they will, and they’ll get micro referenced across the board and you’ll create new network economics where I write a blog post, and I reference you in a portion of my money using, for example, splits will get reallocated and we’ll create a passive income economy where as you create online, the rewards will flow back to the sources.

Adam: One thing that I’m really excited about and there’s a company that a project or a DAO that’s going to be on season 3, called global coin research and their whole model, and I tweeted this a while ago, it’s like, I don’t want to pay $1 subscription for a yearly access to the New York times. Like it’s a dollar, you know, like, but I just don’t want to do that. I don’t want to go through that funnel. All right, enter your first name, your last name, your email, and you’re gonna get spammed with other promotional offers. I’d rather just connect my wallet, hold the amount of tokens and get access to a flood gates of knowledge. I’d rather buy $500 of your token than pay $1 for a year.

But it’s so true. And the reality is like no one wants to input information. So going back to the product development organization we just had, right. I don’t want to put my name and my credit card and give you my personal information and have you grab my cookies. It was like, can I just sign in and kind of just like read and consume and like automatically stream, like micropayments, based on the information that I’m consuming and have a budget, whether we’re I set, and I have a product that is telling me how much budget I’m using on information consumption and make recommendations on it. And I think that is a future that is here. And the tooling is here.

What’s going to eat web 3.0?

I don’t know. So, like if you asked me like five years ago, what was going to eat web 2.0 I don’t think I would be able to answer it.

Adam: But the reason I ask you is because you’re already identifying pain points that’s happening in what 2.0, and like what happens when you scale those solutions on web 3.0? Is there any detriment to that? And what could that be? That might influence web 4.0. From an organizational point of view, I guess.

It was Neal Stephenson who had wrote this book. I can’t remember what the name was, but in the book he talked about feed customization. And so I think right now we don’t have control over the information flows that we actually consume. So I think if web 1.0 is read and web 2.0 is read and write or read and create, and web 3.0 is read, create and own. Web 4.0 is probably gonna be read, create, own and curate.

What do you mean by curate? Elaborate on that.

It’ll be a customization of the engagement that you have. Right now, we don’t have control over the information feeds. You join discord and you’re a part of every channel that you get assigned to. You get every piece of information and you have a lot of noise and we don’t know how to control that right now. And even the web 3.0 tooling that we’re developing is enabling ownership over the data that we’re producing, but it’s not enabling the customization of the data that you consume. So maybe that’s what comes next.

That’s a great take. Before I let you go, where can the audience find you? Where can they learn more about you? And of course I’ll reference your Twitter and all these things that we talked about.

So you can find me on ForeFront at cabin DAO which is supporting different creators and creating a decentralized city. But for the most part, you can find me on Twitter at @rafathebuilder. And if you want to connect just send me a message, and definitely support your local artisans and your local crafters.