Background

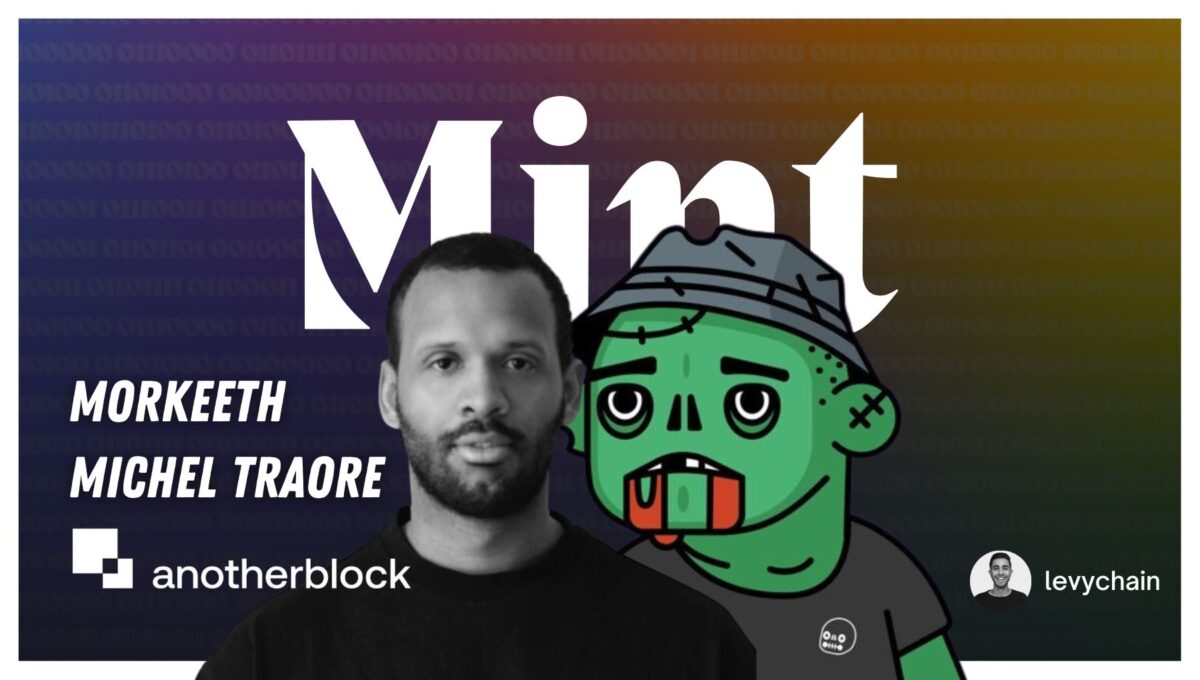

Mint Season 7 Episode 22 welcomes Morkeeth and Michel, the Co-Founders of Anotherblock. Throughout the session, we discuss how their platform connects traditional music ownership via streaming revenue with NFTs for buying and selling music onchain. The conversation touches on what they claim to be the benefits of royalty-backed NFTs over other forms of music NFTs, the psychology of pricing, and the grey area of whether or not these assets are an unregistered security. This conversation is not intended to be financial advice, strictly informational as it goes with every conversation on Mint.

So without further ado, I hope you enjoy our conversation.

Time Stamps

- 00:00 – Introduction

- 05:25 – Why People Should Feel Entitled to Own More of the Value They Create

- 07:48 – The Mindset of the Average Person Scrolling Through Tik Tok and Contributing to the Virality of Today’s Music

- 10:03 – Will Collecting Tokens Become the New Form of Showcasing Fandom on a Greater Scale or is It Limited to a Few

- 17:20 – Thesis for a Crypto-Enabled Music Industry

- 20:05 – Royalty-Backed NFTs

- 22:34 – Psychology of Pricing and Decision-Making Processes

- 26:38 – Do People Mint NFTs Out of Emotion or for Investment Purposes?

- 28:43 – Benefits for Individuals Who Take a Percentage of Royalties

- 30:04 – Rihana’s NFT Launching Right Before the Superbowl

- 36:13 – Securities Laws Around Associating a Royalty with a Music NFT

- 40:06 – Common Misconceptions and Potential Backlash from Labels and Artists

- 41:17 – The Possibility of Paying Individuals per Second or Minute Rather than the Typical Few-Month Period

- 43:09 – Anotherblock’s Future Plans and Roadmap

- 44:12 – Outro

Support Season 7’s NFT Sponsors

🌿 Enter for a chance to win a Lens Profile

Lens Protocol is an open-source tech stack for building decentralized social networking services. The protocol was developed by the Aave Companies and launched on Polygon in May of 2022. Through Lens, web3 developers can build decentralized social media applications and marketplaces that leverage NFT technology to form a fully composable, user-owned social graph where the connections and interactions between people are owned by individual users and creators rather than established networks.

Complete these steps for a chance to win a Lens Profile: https://adamlevy.io/lens-protocol-season-7-campaign/

(🍄,🔍) Bello: The #1 for blockchain analytics tool for web3 creators

Bello is the no-code blockchain analytics tool that empowers web3 creators and communities with actionable insights on their collectors through a simple search.

Join private Beta: https://www.bello.lol/join

Intro

Michel, and Morkeeth, welcome to the podcast, excited to host another block on this episode, a part of season seven. How are we feeling? What’s going on?

Morkeeth: We’re good. We’re good. It’s getting late here in Stockholm. So, it’s, you know, it’s perfect way to round off the day.

What time is there now?

Michel: It’s cold, it’s getting into spring, it’s 1920.

Wow. Okay, well, I appreciate you guys being on super late. I know, we’ve been trying to make this episode a reality for a minute, but never, I guess better late than never. That’s what I wanted to say, right? I think a good place to start guys as to how I like starting all these episodes and is understanding a little about, a little bit about who I’m speaking with. Okay, so I wanna start with a couple intros from you, Morkeeth and then from you, Michel, who are you guys? Like what does the world need to know about you and more specifically, how did you get your start into web three? We can start with Morkeeth, and then work our way to Michel and maybe even include like how you guys met each other in that.

Morkeeth: Perfect. Well, sounds good. I mean, you and I, Adam, we met over at Bogota, where I started hacking together with your co-founder from Bello, Ellie, which gave us also a great shout out in your Eth Denver recap. That was cool. And you know we were sitting there; we were talking about creative economy. And that’s basically what we do, I run product here another block and came across Michel after I’ve been working in endow tooling, a little bit in defi and basically start to fall in love with this kind of like alternative acid and the creative economy. And basically, working with something that sparks joy and passion for people. I mean, money is great as well, when you talk about defy, but it hits different with like trying to change a whole generations kind of behavior of trying to reshape ownership, and especially with music.

And for you, Michel, where do you come into the picture?

Michel: So, I mean, long story short, so I’m the CEO, and the founder, one of the founders, we’re three the founders. But yeah, my background also, like grew up between Sweden and West Africa and Burkina Faso, moved back and forth between the two. And growing up, my dad set up like the first modern record label in Regina. So, I really, like grew up seeing and understanding like the difficulties and the awesomeness of music, but also like, definitely, like how difficult it is to monetize and make it, you know, a big thing that he really, like, started that industry from scratch over there. So given that experience, and seeing that, like I’d never thought it would go into music. So, you know, my background has been a lot in FinTech, my path into web three was actually quite slow. So, one of my colleagues in 2015, he went on to start doing analytics. But he was the one who like sat down with me and bought the first core into like, you know, he was doing this whole gospel thing, you know, so, I got introduced via him into the space, but then I would say, I was like interested and I read a lot about it, but I never, you know, I never collected and it is I understood the tech, I understood, you know, why it’s great. But you know, I never really, you know, interacted that much with it. But I understood definitely like what it could do and what the allure was, yeah. And then I met one of my co-founders, and we bonded about music rights in general, and like the power of music rights, and how awesome would it be to both fund like an up and coming artists and be a part of the growth but also, and more importantly, almost like, you know, at that time, you know, Bob Dylan and Neil Young, all these big stores are selling catalogs. And we were like, you know, we’re the ones who are creating the value of the catalog, because we’re listening to it all the time. Like why isn’t that a normal IPO? Why is it that you know, here, guys, you created the value, now it’s your turn to own it. Like why are those deals always bilateral? Why isn’t always one entity or, you know, big corporation buying up all of those rights, which was the same for the stock market for a long time. It wasn’t a stock market, you know, but for stocks in big companies, it was only big funds, buying them until the public could actually participate. So, that was where the idea started about one and a half years ago. And then it wasn’t until like two months after that, where we decided to double down on building it on crypto because we saw that, you know, it had very clear advantages to doing that. Like technically, you have 24/7 availability, it’s easier to track, it’s easier to do all the payouts. So really like the blockchain aspect of this changing after, you know, after the core concept was really you know, were create it. And then, you know, Stockholm has quite a small web three scene and Oscar was, you know, is one of the founding fathers of that scene, I would say. So, you know, we met quite early on and really, you know, did everything we could to bring him in.

Morkeeth: Yeah. And we tried understanding like, you know, we love web three, and try to really add those things that we loved, and to the end of the block ecosystem.

Why People Should Feel Entitled to Own More of the Value They Create

Got it. Why should people feel entitled to own more of the value that they create? Like why should that be a right of somebody interacting in the digital world? Because if you think about it, right now, when you consume content, and you consume media, the average listener doesn’t think, wow, I’m getting screwed here, I should be owning a piece of the value that I’m creating some capacity. It’s a very, it’s a new way of thinking for the consumer. And I’d say you’re very early in the adoption curve that sort of thinks this way. So, when you’re thinking about, and you made the argument that we should be capturing more of the value that we create, like that’s essentially paraphrasing what you said, why should that be a right? And would you say that a lot of people think like that today, but they just don’t have the tools to achieve that that want?

Michel: Yeah, I wouldn’t say it should be right. Definitely not, it shouldn’t be right for anyone, like it’s up to the creator in the end of the day, I’m just saying that it’s something that would be very, you know, I think it’s something that would be very welcomed, and something that people would appreciate having the opportunity to be a part of, because.

Morkeeth: We need the option to.

Michel: Yeah, it’s more on the option side of it. Like obviously, it’s going to be down to the creator at the end of the day. But like if you look at other things people invest in, like music and these kinds of assets, they also perform really well, and they are good investments. But the difference is that it’s so much clearer that you’re a part of that value creation. So, to me, it’s just like creating that possibility. And I’m sure that people will want to be a part of that, you know, because they’re a part of the value creation, they should be part of the value extraction. But it definitely shouldn’t be like, I’m creating, like I should have the right to own some of your rights, because I’m the one that’s listening. But it’s more like, you know, why isn’t this a part of the mix of things people can place their capital in and be, you know, co-owners of.

Got it.

Morkeeth: And if we’re looking at the kind of like attention economy, like if we do want to have a generation that just scrolls and not participating, and like actually activating, I think this is a great way of just activating people and making people have cautious decisions of what they actually like.

The Mindset of the Average Person Scrolling Through Tik Tok and Contributing to the Virality of Today’s Music

When you think of the average person that’s scrolling through Tik Tok, and contributing to the virality of today’s music, what do you think their mindset is, as they’re consuming this content? When it comes to the music that that’s pegged and complemented to the video content that they’re watching? What do you think their mindset is, in that given time?

Michel: I mean, in the Tik Tok part, it’s hard to say like, because maybe I’m more focused on the image material that they’re watching, and they don’t really, you know, notice the sound or, you know, maybe they do and their mindset then is, I don’t think the mindset is like I’m a part of making this a success. You know, I don’t think that that’s part of the thinking today, but, you know, 10 years from now, maybe if you see a video that you think is gonna go viral, or listen to the song that you think it’s gonna get big, like if there’s an opportunity to jump in early, because you have a great taste, or whatever you care about it, like it would be great to have that opportunity, in my opinion.

That makes sense. I’m a big believer that I should be, I would love new ways to contribute to more of the value that I create, and like be more hands on with more value and value is very arbitrary, could be listening to a song. And my way of contributing is supporting the artists by collecting their NFT, right. Or if I’m listening to a podcast, my way of supporting the network is through patronage by collecting their NFT, like it all comes back to the NFT for me, right, something that shows my level of intimacy and my level of love that’s measured on chain, I think, is a very cool way to do that. But I’ve yet, a lot of people have yet to sort of like get that that fuse clicks, you know, the way we sort of, kind of like came.

Michel: And I agree with you. And I think that like, just, you know, the NFT part of it is an important aspect of it, because it’s like some sort of, you know, almost is tangible, but you know, you can touch it, but it is the closest thing to tangible, you know, owning a piece of something, and being a part of something that you can come, so I think that you know, this revolution is needed in order for people to start thinking this way.

Morkeeth: And a good way to bring around your data instead of having Apple collect, oh, you did a great review on the podcast you level. You gave five stars.

Totally.

Morkeeth: That’s very limited to the Apple ecosystem.

Will Collecting Tokens Become the New Form of Showcasing Fandom on a Greater Scale or is It Limited to a Few

Totally, totally. Do you think that these behaviors of collecting tokens, are going to be the new form of showcasing fandom on like on a greater scale or is this niche limited to a certain few?

Michel: It completely depends on how well we bridge the limitations right now. So, I mean, if you look at it, like it’s been a focus for us all the time, like how do we make it so, so, so easy for anyone who loves music to be a part of this, but you know, it isn’t that easy today to just interact with a credit card. And to build a product where you can, you know, have your tokens, like where you can have all of the benefits of an NFT and, you know, having on the blockchain, while also leveraging all the benefits of, you know, a web two check out or, you know, that flow of things, and I think it won’t be until, you know, we can have both, where, you know, it can go really, really big, but you know, if we don’t figure out as a community how to solve that, it’s going to stay niche, in my opinion, you know. And what I mean, there’s like, okay, OBC, they’re really good custodial solutions and things like that. But then, with those things, you also lose some of the parts of you owning something directly, right. But if the ecosystem as a whole, I’m talking about the whole crypto, and if the ecosystem figures out a way in which you know, you can really come close to that feeling of like I own this piece, I own this wallet, but at the same time, it’s just as simple to check out as it is on Amazon like, but then if those two things align, then I definitely think this is a mass market thing.

The way I’m understanding the way it works today outside of web three, when you build music fandom, I’m going to use one specific example, I’m gonna use Lady Gaga as an example. It’s an example that I use oftentimes in the podcast, and I like to ask my guests about that are building web three crypto native products. Now, a lot of the premise of this question stems from sort of what’s happening in my world today, going through crypto startup school and accelerator for Bello, right? Talking to all these people who’ve done on chain IP really well, who’ve built communities. And me thinking like what if the thing that’s preventing web three from hitting 100 million users is web three itself? And what do I mean by that? When you go on a Facebook group today, and you look up, or when you go to Facebook, and you look up Lady Gaga, you’ll see thousands of Facebook groups around Lady Gaga that her fans have independently created around different attributes of Lady Gaga, the equivalent of that could be like, everybody has a gold jacket and the board a yacht club will create a discord for those gold jackets, everybody that’s met Lady Gaga will create, will join the Facebook group that says I’ve met Lady Gaga. And by the way, that is a Facebook group. And there’s 7000 people in that group. And they posted like 20 times in the last day. Okay, so they don’t have a token, but they love the music they love. They love the element of connecting with all the other Gaga fans. They love the music, they love what she stands for, they love her fashion sense. They love all these things about her. And that’s what brings them together. Not a token, right? So, and I and I present this question or this narrative, or whatever you want to call this, the speech that I’m giving right now, okay, from the sake of challenging how I think of things in web three, and what’s actually important to the end user, when it comes to connecting with their fans. Because if I feel like if you brought a token into the mix, or any sort of financial element, whether it’s on chain or off chain, into those communities, the entire vibe would be completely different. Completely different. I’m curious if you have any thoughts on that.

Morkeeth: I mean, we had a look in these chords in the sub-Reddits. When we do, when we did a drop with, with Danny Boy style, producer for the weekend, we went on a hunt, to kind of look at the different sub communities. So, you know, try to, there is a difference.

Michel: There is a difference, and we were in like the weekends, you know, just their Discord server that has nothing to do with a token or web three, and it’s super, super, you have so many people have so much activity, they don’t need a token to be there at all. So, I mean, I still agree with you. And it’s like, you know, two years ago, when you met startups, you’re like, but why are you doing this on blockchain? What’s the actual benefit of this in this case? I think to us, if you look at like the big artists that we’re working with are the big producers, the big songs, then obviously, it is like, partly the financial aspect of it, like you can actually, you can actually trace the token you hold to a physical contract that says that you are a co-owner of this track, and that’s what we’re building the community around. So, I mean, that would be more difficult, not having it on chain. But I’m not saying that, you know, the fact that we have this token makes it a better fan community. You know, I think that those are two really different things. So, like, for us having it on token makes it a much easier way to say that you actually own a piece of the song for real. Like that’s what we’re serving today. And I think that, you know, for these really, really big artists, it might be difficult to have, you know, tokens be the bridge to their fans. But I do think, though, on the long tail, that, you know, tokens may play a role in just, you know, assembling those early supporters. But yeah, I mean, it’s hard to say like what it could, what it actually does that that’s completely different from a real Facebook.

Mokeeth: I mean, for us, it’s easy to distribute utility. And I mean, like you did, Adam, with your minting the NFTs. For the podcast, tracing everything, analytics becomes very much I mean, you’ve become closer with your audience at least.

100%. And I think just on this rant really quick of, I think it’s less about if tokens are needed or not, because I do see a world for tokens, it’s more about like what is the human behavior that a token fits into place organically. And when I think about like, web three’s adoption, I think let’s plug in this technology into systems in which everyday user already participate. So, for example, you buy a ticket to see a lady gaga show, the underpinning of that ticket is it NFT, the user and the attendee has no idea that’s happening, they then go create a Facebook like group around everybody that’s attended the conference, and the concert, and the only way to get into that community, is if you were at the show itself. And then forget token, forget price up price down, floor price, like forget all that stuff. You just shoot the shit and talk about Lady Gaga, you know, but exactly, to do was this verifiable thing, right? That would symbolize your access into the community.

Michel: Yeah, love that. And I mean, that also has to do with like, the simplicity in which you can access this. So, if you really bridge everything, so it is easy to buy, we are feared as we are crypto, when you buy this ticket ,like that is the initial step that needs to be bridged before all of those, you know, that example, for instance, would be a reality where it’s like just, you know, just a different technology, it makes it easier.

Thesis for a Crypto-Enabled Music Industry

So, I want to pivot more into talking about another block and just understanding, what is your thesis for a crypto enabled music industry?

Michel: So I mean, the thesis as a whole is, you know, it starts off with like, we want people to be able to co-own music, and there’s two big legs that with that stance on, right? The first leg is we want people to be able to own parts of big tracks, that have delivered and are going to deliver. It can be a new track or from an established artist, and you know, that has two values, it has the emotional value of owning a piece of something. But it also has obvious you know, financial value, because you actually own, think piece of something that’s going to generate, you know, something, and, you know, that’s the first leg. The second leg is for the up-and-coming artists and that’s something that we’re going to focus on. Not now but after a while. So, the reason why we started with the first leg is because we want to bring people in, educate them and how it works, before you know allowing up and coming artists and to have this tool that they can also use, you know, for their community. And I think it’s going to be two different value propositions for these groups, like in the second groups went up and coming artists, you know, royalties is going to be less important, it’s going to be more focused on you know, how you can actually engage with this young artist in their path of creating something bigger. While for the bigger artists, it’s more of this emotional thing of like, oh, I own a piece of this star, and I’m worth it, right? So that’s, you know, I think that that’s in the realm that we’re working, like, you know, better attachment to the songs you already love. And being a part of that, you know, that financial development, and also being a part of this up-and-coming artists, you know, those are the two ways I think that our space can actually have an impact.

What do you say to those who are thinking, forget the old system, I’m here to build a new system, the old system screwed me over. NFT serve as a great primitive to sort of, like, create this new platform for myself, for my music and everybody that loves it. So, I don’t want to integrate the royalties. I just want to create; I just want to tokenize my existing song Independent of what’s happening in the web two world.

Michel: I would say I love that, you know, we need so many products out there, so like, why not do that? That’s awesome. If that’s what you feel like, if that’s what you know, feels the best and if that’s where you’re gonna get a lot of people in, like, you know, definitely do that. And you know, for our up-and-coming artists, what we’re going to do, it’s not as sure that we will work with royalties in the same way. But for, what I would say to someone, like, you know, that has that opinion is that, you know, it’s great, you have some options that are doing that, you know, you should definitely use that. But we’re here to provide a solution for all of the people that say that, you know, these NFTs has no value, like, you know, you just gonna create on just, you know, we’re here to create something that actually bridges the real world and the NFT world, where we say that, you know, this NFT, they are not empty, they actually own, you own a piece of this in the real world. Like we’re doing something different. I think that’s also needed in the space. I don’t think it’s like a dichotomy that we need to do.

Got it.

Michel: Either one will win everything or the other will win everything. I think, you know, it’s different approaches. I’m a firm believer in what we’re doing. And I think that the reason why I didn’t get too involved with NFTs before, this was that I missed that aspect of it, I missed the aspect of, you know, what does it translate to the real world?

Royalty-Backed NFTs

Let’s talk about that for a second. Because I think it’s super important to create frameworks for people to understand how all these new primitives fit into place. So, what you’re sort of explaining is one framework and then there’s another framework. I want you to tap More into your framework, like when does an artist choose to go the royalty backed NFT route?

Michel: Yeah. So, I mean, for an artist’s first of all, like the artist doesn’t need to understand much about web three or anything at this stage. So, an artist today, we can say that, you know, say that the artist, in general gives away a lot, let’s take an independent artist as an example, they can give a lot of weight to a label, in order to get funding, right. So, they give 50% of the rights away to label, so that they get a little bit of funding, so that they have something to live on, while you know, they hope that the song is going to make it big. But if it does, right, the label has 50%. So, if there was an open marketplace for music rights, then you can say, You know what, instead of giving away 50%, I’m going to sell 20%, but I’m going to sell it to the people actually like this music and support this music, and it’s going to spread this music, and they end up with 80% of the right, but maybe they have the same funding in the end. That’s the type of mentality where we think that, you know, the public and the community can actually replace a big part of what the major labels have been able to do, which is, you know, one of the biggest things in the marketing, you know, marketing mix is, you know, being able to give upfront cash. And if that is, you know, if that can be represented by people who will then spread this even more aggressively than that might be a really, really good option. Right?

Psychology of Pricing and Decision-Making Processes

I love that. And from a product perspective, Morkeeth, when you think about like designing a product, thinking about like the visual psychological effects when you see a product like in a music, royalty back music NFT, right, you can’t help but wonder like, what is the optimal price? And what is the optimal format for displaying these items, for selling these items? Let’s talk about price for a second. Okay. How do you guys think about pricing these NFTs? Because I feel like the Rhianna drop is much different than another drop that you’ll do, that’s much different than another drop that you’ll do. Like how do you think about the psychology of pricing? And how do you actually get to the conclusion that alright, this is what we’re going with, this what makes most sense?

Morkeeth: Yeah, I mean, the evaluation, we have a fairly standardized way of evaluating.

Michel: Yeah, exactly. So, I mean, I can talk a little bit about how we value like the evaluation, so and then, but then it’s up to you and the product team to decide like what to, how many NFTs and how much to split it. But if you started like what to revaluing. So, we have a percentage of the song that’s going to you know, that’s going to bring X amount of capital. And you know, the NFT price is going to be that divided by the number of NFTs eventually, right? But when we look at like what we’re selling it for, we aim to have a yield that is, you know, wildly between 7% and 12%, or something per year. So, it is like when we look at like the performance, the historical performance, we work with third parties that give us a good view on the next coming years in terms of streaming. So, we have a good view on like, how much cash flow this asset to, you know, the song with generate. And then we obviously work with, you know, risk assessments and, you know, interest rates on, you know, on, you know, in five years in the future, that value is going to be less than today. So, you know, we look at like, how is the cash flow gonna be over the next 20, 30 years? What does the cash flow the future mean, in terms of value today, right? Standard discount flow, discounted cash flow methods, but when we put all of that together, we get eventually get a price, like this is what we believe this track is worth and we presented to the seller. So, we’re a platform so the seller is always going to sell it and today, we aim to negotiate with the seller as much as we can, to get as fair price as possible to our end users in the future. The idea is that the seller should be able to price it at whatever they want but we’re always going to state, you know, what our economic calculation of this track. So, that if you completely miss out on that, then it’s up to you if you sell it or not, essentially, right. But that’s it. And then we need to figure out like how many tokens to split into what the price is. And that’s difficult, because that’s psychology, basically.

Morkeeth: That’s a lot about listening to the music, but also listening to the rights holder that wants to divest. Because there’s a kind of psychology and kind of branding mechanism in having a higher price point for NFT, assets being portrayed is more exclusive or more scars. But I would say I mean, let shout out to on chain music that also helped me, we worked a lot with third parties to get this kind of almost independent analysis of the track’s performance. And you know, really fighting for our holders in this current shape to get a good deal and a good valuation.

Michel: So that’s basically it. So, when you put the things were put together, it’s like this is the value of the track financially. And today, I mean, we price the tokens at that value. So, any, if it goes up on the secondary, you know, that’s up to the market, because maybe there’s emotional aspects to own music, right. So today, we’ve seen that yeah, all drops have risen on the secondary, which is great for, you know, our early minters. But it also shows that obviously, you know, music has more value than then than the financial value, which is what we’re pricing it at initially.

Do People Mint NFTs Out of Emotion or for Investment Purposes?

So, you talked about the emotional aspect. So, that that sort of like brings me into my next question. Do people mint these NFTs out of emotion or for the investment, the royalty’s element?

Michel: It’s hard. I like what I tell people who ask because that’s such, like a lot of people ask that question. And the honest answer is that we don’t know. We obviously have, you know, in our Discord and everything, like, we can see that there are several types of users, there’s the user who just you know, loves web three and loves this type of application. There’s the user really in it to, you know, to gain royalties and invest and to flip and to make sure that they win financially. And then there are definitely the user that just love building catalog and owning pieces of music. But it’s so hard to say today, like how big these parts are. And you know, if, you know, maybe the ones who are in it for the music are just more vocal than the others. Like it’s so hard, since we’re not collecting that much data, you know, on the people who use this, we don’t yet know, like what is the focus? So, I think that, you know, as this grows, and this behavior matures, we’re going to learn as well, like where to put the emphasis on a product level?

Morkeeth: Yeah, because right now we very much focus on splitting it between the ownership and the financial. I mean, we have one of our biggest whales, working for Goldman Sachs and our superb bullish on alternative assets music. So, he’s always preaching about the financial return and, and the type of assets that are not correlated with the market, because people still listen to music when it’s a bear market. But obviously, yeah, we split it, and we’re trying to figure it out. I mean, we’re running basically experiments with every one of our jobs.

Michel: I mean, what I could say is, I can’t see this being like a Bloomberg terminal.

You cannot see it.

Michel: So, and what I can’t see either, is this just being like a collectible with no rights attached to it. You know, so like, I definitely think, like we need both on a good level.

Benefits for Individuals Who Take a Percentage of Royalties

Interesting, there’s so many, so many rabbit holes to sort of, I guess, go down after that. Like I want to ask you guys like, what is the, I guess, what’s in it for the people that you select to kind of like take a portion of their percentage? And then I guess it’s like, fractionizing it, right? And selling it actually at a premium, right, to people who collect the NFTs for the most part, right? Or is there a different model that you guys have in mind?

Michel: No, I mean, that that is it. So, I mean, we’re trying to sell it at a fair price. So, that means that you know, at a certain price level, it makes sense for the seller to sell it because they get capital upfront and sell capital later. But it also makes sense from an investment standpoint, you know, because it actually has a good deal. So, the definitely is a level where you can actually strike a balance and the buyers and sellers can meet and that’s what you know, we want to do at scale. So, you know, I definitely don’t see at this stage. You know, we don’t want any part to get screwed. But the other factor here, we’ll see how that develops with the marketplace wars, but obviously, like the seller gets royalties on every secondary trade. So, you know, that is an aspect that you can bring in to actually get a better deal for the initial sales, right? Which is a good factor as well.

Rihana’s NFT Launching Right Before the Superbowl

Got it. Let’s talk more about your recent drops, specifically the Rihanna drop because that was perfectly timed and light with a Super Bowl. I love that the execution of it leading up to the event. It was really cool to see and shocked a lot of people to kind of like come out with that project at that time. So, prop props to you guys. Can you walk me through like how did that happen? How did you like manage to pull that off specifically in timing for the Superbowl and just that entire story?

Michel: Yeah, I mean, the story is quite simple. So, we work with this network of people who sit on good music rights, and I was in LA last year and I met deputy which is the producer for this track. So, he’s done a lot of great tracks. And he did pitch but our money and he has YouTube videos on how he produced it. So, he’s a real superstar producer. So, we basically told him about the concept. We’ve done a drop with one of his friends before we knew people in his network and we were you know, discussing our platform and saying, you know, this is a really good way for you to get more visibility as a producer, to tell people in the world that you know what you created this but it’s great you know, from a financial aspect you know, this is likely to be traded a lot, you’re gonna get cut back on every trade. And you know, if we find a price where you’re comfortable, and that makes sense for the buyer, like this is something we should definitely do and you know, he got hooked, and we started working on it. It was mainly my team, my music team that was working on hashing out all of the details. But yeah, then we started planning on what’s a good timing for this. Obviously, the Superbowl was coming up, and then we did the drop and we definitely like underestimated the impact that would have, we just did 300 additions, you know, three NFTs of this. So, in our you know, we’re sitting here in Stockholm, and we’re like, yeah, it’s good timing, you know, maybe we’ll sell out quicker than expected, you know, that was basically the expectation levels. But then yeah, it went completely viral, like a bit too viral in my opinion, because yeah, we got just so, so, so much attention like it ended up on CNN after a while. And I think one of the great things about that attention is that it brought a lot of eyes to our type of NFT. So, you have people from law.com, like analyzing our, analyzing our contracts that are tied to the token, like how can you actually do this? You get people saying it’s a perfect application for you know, this added in for putting NFTs you got others criticizing, like it’s really good to start a discussion you can, you know, all of that.

Morkeeth: I mean, it started by us talking of all of our other tokens too.

Michel: Yeah. So, it was it was super good. All in all, like what I didn’t like so much is like when a media hype starts, like we were, where we really proud that it’s deputy who does the drop and he creates a song he’s selling it CROs, right, but when the media cycle goes, it goes, you know, deputy selling, which by the money by Rihanna, the next one says something and when it goes on CNN said like Rihanna sells NFTs, which you know, wasn’t at all, our press is it. So yeah, I would say that’s the only like negative factor of that.

So, when you saw a new got news at open sea halted trading on the NFT, what were your first thoughts?

My first thought was like this got too big, you know, because I think we had like, crazy amounts, like we were, at one point I think we were the most traded over the last 24 hours or something like on all projects. So, my first thought was like this is being traded way too much because the secondary price was also going through the roof, which doesn’t really make sense with our whole you know, royalties’ expectations and all of that, you know, when you buy it at that high price. So yeah, I mean, when we saw that was going viral, even on open sea, we were like okay, what is going on here? And when they halted it, we of course started thinking about what’s going on here and we didn’t really get a straight answer to why.

Mokeeth: Because it was also doing the Super Bowl, so but people were on holidays. And we have this issue, which not a lot of other NFT products have that we release new collections, like every single month. So, we have been pretty much in good contact with open sea, trying to understand like get our collections verified, not for that to be like any scam collections. out there. So, but it just got escalated and we’re still, I think a lot of NFT projects gets a little bit stuck in this kind of marketplace more.

Yeah, I think your model is very unique, in which you don’t go to the artists themselves to try to fractionalize a percentage of their shares. You go to the writers, the producers, and then you try to bring those people to kind of like bring light to music NFTs on your platform through their share, right? And the second an artist like Rihanna comes into the picture, who has so many eyeballs on her specifically right before the biggest event, entertainment event in the world kicks off, you know, and just so happens to open with that song as well, throw a lifetime performance, which is even crazier. The media starts twisting, oh, Rihanna started selling NFTs and then the narrative gets convoluted. And then I see why it would get taken down.

Morkeeth: Yeah, I mean, maybe that is why I mean, we don’t, we haven’t really gotten the answer. The narrative got twisted. We’re happy that we got a lot of attention, but we want the attention to go to Deputy because he’s the one who’s doing this, which is awesome. But I would say it is like we do work with producers and songwriters. We’ve done it quite a lot and we have more in the pipeline coming, but we also work with directly with labels. We also like our first job was directly with rehab and Laidback Luke. So, trying to mix it up artists, like for us it’s all about, like all of these people are part of creating this. So, you know, no matter who they are, if they’re the main artists or not, if it’s a good track, we want to give them a platform to share it.

Michel: And just to add, like we’re still listed on open sea and hopefully we’ll get the conversation going and try to understand this together. Because I think like we all need a regulatory clarification of what’s okay and what’s not.

Securities Laws Around Associating a Royalty with a Music NFT

Yeah, got it. That makes sense. Another question I want to ask you guys is sort of the securities element around this because everybody’s thinking about it. Right? And nobody has really provided clarity and I think you guys are the practitioners and the most ideal people we could go to, to kind of get understanding of what are the securities laws around being able to actually associate a royalty with a music NFT. What are your thoughts on that? How do you explain that to the person who asks you, like what the hell’s going on over here?

Michel: Yeah, I mean, so I would say like, we’re based in Stockholm, in Sweden, and here in Europe, it is way more care. So here, you have this framework, you know, to be considered a security you should either deal with depth, or you should have voting rights in a company, or you should be traded on a regulated exchange like NASDAQ. Right, so here you know, we’re clearly not a security but we are something you know, we are something that you know likely should be regulated and I, you know, we have a legal team, like we want to comply with regulation, but it is a gray zone. So, we don’t know, there is no framework in which we can apply to at this stage. So, there’s this mica regulation coming out in Europe, which will be enforced in one and a half years from now. So, we’re hoping that that will give us more clarity and to how we should position this, and you know, what guardrails we should have with the product to protect customer because, you know, the SCC and you know, our version of it here, like they exist to protect the end customer. So, you know, we don’t want to mess with that we want to be aligned but it’s really hard when you don’t know how at this stage, right? We could do like most of the things you do with the security but like maybe that will not be necessary because we know we’re not classified as that, because sharing royalties it’s way different. So, like at this stage we’re, it is great. So, we’re operating in, but we’re keeping an eye on like the European regulation to see how we can comply when it comes. In the States, it’s different. So, we have players like royal.io, you know, that are there, that are doing something very similar to us. And I you know, I’m guessing that you know, being based there and having more, like it’s a minority for us, that are Americans, right, but I’m guessing it’s more for them and I’m assuming that they also are trying to get answers from this is it, like how should you know this be, how should we act in this market, you know, in order to be compliant, but I’m assuming also that it’s not that easy for them to get answers. And we’re looking into this now because we know that like the SCC, especially in America, like can be more aggressive, so we’re actually looking into potentially, you know, restricting Americans.

Morkeeth: Just like blurted with their air drop. And now the trending of I’m not an American citizen, you have to check the box. It’s a weird world we’re living in

Michel: Yeah, so I mean, we’re looking into that, we haven’t decided yet but like one way, like unless it comes out of a clearer communication from the states, like it’s not unlikely that we will, you know, restrict access for Americans because, you know, it’s a very aggressive identity like don’t want to mess with any of that. Once you’re in Europe, we have a much more clearer view on like, what will be the ramifications and like what could happen like if they say we’re security, okay, then we do this so that, you know, we’re more comfortable with that. So, I mean, we’re still seeing but I think in general, people should be happy that this, how do you say it? Entities or you know, that they exist, and they’re here to do something good. But, you know, let’s not hope that they hold innovation either.

Common Misconceptions and Potential Backlash from Labels and Artists

Right. Have you guys got any backlash from labels that you’ve tried to work with, with approaching them with this new model, artist and writers that you’ve tried to work with? What tends to be the common misconceptions?

Michel: I would say like early on when we were pitching, like a lot of people are afraid of the space in general, like how can how it can have an effect on the brand. You know, being a part of the NFT world, basically. I think that’s a big thing that we tried to work on when we have early conversations.

Morkeeth: A year ago, it was the environmental aspects Ethereum And then all of a sudden, they changed to becoming like NFTs is a scam. Those are the prejudice that we’re trying to fight.

Michel: I would say that those are the two biggest things because like, from a standpoint of like what we’re offering and the product, like a lot of people find it pretty clear and like, either they like it or they don’t, like it’s a normal sales process, but that’s the factor that I find a bit arbitrary, you know, what they think about the space essentially.

The Possibility of Paying Individuals per Second or Minute Rather than the Typical Few-Month Period

Got it. I have a couple more questions for you. The first one is, the second to last one is this concept of paying people out royalties. I wonder if there’s a world where you can pay people out per second or per minute, or per X timeframe versus the typical like few month period in which people get their paychecks from Spotify and Apple Music, the DSPS. How do you guys think about that?

Morkeeth: Yeah, because royalties are kind of structured in a very conservative and fairly old way and the model of getting paid per year or per six months. And so, we wanted really to bring in the concept. One of the first concepts when we started to contribute to Dao, me and a couple of other devs here was to get paid every second and having that, you know, making it almost trustless that you are not going to get robbed if you work for one month, and then the project is going to decide no you’re not getting paid. But if you get paid every second, you’re always getting paid for what you do. So, we wanted to bring in that concept and I think we’ve really tried to scout all over the web three the ecosystem of finding good partners. So, combine that with super fluid or the money streamers, because we met them and talked with them at Eath New York last summer and we’re like it would be super awesome if we could just remove that little trust from another block and just started paying them by the seconds. So, we can almost you know, stand, like take a step back and become just the platform, trying to facilitate this and giving them based on how it streams, looking at the data and paying it out and giving the custody to our holders.

AnotherBlock’s Future Plans and Roadmap

Got it. And the last question that I have is, what’s next for another block? What are we, what’s on the roadmap? What can we expect that’s coming out soon?

Michel: Yeah, I mean, I would, I mean, that is the big thing coming up, more big drops, more of a mixture of drops, I would say, like more experimentation in terms of genres and where they come from. It’s not just gonna be like, you know, it’s gonna be more of a variety, more of a mix, but still, like proved music.

Morkeeth: And then obviously, like social stuff with lens.

Michel: Yeah, definitely.

Mokeeth: Bringing in some lens integrations to get the fans connecting.

Michel: And then, you know, in the near future, like obviously, something really, really exciting for the independent creator as well.

Morkeeth: We’re looking to scale up you know, having more drops, not just having one every month and just bringing in more music, making you know, people own music, making them catalog holders you know, really getting the music that they like.

Outro

I love it. I’m keeping an eye out, excited to see what comes next out of your corner. Before I let you go, where can we find you? Where can we learn more?

Michel: I’m on the blog.io, is the most simple way and you can find your way to our Discord there and our Twitter and all of that.

Morketh: Big mesh.

Michel: Yeah.

Morkeeth: Morkeeth.

Amazing. Let’s go. Thank you for being on till next time.

Michel. Thank you so much.

Morkeeth: Thank you.