Background

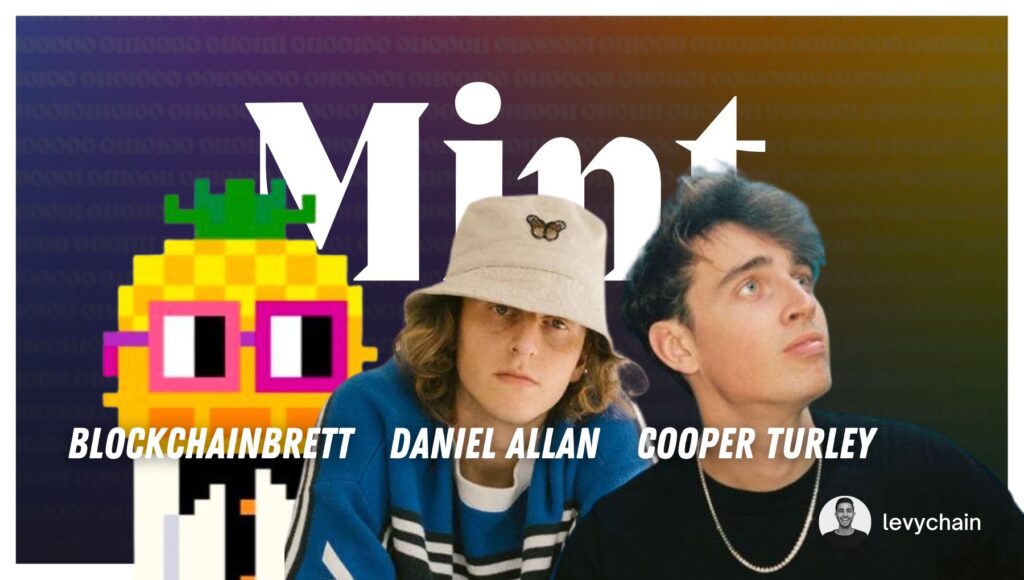

Mint Season 7 Episode 21 welcomes music collectors Cooper Turley of Coop Records and BlockchainBrett of Palm Tree Crew Ventures who are joined by web3 music artist and producer Daniel Allan to discuss Daniel’s recent one million dollar fundraising round to propel his music career. The three delve into the artist seed round, ROI when investing in artists, how Daniel plans to spend the one million dollars, the future of web3 music + much more.

I think this model changes the game completely and provides creatives with a new means of support. The goal of this episode is to shed light on the process and what goes into raising a million dollars. Full disclosure, I did invest in the round as I’ve been support Daniels journey by documenting his early beginnings on Mint and by collecting his music NFTs. I’m excited to see how this experiment plays out and stoked to capture this milestone for you all to hear.

Time Stamps

- 00:00 – Intro

- 05:32 – Raising a Million Dollars for Daniel’s Creative Endeavors

- 11:10 – The Artist Seed Round

- 16:07 – Daniel’s Impact On Crypto-Native Independent Artists

- 20:15 – Implications for Other Creators Who May Follow the Same Path

- 32:10 – The Artist-Market Fit

- 33:48 – ROI Investing in Artists

- 40:48 – Removal Process of a Web3 Record Deal

- 47:34 – Upcoming Milestones

- 49:27 – Outro

Support Season 7’s NFT Sponsors

🌿 Enter for a chance to win a Lens Profile

Lens Protocol is an open-source tech stack for building decentralized social networking services. The protocol was developed by the Aave Companies and launched on Polygon in May of 2022. Through Lens, web3 developers can build decentralized social media applications and marketplaces that leverage NFT technology to form a fully composable, user-owned social graph where the connections and interactions between people are owned by individual users and creators rather than established networks.

Complete these steps for a chance to win a Lens Profile: https://adamlevy.io/lens-protocol-season-7-campaign/

(🍄,🔍) Bello: The #1 for blockchain analytics tool for web3 creators

Bello is the no-code blockchain analytics tool that empowers web3 creators and communities with actionable insights on their collectors through a simple search.

Join private Beta: https://www.bello.lol/join

Intro

We got Daniel Cooper and Brett. The Avengers of web three. Is that what you guys call yourselves? How do you guys introduce yourselves? What is this?

Cooper Turley: So, great friends out here, you know, companions, compadres.

Compadres. Companions. I like it. I like it, guys. I’m excited to have the three of you on. We got a lot to celebrate. First thing to celebrate is we have a trio, the first time a trio has been on. You guys have been on the podcast separately, but never all together. So, that’s one thing. Second thing is Daniel, congratulations, which we’ll talk about in a minute. We have a lot to celebrate on your end of the spectrum, that Cooper and Brett sort of, yeah, all three of you play a big role in it. So I think a good place to start is, quickly, who are you guys individually? Because those who don’t know you, it’s always great to get a brief. So, Cooper, start with a quick intro Brett and then Daniel, then we’ll kick it off.

Cooper Turley: Cool. Hey, guys. I’m Cooper. I’m the founder of a firm called Coop records. We’re investing in early-stage next generation music companies. I’m a big collector in the space, advocate for artists and just excited to be here with the legends that are on stage with us tonight.

Legendary. Brett, take it away.

BlockchainBrett: Hey, guys, I’m Brett and I’m a co-founder and managing partner of palm tree crew crypto, investing in the early-stage creative economy space, and a longtime collector and founder in the space as well.

Last but not least, the man himself Daniel Allan, who are you man?

Daniel Allan: Can you guys hear me? My Wi Fi like cut out. My Wi Fi cut out, so I couldn’t hear a thing.

I can’t do this, seriously.

Daniel Allan: My bad, this is.

We got to figure out a different format here.

Daniel Allan: I’m doing the best I can here. I mean, I could do a good move into another room, like 20 minutes. Right? Probably like the reset everything up. Was 100% Cooper’s fault.

Are you at Cooper’s place right now?

BlockchainBrett: Can we just start from scratch or can just like edit that.

No, no, yeah, of course, you’ll just start from your end. So let me like, so ready, three. Cool. Okay, let’s go. Daniel Allen, the one and only quick intro on yourself.

Daniel Allan: Yeah, I’m Daniel, thanks for having me. I make beats and DJ and have been dropping music NFTs for almost two years now. I think the first one was end of March of 2021. So, let’s call it like, right at the two-year mark.

Wow. Congratulations. I’m really excited to have the three of you guys on. We have a lot to talk about with a short period of time over here. So, I want to figure out how should we kick this off? Like I don’t want to pop it myself. Daniel, can you go ahead and talk about it? What are we celebrating here today?

Daniel Allan: Yeah, it’s pretty crazy to like, say it out loud, I guess publicly for the first time. I mean, right now it just feels like it’s us. But I noticed there’s gonna be like in the broader like world in a couple days when we announce it. And by the time this comes out, but with Cooper and Brett co leading the round, I raised a million dollars. And it’s the first time that I’m kind of treating an artist project as a company. And the whole point of it is for me to like to broaden the horizons of my project both on the web three side and the web two side, and just find an interesting alternative to like, the record label model that has existed for so long.

Wow, one milli, that’s a big deal. I have yet to see another artist raise a million to support their creative endeavors. And I want to start by saying congratulations, Brett, Cooper, congratulations to you guys as well. Yeah, it’s a lot to dive into. I remember seeing that first mirror crowdfunds campaign rollout and the big sort of PR moment that came behind your brand and your music career in web three. And to see how far you’ve come all the way till today, to celebrate a race. Feel like you’re treating yourself as a startup, something that I’ve been talking about on the podcast for a minute and to see you be the practitioner behind it, to see the three of you sort of put this into the world. I’m excited to see what comes out of it. Cooper, Brett, how are you guys feeling? I’d love to get first your perspective Cooper.

Cooper Turley: Yeah, I mean, it’s a longtime comment. You know, I’ve been friends with Daniel for the better half of two or three years now. And it’s really just an accumulation of all the work he’s put in today. You know, Daniel is extremely hardworking, and discipline, I think it takes a very specific type of person to be able to execute on something like this, you know, as Coop record speaking here, we’re just excited to keep supporting Daniel’s career, you know, I’ve been collecting as NFT since day one. We believe that there’s an extremely high potential for it sailing in the future. And I think at this round is really just going to unlock a lot of new avenues for him to expand his career. So, we’re just excited to support and see what happens.

Brett, how are you feeling about the whole thing?

BlockchainBrett: Yeah, I mean, I think this point is, it’s a testament to how powerful music NFTs are. I mean, I originally met Daniel by collecting one of his one of his songs, one of his music NFTs. We’ve grown a lot closer throughout several drops and a bunch of amazing projects that he’s, you know, pioneered the space with, from, you know, one of ones to editions, to generative projects, to collabs and major EP, the biggest EP drop we’ve seen. So, I think it just makes sense that he’s continuing to push the space, the boundaries with this race. And I’m excited to see what he can do with more firepower. And we’re super stoked to support it. You know, like the leading music NFT artist in the space.

Raising a Million Dollars for Daniel’s Creative Endeavors

Daniel, when I first got into, like startups and venture capitals, seeing all these companies raise millions of dollars, it always like star struck me. And to think that an individual is able to do that right, and sort of put some type of valuation on their brand as a whole very early on in their career, is quite captivating. I’m curious, like at the very early process of kind of like putting this thought into the world, what went into that, like what goes into raising a million dollars to be able to support your creative endeavors? And I just want to deep dive into the entire process.

Daniel Allan: Totally, I mean, I think that I’ve been thinking about it for a really long time. I mean, I think that I’ve been thinking about it really, since overstimulated. I think in a lot of ways this is kind of what like what overstimulated always wanted to be like at scale. And so, for me, I think that, you know, I’ve looked around me, and I’ve said this multiple times, I’ve seen so many people that have been in and out of the record label system. And for me, I’ve kind of built a career so far on like finding the alternatives that don’t necessarily rely on like what the industry system has been, because I think that, again, I think that there’s totally a time and a place for a record label. But it just didn’t, for me, it never took the boxes that were I guess, like I didn’t really have any leverage to be able to do anything on my own terms. And I think that a lot of those entry level deals kind of put you in a tricky situation. And like for me, a lot of my nonstarters have been like, okay, I want to put out music at whatever cadence I want to put out. So, that means that if I make a song, I want to be able to mint it the same day, I want to be able to try to put it up on DSPs as fast as I can, I don’t necessarily want the lag time or wait to have like a Tik Tok moment or whatever. But at the same time, like for the longest time for two years, I was using my NF T sales, primarily for the most part to pay my rent, because I had never made any money off music at all before this was happening for me, right. And so, after two years of that, and like saving some money and whatnot, putting a lot of side, I kind of got to a point where I was like, okay, I’m not necessarily relying on music NFTs as much to pay my rent, but I still really want to scale out my project. And I want to do it in a way where I’m one, able to retain way more ownership than I did, I would understand the record deal. And two, do it in a way that doesn’t take off the things that are my nonstarters, like the cadence, you know, like I said, when I was, in the search of looking for like deals, I would say in the course of the past year, like my preference has had nothing to do with money or term length or whatever. It’s just been like, if I want to put out a song today, is someone going to tell me no. Right. And so, I think for me, all those things kind of came together. And I mean, I think a lot of the people that had, that led this round, or that were involved in the round in any capacity, have been people that have supported my NFT journey, I think in the past two years. So, it’s pretty nice to kind of be like, okay, you guys have been here for, you know, the better half of two years. Now, let’s see what we can do over the next 5, 10, 15 as I build my career past, not only music NFTs, which is obviously always going to be the backbone, but like, what is my brand and web three? Like what is, how do I incorporate that into my shows? How do I incorporate that into like my music right? And so, yeah, I mean, like I said, I’m a pretty, I think I’m a pretty like entrepreneurial, I guess, musician. I guess that’s kind of like been my stamp and I kind of get it. I mean, I went to business school, even though I don’t really count it like that, I was pretty bad student. But I guess my head has always thought about it in that way. And so, just kind of, yeah, I don’t know, a lot of things came together with a group of people, this special group of people that we brought together for this. So yeah, I’m just super stoked, but honestly, just more focused than I’ve ever been. Because a million dollars might sound like a lot of money. And don’t get me wrong, I’m grateful for it. But I have to use all the resources to kind of better my career, you know, so I only, in my mind only have like, if you know a few shots and goals, I’m just trying to maximize those.

With raising around like this, you can’t help but wonder what do you need a million dollars for? Like what is that million dollars is going to be spent on? How are you going to be distributing it and allocating it? What are the first few things you’re really going to be kind of like investing in to propel your career forward?

Daniel Allan: Totally, I mean, so the way that music typically works is you have like a manager, you have an agent, you have a business manager, you have a lawyer, right? And a lot of these people have other clients and don’t get me wrong, I still have like my manager, my agent and I love them. But at the same time, there are certain requirements that I need that I don’t necessarily, like I want to be kind of treated as a priority act in a lot of ways, right? Like for me, I want to be able to, I remember when I was doing a lot of the stuff on like, on bonfire, for example, and bonfire are my absolute homies. Like I think that as we started to do glass house, as we started to do projects after that, they were fortunate enough to bring a bunch of people on and but one of the things that I missed, and this isn’t bonfire in particular, this is just like working with people in particular, is I really wanted to be able to have some sort of like a focus that’s like, hey, let’s, I really want to be able to build this out with one person, I want to be able to individualize the experience. And obviously, as all these companies are scaling, you know, I would do the same thing, you know, I would be trying to diversify my client base, you’re working with as many people as possible. And for me, as an artist who’s kind of treating myself as the CEO of a company, I need to have employees that are going to help me whenever I need stuff, right. And so that goes from everything from marketing, reach, audience, like having someone that’s full time on my social media team, having someone that the full time or at least a part time developer, when I have very specific asks for projects that have been put together. Like if I’m doing a generative project, like I could ask a bunch of people who are working on so many things at once, or I could hire someone for like a three-to-six-month time horizon to help build out a website for me, to help build out the, you know, whatever contract work that I need. And so, like for me, it’s kind of, a lot of the money is really buying me flexibility and attention, you know, so that’s kind of, I think, what my goals are, is just like hiring people that are gonna kind of be on my team full time.

The Artist Seed Round

Definitely. Brett really quick, when we’re not talking mute yourself. I’ll cut this out. Because I hear like, like plates clinking. Cool. Okay, great. So, my next question is for you guys. Okay. So, 3,2, 1, Cooper, and Brett, I know you guys have been super vocal about betting on artists, supporting artists. I mean, both of you combine probably some of the biggest supporters in the music NFT space to begin with. Cooper, one thing I’m like a big fan on your end is, you often document your thoughts and how you sort of think of the world in web three as it pertains to music. And a while ago, you pushed up this concept of the artists seed round. And it seems as if it very much plays into tack with what just happened with Daniel, was this like the next iteration of what you were expecting to create? Or did this deal sort of just happen through this belief that artists should sort of find other means of capital to bootstrap themselves? Like how are you thinking about this as it pertains to the artist seed round?

Cooper Turley: No, I think this is the Genesis, you know, when I was going out and raising this fund, I was talking to my investors about a concept of investing in artists. And I think that Daniel is a perfect case study for this, you know, I think it takes a very determined individual to sit through all the nuance of raising a seed round. So, behind the scenes, you had a lot of corporate structuring, you had a lot of legal work going into it, you know, a raising through a safe, and Daniel now, you know, this stuff is not the most ideal situations for someone who just wants to sit and make beats. And so, it was definitely a very gradual process. But I think the reality of it is, if you want to bring on outside capital, there’s a lot of legal work that goes into that, that legal work takes time and effort. And it takes very specific individuals that are willing to participate in that. So conceptually, yeah, I think that investing in artists is really exciting. But mechanically, when you go and do that, you know, setting up a C Corp, setting up underlying subsidiaries, being able to raise into a vehicle through a safe, having investors that understand the vision of backing and artists. There’s a lot of moving pieces here. And so, I think, for me, and for coop records, this is our first example of an artist seed round. You know, I’m optimistic that there’s a world where there’s many more of these. But I think in the immediate short term, it does really take a lot of dedication from someone who’s very focused and willing to experiment in a new and creative way. And I think that Daniel was the perfect case study for that. And I think someone like Brett and pumped your crew crypto, were really the other backers that we needed to help make this a reality.

Yeah, Brett for you. I mean, you guys have a pretty prolific portfolio of backing creator economy-based startups in crypto. And it feels as if this is like a, like an outlier type of bet that you obviously believe in and you’ve supported Daniel since the get go from the initial mirror crowdfund to collecting NFTs, advisory, all that good stuff. But this bet particularly feels a little bit outside of the software place that you typically invest it. Right? Can you walk me through your thought process in that?

BlockchainBrett: Yeah. Yeah, I mean, yeah, you’re right. I mean, we usually I mean, we look at the creator Economy space, the crypto creator economy space as like the different verticals of content, and all the infrastructure around that, at its core, and music is obviously a huge part of that. And that’s something we’ve been really focused on. And we’ve done like the infrastructure side of it to start. And I think we’ve kind of just done a lot of those different layers that make up the music NFT stack, from, you know, the co-creation at the, with our Peggi and the minting and curation around sound and heads for creation and, you know, kind of up the stack. And I think when you finally get to like, the top maybe the most important part of the stack, which is the artist, Daniel is definitely my number one favorite choice to be a part of, you know, from what he’s, the hard work he’s put into and what he’s been able to build in this space. I guess you could call it like the brand slash IP layer, right? And I think he’s gonna be definitely like the leader, if not one of the most forefront leaders in the music space in the cryptocurrency economy. So, it does fit in with the thesis for sure, we don’t like normally just go for, you know, creator to creator brands or brand, but it definitely fits in to the total stack. And I think really like as an individual collector, I’ve been collecting Daniel for a long time, we’ve continued to, you know, kind of keep my ownership, I think about like buying music NFTs is very similar to how I think about running the fund. And I have maintained like a significant ownership of the outstanding music and ftu that Daniels put out. But every time buy personally, it’s you know, it’s $100 at a time maybe like the one on ones, maybe it was a couple of $1,000 at a time, but it’s like small little increments. And from a fun perspective, when you have, you know, tens of millions of dollars, you have to kind of do it in bigger amounts. So, I think this opportunity where Daniels raising a more significant amount of cash at once, it gave us an opportunity to participate in a bigger way from the fund and not just from me, personally.

Daniel’s Impact On Crypto-Native Independent Artists

I’d love to get each of your perspectives on this. And we could start with Brett, then go to Cooper and go to Daniel, how do you think this changes the game for independent artists, specifically as it pertains to those that are trying to be more crypto native?

BockchainBrett: You want to start with me?

Yeah, let’s start with you.

BlockchainBrett: Yeah. How does it change? What was it how does it change the game?

Yeah.

BlockchainBrett: We changed the game. Upside down, reshaping and baking it.

This interview, I’m probably just gonna come out great. But you guys are killing it.

Daniel Allan: Answer this question. My Wi Fi is hanging by a thread bro, I don’t want to fuck this up. Let’s go, c’mon.

No, no, no, this is actually important question. Daniel, you’re the first person to fucking do something like this. Like who the fuck raises a million dollars as an artist, that’s independent that started making music in COVID. Like who does that? Okay. So, when I think about changing the game, that’s what I’m talking about. Okay, so let’s try this question again, Brett, Cooper and Daniel. All right. From an artist perspective, specifically, as an independent artist in web three, this model completely changes the game. You guys are a bunch of people and that sort of bet on Daniel and his future endeavors, his musical endeavors. And he raised around a funding, like who does that? How do you think this changes the game for independent artists, specifically those that want to be more crypto native?

BlockchainBrett: Yeah, I think it’s lays down, you know, a path for more artists to follow. I think being an artist that has focused on music, like embraced music NFT space has is, music NFT an unbelievable alternative, or option or kind of new system for getting value directly from the people that appreciate you the most, like your fans, your audience. And yeah, it shows that music can be really valuable. So, you know, that’s something that Daniel is built on. And now this point like, and it’s a really strong exposure. I mean, I think buying music NFT directly the artists will probably always be the strongest exposure to the artist. And I think, you know, an artist, in our case, from the fun like this is an opportunity to write like, a kind of bigger check at once. And push and help push Daniel to the next level. But also, from the fun we’ve been buying his music NFTs directly as kind of like a side as a side to the investment directly. So, we have his music NFTs in the phone as well.

Got it.

BlockchainBrett: Yeah. And I think it’s like, it just goes to show that like that, like owning his music NFTs are a really strong exposure to his future. And like how he’s gonna continue to innovate and grow on that. And it really is like an opportunity to be a part of his future and like have like his upside, like I think, you know, when you look at investing in this round, like you know, sure, like you don’t have to invest in the equity of Daniel Allan in order to get the access or that be a part of his journey. Like I actually think that NFTs are the best exposure to and that’s why we also thought NFTs insights from the fun and we’re excited to support from all sides of the exposure.

Cooper, how do you think this changes the game for artists in web three?

Cooper Turley: I think it sets a new precedent. You know, you have record deals, you have distribution deals, you have publishing deals, and now you have equity seed rounds. And I think what we’re doing here with Daniel shows that there’s an alternative to everything that exists out there today. I think it’s going to take a lot of time for it to get fleshed out and be able to be recreated by a lot of artists at scale. But you know for Daniel’s specifically, he has a great group of supporters around him. There’s people have been collecting his music for last couple years, they really see the vision of what we’re building here with web three. And so, I’m optimistic that there’s going to be many more of these seed rounds in the future. But I think Daniels really pioneering what it means to support an independent artist that scale.

Implications for Other Creators Who May Follow the Same Path

Daniel, I know you’re often vocal about, like wanting to be the example for other creators in the space, you did this with your personal website, you did this with your like attributes to your different NFTs that you’ve dropped, like you’ve consistently set that tone for yourself. And when I asked you how does this change a game, I’m curious, when you think of other creators that probably want to follow your footsteps eventually. What does this mean for them?

Daniel Allan: Yeah, I mean, I think the way that Cooper put it, saying that it’s like an alternative is a good way of looking at it. I think that the way I look at it is similar. But also, I think that like flexibility is always like the key word for me. Because the reality is like, when you sign a record deal, like you have really like, you know, unless it’s a 360 deal, which are like less kind of common. And I kind of think that this is more of like a web 360 deal. It’s kind of the like the term that we’ve coined for it. Like most traditional record deals are kind of like you have one at that, which currently like as presently constructed is like blowing up a record on Tik Tok, so that you can come out with a single, single does really well, you’re no longer shelved, you’re able to, you know, put an album out and maybe tour with it. But really like that is few and far between. And a lot of ways it’s kind of up to the Tik Tok lottery. I think for me, the reality is there are very, there are a lot of different avenues in my career. Right? Like there’s the music NF Ts which have always been the backbone, and I think kind of the most important part and the primary source of revenue, right? At least in the past two years. But then there’s my masters and my publishing, I’ve been really vocal about, you know, I’ve been very vocal about the fact that I want a big record, that’s something that I care about, and I’m like, not scared to talk about. And then there’s also my touring, which, you know, I signed to CAA six months ago, I have a bunch of really exciting touring announcements that I’m, that I think the first one is going to drop like at the end of this month, right. And then it also has to do with like my future endeavors, which I mean, you know, I’m not gonna say too much, but we have like a lot of plans for things that we’re going to be rolling out in the next six months to a year. And I think that the reality here is like when, you’re a record label, you’re kind of betting on one kind of side of an artist. And I feel like a lot of this has been people betting on me as a person, just as much as it’s them betting on me as an artist and betting on me as a businessman as well. So, that’s like, I think kind of the nuance, and I think that the, I think a lot of artists are not like one dimensional, where you know, I mean, don’t get me wrong, I love making beats just as much as the next guy or girl, you know, but I think that there are just so many things that I’m interested in, so many parts of my career that I want to build out. And I think even if I don’t have the total answer, or what I want my first global headline tour to be right now, I think that the people involved in the round trust that I’ll figure it out.

Cooper Turley: Yeah, and maybe to jump in here, I think that’s what’s exciting from an investment standpoint, is you don’t have to bet on one specific output from Daniel, it’s not like we have to only optimize for as NFTs doing well, or only optimize for his masters doing well. You know, this vehicle really allows you to have exposure to all aspects of Daniel’s career. And when it comes to investing in a creator, there’s so many different things that they might want to do, you know, who knows, maybe someday Daniel wants to open a pizza shop, right. And if he wants to do that, I think there’s a real world in which investors in this round are getting exposure to Daniels pizza company. Now, it’s not something that we’re going to investors today and saying, hey, Daniel is going to open a pizza shop, come and invest in, you know, the seed round. But I think in the short term, being able to say, hey, this investment vehicle actually encompasses his NFTs, it encompasses his masters, his publishing his touring. That’s an incredibly exciting prospect. And if you go out there, and you look at what deals look like today, as Daniel alluded to on the master side, a record deals really only touching your Spotify streams, you know, publishing deals, rolling and touching if you get placement in a commercial, or you get some streams on the radio, but for this opportunity, and the investors involved in it, they can sit back and feel confident that no matter what Daniel does, they’re gonna have some exposure to that. And supporting Daniel actually means just kind of giving him cash and getting out of his way. I think that’s something that’s very different from other vehicles, where people are so much more hands on in the process. You know, I believe in Daniel’s ability to spend the million dollars how he sees that’s fit. If that means that he needs to pay for recording budget, if that means that he needs to hire a content person. I don’t think the goal of us as investors say, hey, you need to do X, Y, and Z because it’s pre mandated based on 100 record deals that have been done in the past. This is creative ground for him to really explore what that means. And I think to his point earlier, Daniel, bringing on a couple of full-time employees to be able to help him scale up his content, to be able to think about things like getting more placements, more press, more opportunities on the touring side, having street teams and more presence in college atmospheres. I think all those doors are kind of open and enabled by this. And so, to really round that out, you know, a million dollars is not a lot in the grand scheme of things for running a company. But when it comes to an independent artist having a full-scale budget to spend on what they believe is best to scale their career, in partnership with people such as Brett, myself and all the other investors participating. I think it sets him up in a really strong position to make a big headline for himself over the next couple of years.

BlockchainBrett: Yeah, and I think it’s amazing how it is 360. You know, it makes a ton of sense but you know, I I think like, from my perspective coming at this, like I think what has been happening and then at the space like and what Daniel has done in the music NFT world is what makes this possible, like we have examples to point to previously, and like the crypto art space, like imagine if, for instance, x copy were to raise a seed round in 2018, or 2019, right, like he went on to do 100 million plus, I don’t know the exact numbers, but tens of millions, 100 million plus in sales. And I think that from an investor perspective, that’s something that you know, to get exposure to. Right now, we’ve seen an artist that you had no idea was possible to grow in that way, in a digitally native world and a crypto native world. You can do it and now we think it can happen with music, you know, or not think we were very confident you can happen in music and Daniels is that person we want to bet on to make it happen. And we can get exposure to that, right. And I think you get exposure to that from the NFTs directly as well. I think and the money is also, I think a big part of those resources that’s really helpful, is to create natively in the web three space with more collaborations, working with more partners, building out more of the stuff yourself that can interact with like. The same way that other web three companies are partnering and releasing on this protocol or doing creation with this app. It’s like, it’s just to have the resources even keep track of everything on web three, all the partnership opportunities, all the collaboration opportunities, where to draw up, how to drop these, there’s like web three, manager web three aspects that I think take a lot of work. And it’s a lot for one person to take on themselves. So, I’m excited for Daniel to use the money to bring on some more help to build, even more so natively in the web three space, in addition to all the different aspects that make being a musician so much fun.

I think it’s one thing to recognize, sure, a million dollars is not a lot of money for a company. And we see people specifically in web three, raise 3 million over here, 10 million over here, a 25 million like we brush this off, like it’s no big deal to become a norm in our environment. But the reality is, it’s still very difficult to deploy a million dollars if you’ve never done something like this before. And it’s very difficult to deploy in a way where it’s efficient, and calculated, and you mitigate risk around along the way. And I feel like it opens up a whole new profile of things to consider than if you were to just take a standard record deal. Right? Like you’ve literally opened, like you are treating yourself as a startup and like respectfully said, like you, you have to think yourself, treat yourself as someone who’s generating cash flow, right? You have to think about your operations, you have to think about all these things that a traditional company would sort of like, consider when they’re raising funds and taking their data do their business in into their own hands. And it’s a, I don’t know if it’s for everyone, like I want to think that it’s like, it’s one of these models where it’s an alternative model 100%. But I don’t know if everybody can withstand the responsibility that comes with this. Do you guys have any thoughts around that?

Daniel Allan: Yeah, I mean, that’s why that’s why for me, I purposefully decided to like, still have traditional mechanisms and barriers in place, like having a manager and an agent, right? Because a lot of my life right now, you know, is going to be, yeah, like making beats and doing the things that I’m really good at. And, you know, a lot of, I remember when I was like starting off, like early in the music industry, I’m obviously still so early in my career, but I remember like, I was really looking for record deals to be able to pay my rent for a little bit of a time. And I remember like, you know, I would get these marketing budgets thrown at me, and I remember having those conversations like, hey, you know, how are we spending this? Like where’s this gonna go? And like, some of the conversations were just like, yeah, man that’s on you, you know, like whatever you want to do, whatever, you know. And so, for me, that’s why I kind of have these barriers in place where I have these people on my team still is because, you know, I, my manager, who’s been, she’s, you know, she’s been in music for a little bit and has touched like, a lot of different aspects of it. It’s kind of just like, you know, it’s kind of been a catch 22, where it’s like, oh, well, like we I have these broad ideas for what I want to do. But then the question is always like, okay, but we need money for these ideas. But then to get money for the ideas, you have to sign a record deal. And if you’re in a record deal, you can’t execute as freely on those ideas, you know, so it kind of became this very interesting like catch 22 situations. And so, my having the guardrails in place of having people who have a little bit more experienced than me, and especially like Phil and Jonathan, my agents on the touring side, who have you know, that, you know, Phil has The Chainsmokers, he’s been doing, he’s been doing this stuff for like a really long time. And he’s also like very involved in web three as well, has definitely been, you know, a place of like, hey, you know, what are we thinking about this? Should I spend this much money on a tour? Or should I spend this much money like, on ad spend, whatever it is, you know, so that’s why I’ve tried to keep it a little bit traditionally intact as well.

Cooper Turley: I would add in there that I do not think that this is for everyone. I think it takes a very specific type of artists to be able to execute as an artist and a CEO. I think Daniel’s very uniquely positioned to do so, hence why this was an exciting investment opportunity from the fund. But to Adams original point, it’s a very complicated process, you know, expecting hours to be able to run a business at the same time as making music. It’s very difficult. And so, I think that there’s an exciting headline here of saying, hey, this artist got a million dollars. But when you really unpack that, that means that Daniel is a lot more responsibility on his shoulder. I think that there’s a lot of artists who are phenomenal artists, but they’re not great business-people, and they have teams around them that handle that. But in order for something like this to be a reality, you really do need the artists to think about their brand as a business. And I don’t think that’s something that’s for everybody. But in the particular situation that it is, I’m optimistic that these models can help to inspire people to think more like CEOs of their brand and of their company, because I think it really challenges you to elevate your ceiling and think more broadly about the opportunities that exist about being an artist today. And so, yeah, I don’t think it’s for everyone. But I think that Daniel is a great person to start this out with, and I’m hoping that he can inspire many more artists to come.

BlockchainBrett: I think like you know, it’s interesting like music and NFTs enable world or like, you actually really don’t need to raise as well and I think like as the music NFT market grows, you know, as you put out content you kind of like, as you release it you’re getting the value that content deserves like back to you. And you can kind of continue to fall off that basically, you’re releasing more music continues to find you more and more and you kind of continue to use that to grow the operations and I think you can do it organically. without raising, like people can do, musicians can do that over time without having to you know, set up a C Corp, but whatever reason to say, I think that option will always be there. I think in this situation, like Daniel is a very ambitious person. He has really big goals and he wants to get there quicker, and he sees an opportunity to make it happen. And we’re excited to support that. But you know, I think it’s somewhere in between like a label and music NFTs. There’s, there’s a spectrum and you can, like you can stay over in the Music NFT and really grow a lot and have a lot of growth around that as well. Even without like raising directly.

The Artist-Market Fit

Yeah, I want to bring up another interesting topic that just came up to mind as you were speaking, Brett, like art, startups typically raise money, either premarket, pre product market fit or as they find product market fit to help accelerate the things that they’re doing, right. And I’m trying to think if Cooper and Brett from more of an investor perspective, do you guys think of artists market fit? Like is that a thing in your mind where the artists reach a certain point in the market, where they accumulate enough attention or enough revenue around what they’re doing that, now they need capital to help accelerate those initiatives? Do you guys think of it like that?

Cooper Turley: I absolutely. Think of it like that. I mean, I think that Daniel is proven himself as being a leader and went through music specifically, but the thing is, it’s actually bigger than just Daniel, you know, and I think that obviously, Daniel said an incredibly precedent for himself to be able to go and sell music NFTs and have these kinds of major projects and events. But the bet on Daniel as an artist is not only the bet on Daniel’s individual artists career, as Daniel’s individual artists career and everyone else that he can inspire in tandem, as a venture investor, you know, we really think about 100x, 1000x returns, and if Daniel were to go and sell, you know, 500k worth of music NFTs every year, that’s great, but that’s not necessarily what we’re looking for as venture investors. You know, I think the opportunity here is it’s not only about Daniel succeeding really well in his individual artists career, which I very firmly believe will happen. Is Daniel taking that playbook that he’s built for himself, replicating that and executing that against dozens of other artists to come, so that he ends up becoming this sort of center point of saying, hey, if you want to make it as an artist and independent artists, and you’re passionate about web three, here’s the model that I use, and using these resources, we can help to upscale other artists careers that actually have exposure to those income streams as well.

ROI Investing in Artists

That makes sense and you brought up the element of sort of your guy’s perspective as an investment, right? You guys are investors, you need to return your investment, your LPS depend on that. Right? So I’m trying to think like, is this investment in and I know it’s like it’s an interesting topic to talk about publicly, especially with you on the call Daniel, like we don’t want to think of you as an investment but you’re making an investment, like the funds are making an investment like very simply put, so when I try to think of like the ROI of a bet like this one an artist, right? I’m trying to think like, what does the scale the ROI sort of look like? Because for anybody listening to this conversation, you’re gonna listen, you’re gonna get the creators listening to this, and that stimulating the curiosity and you’re also going to get the investors listening to they’re like, how can we also participate in what Cooper and Brett and all the other investors on the cap table just did, right? So, share that light with me for a minute, like how do you guys think about the ROI, like is this a 100x opportunity that you see a market for, where you see creators actually becoming billion-dollar brands and web three is a large component of surfacing those individuals, like where’s your head at when it comes to this?

BlockchainBrett: Yeah, I mean, I think that from the valuation, if you think about it from a brand like IP perspective of Daniel as an artist, and the potential that he can, I think, just from my perspective, just exclusively what he has ability to do to grow in the music NFT space. I mean, we see music NFTs like we saw crypto from virtually nothing, did like 50k in volume in 2018, to 2021 to and billions, right. And like that is where I see music NFT space going, and if that’s where that will go and who are the leaders in the music NFT space? How much of that volume are they going to be able to do, potentially a significant amount really stir that volume number up? So I see, you know, this as a leading brand, a leading IP, like Daniel Allen as someone that is, like one of one of those forefront artists in this space, and has the ability to like, basically, you know, be a lot of that be a good amount of that volume, like a real amount. So, yeah, in that situation, it’s like, okay, what’s the valuation that we’re coming in at now? And like what would a valuable IP in that area look like and other definitely, from where it raised, it definitely has that 100x potential. So yeah, we’re excited about just from that angle alone and let alone I know there’s always a lot of ambitions around the sort of web two, music web three worlds, and I think those things are just going to add to it a lot and increase ways but from my perspective, we’re pretty crypto native and even just that side alone is enough for us to show I’m really stoked about the opportunity.

Cooper, what do you think?

Cooper Turley: Think there are already billion-dollar creators that are out there today. You know, on the artist side, you can use an example like Jay Z, right. Jay Z has had an extremely prominent career as an artist, his masters are worth hundreds of millions of dollars and he’s the owner of rock nation. And so if you think about that from an investment perspective, what would it look like to have exposure to Jay Z’s masters and all of roc Nation’s masters? Now you add in this new component of web three and NFTs, and you’re just adding another layer on top of that, you have all of these artists that have gone on to start fashion brands or start different clothing lines or whatever it might be. I think all those opportunities are on the table. So even just looking at something like you know the sale of catalog, you’re seeing $10, $50 $100 million catalog sales left and right all the time now, that’s all on the table, plus this net new revenue stream that Daniel is producing. So absolutely, I think that creators are a billion-dollar business opportunities. And I think with someone like Daniel that’s thinking about this from a 5, 10-year perspective, I think there’s a lot of net new playbooks that haven’t even been built or started yet and I think that’s going to lead to even more value creation that we haven’t even seen today.

I love it. It’s such a good visual indicator to sort of think about how big this could be Cooper, because when you bring up the Jay Z example, like that’s a fantastic example, to think about all the other businesses that Jay Z sort of created that are under his umbrella as a brand, and the value that accrues to each of them because of his name, and because of his network, and because of his music and everything that he’s done. So, when you put it from that perspective, this model makes a lot of sense. And quite frankly, it seems huge. Like it seems, it seems really, really big. You have something else to had?

Cooper Turley: Yeah, Daniel, I think it’d be interesting if you told the story about Roger Federer, you know, you’re a big tennis guy and I think that story you told me about him as a creator and some of the business trades that he made was pretty legendary. So, I don’t know if you’re interested in telling that story. But I think it’s an interesting backdrop here.

Daniel Allan: Yeah, yeah. Yeah, that’s funny because I’m like, I’m trying to get Cooper more into tennis. Brett is already into tennis via palm tree crew and friends and whatnot. So yeah, I was given Cooper a little bit of a tennis lesson, so Roger Federer, for anyone who has not played tennis, he is the goat like technically speaking, even though Joe Kovitch will have like more slams, Federer is the like tennis playing goat and it’s not even a question, but outside of that he’s also the goat because of some of the business moves that he has, don’t shake your head like that. It’s just like, oh, we can talk about offline. But he’s also made like a lot of great business venture decisions like throughout the course of his career. So like for the longest time he was with Nike. And when it came time for him to renegotiate his Nike deal, I think that they were gonna pay him out on a contract that I think was $10 million a year, just like as like an endorsement deal. And instead of doing that there was this company it’s called on, is it called on running? I think that’s what it is. And basically, they were like, he signed like a clothing deal, I think with Uniqlo, but he was able to have like a separate clothing deal with on running and for on running. Instead of getting money up front. I think he got like 3% of the company and because he wore the shirt or no, he got, how much, yeah, he got 3% of the company and because he wore the shoes, he like basically mooned the stock of the company. And the company just, I think it’s worth $10 billion now so he made like $300 million off of that investment, of just like deciding to wear like the on running shoe. So yeah, good little analogy.

Cooper Turley: The reason the reason I want to tell that story is because A, Federer goated, that’s an incredible story, but B, when we think about investing in artists. I think a lot of the times we stop what we see on the surface, right? We stopped that buying Daniels NFT, how many streams did he get on Spotify? How many tickets did he sell on tour? What I’m personally excited about as with web three, there’s net new ownership mechanics here. If you’re producing and creating value for these networks, you can capture that value, whether it’s in the form of equity on a cap table or governance tokens. You know, the bet on Daniel is not only the bet on his individual assets, it’s actually his ability to create new business opportunities. You know, I think there’s a very real world in which Daniel has equity across a lot of these web three companies. I think that he’s capturing ownership in the form of retroactive airdrops and different things that these platforms are launching. And so, what I want to highlight here is that, again, going into the 360-exposure deal, it’s not only the music, you know, it’s Daniel’s ability to create value across many different revenue streams. And I think when you add all those different variables into the equation, the case for a billion-dollar Daniel economy is not just saying he needs to sell a billion dollars’ worth of music NFTs, there’s many different buckets that in aggregate are going to become valuable. And as investors I think that the opportunities to really make sure you have exposure to all those different instruments that are on the table.

Removal Process of a Web3 Record Deal

We talked earlier in the conversation like the different options artists have when it comes to getting capital, whether it be a record deal, doing something like this, crowdfunding, whatever it may be. And I can’t help but wonder that this model is like we’ve seen instances of this model, kind of like a crew across other creators outside of web three music. And my question for you guys is assuming this gets adopted more investors love this concept, more creators love this concept. They want to start raising equity rounds instead of taking record deals. Eventually, record deals expire to some extent, right? They have like limited terms and over a period of time either. Revenue gets accrued or whatever it may be in the deal ads, right. And the artists in the label go their separate ways. What is the equivalent of that here? Let’s say an artist doesn’t like the people on their cap table. And technically they’re kind of tied to them for good, unless they buy them out at some point, right? Like how are you guys thinking about the removal process? Because I can only imagine the questions going through people’s head as they potentially want to replicate something that you guys just did. Right. So I’m trying to get all corners of the spectrum here.

Coper Turley: There’s three pieces here and Daniel had some color one. I want to start by saying that because Daniel did an adventure around does not mean that he can’t sign a record deal. You know, I’m actually very excited for Daniel to assign a record deal in the future. And this was structured specifically to make it so that if Daniel does sign a record deal, that fits in very compatible with what was happening here. The second thing that I want to say is that the investors in this round are extremely crypto native, you know, people like Brett and myself, participants like noise Dao, Woodstock Dao, Fire Eyes Dao, these are people that are willing to take on an extreme level of risk. And so, I think their appetite for what this turns into is a lot more flexible than a traditional private equity firm or traditional venture arm of a record label. But lastly, on sort of the ownership side of things, this funding is non recoupable. And I think that that’s something that’s very different from other music investment opportunities. Typically, when you’re signing a record deal and a record label gives you a million dollars. You have to pay that record label back a million dollars before you make money. This investor I was set up to say that this investment is not recoupable. You know if Daniel doesn’t make a million dollars back, us as investors are aware of the fact that that’s the risk that we’re willing to need to take. And on the flip side of that, as far as Daniel’s ability to consolidate the cap table, in my opinion, it’s no different from a tech company going out and raising a Series A and if you don’t want people on your cap table at that next stage, you go to them and say, hey, we’re gonna raise additional shares. I want to give you an opportunity to cash out of this investment and then we’ll probably have to buy them out. But I will say that we were very, very diligent who we brought into this round and made sure that people were already invested in Daniel’s career. They’ve been collecting his NFTs for years at this point, Daniel as a personal relationship with all of them. And as far as the sort of downside protection here. This was not like it was touted to everyone who holds one day and your music NFT or even more than that, that’s residually interested in music at large. This was a very selective round with individuals who are very determined and focused on the sector at large. And so, I think that makes for a cap table that feels very flexible to Daniel’s part and allows him to be very versatile.

I think that’s like that’s the key. Go ahead, Brett. Go ahead.

BlockchainBrett: I was just saying that and really like in this situation. I mean, Daniels still like the biggest owner by far like he’s very much so in control. And you know, he sold like, I guess minority percent of like, I mean, you know, he has like the vast majority of company by far so, so. It’s really his, it’s his to do whatever he thinks is best. But it’s not up to us, we can’t tell him what to do. We can just, all we can do is just help and help guide.

Yeah, I think when we were talking about the stress and the pressure that comes from being an artist and treating yourself as a business, comes with who you have on your cap table. And Brett and Cooper, you guys have so much experience in this investing into different rounds, whether it be leading rounds, Angel and rounds, and seeing companies either demolish, getting into arguments, hits the fan somewhere, right. And a lot of how things get handled depends on who’s on your cap table, who you’re working with and the people that come together around something today. So, I think having a very curated cap table and a group of people around you that bet on you, is pretty much a contributor to what the success of this could look like down the line, especially giving you Daniel your creative and your creative ability to do whatever the hell you want and to make your vision come to life.

Daniel Allan: Yeah, and one thing I’ll say really quick is to be honest, and a lot of ways it really is just putting a formal stamp on something that’s been going on for years. You know, like a lot of the people that I’ve, that are in this round. I mean, I would say like almost all of them or people that have already expressed their belief in me by purchasing my music NFTs and being a part of, you know, part of the way and I remember like Adam from noise Dao after this, who’s also involved in the round both from noise and as an angel. He just sent me on telegram. He’s like nice to formally be in business and you know, that’s kind of how I feel about a lot of this. You know, what I mean? These are people that I’ve informally been in business with, you know, for a couple of years now. And this is just kind of, in my mind, it’s kind of yeah, like it’s a way for me to have resources to be able to scale it out, but it’s also a way to like give them a cushion to be like, hey, you know, in the extremely unlikely event that all my music NFTs go to zero, you guys.

I love that. I love that.

Daniel Allan: Yeah, that’s kind of where I’m at.

Cooper Turley: I’ll add in there to that. It’s funny because from an investor perspective, I think that like where investors are contributing here is actually very funny to me. You know, my relationship with Daniel is basically, he makes a song and then I tell him to mint it the same day that it drops, and Daniel is one checking me to be like, we have to follow this strategy, you know, Spotify, you need six weeks, all this stuff and I’m like, fuck the strategy. I was like, we’re in a net new business here. I dropped the song on the same day and so I think it’s just funny to hear about investor expectations from the standpoint of like, treat this as a very long form project, treat this as like a two to three year blueprint. Daniel is that such a formative place in his career where he realistically could go and upload a song to sound today, with no marketing, no promo, dropped that and make the equivalent of millions and streams in 24 hours. And I think that that’s a window that’s obviously very time based on where we are in the market today. But having that leverage to think about how to scale his business is extremely powerful. And I think the benefit of his cap table today is that everyone on that cap table also believes in that formula. They believe that Daniel should go and drop music NFTs in real time. They believe that Daniel should go and actually do these things that feel net new. And I think if you were to try and construct this round of people that were at record labels or traditional music industry execs that made their money off of catalogue, I think it would set him up in a very different position. So, I think that this round uniquely positions him to be very experimental and how he built his career from now and you know, someone that’s really invested in him, you know, I’m just excited to see where he takes it because he’s shown time and time again, that he’s willing to be innovative, and I think he’s gonna keep doing it moving forward.

Upcoming Milestones

The last thing I want to sort of leave all of us with and Daniel, this one’s directed at you typically when people raise money, they set milestones into place, right? I’m curious what your milestones look like. For the next few months if you’re willing and able to talk about them.

Daniel Allan: Totally. I want to play music festivals. That’s a very big part of my career and that I’ve, as I’ve been very vocal about. I want to drop; I want to do an album at some point. I know that a lot of the stuff that I’ve been doing has been branded as, you know like a project here and there and EP here and there, not entirely sure what an album looks like, right now. I mean, I know that, I’m pretty close to being done with like my next project after criteria. I think that my milestones in terms of the numbers, I want to keep pretty close to the team or I can, you know, me and Cooper may or may not have like a little like whiteboard, that talks about some of the numbers that we want to hit. But to me I of course have like metrics and numbers, but my biggest thing right now is, honestly just seeing what I can do with the resources that is gonna go towards the goals that I’ve always had. Right. And I think that a lot of those goals just fall into all those buckets, which is how can I have a record that goes crazy without giving away fucking 85% 90% of it? How can I play on some of the bigger stages in the world right, and then start to get my name across that way? How can I build brands and IP in a way that’s like that, that let gives me more leverage to do things that I’m really excited about. And I think, you know, more importantly, as we look into the future that Cooper and Brad have both kind of pointed out a little bit is like, how do I help bring other people on, you know, and start to get exposure to some of the things that they’re working on? Like the blueprint that I’m building publicly right now. So, yeah.

Outro

Look, I’m cheering you on. I’m really excited for this, to see where this in a year from now. We’ll have to do a check in literally in a year from now and see where we are in this process Daniel, Cooper, Brett, congratulations to the three of you. This is a lot to be proud of Daniel for yourself and the journey that you’ve come across and I’m honored that I’ve been able to document certain moments of it on the podcast, that we could always look back on and reflect on so more power to you guys, before we let you go, and we wrap up. Where can we find more about the project? Each of you, specifically Daniel, hit away.

Daniel Allan: yeah, I mean, by the time this is out, we’re gonna have a whole you know, whole thread documenting everything that we’ve talked about, and you can just find that on. I’m Daniel Allan on Twitter. You should also give invest in music and follow. You know, you should follow Cooper’s newsletter you should follow Brett. Yeah, pretty straight for it.

Where can we find palm tree crew?

Cooper Turley: Yeah, I’d say for me.

Let’s try this again. One sec. One sec. Cooper, where can we find, hold on, wait, wait. Cooper, where can we learn more about coop records and everything that you’re working on.

Cooper Turley: Best place to stay up to date would be on Twitter. Personally. I’m @Coopertroopa. Coop records @cooprecordsxyz and I very recently launched the podcast and rebrand a newsletter called invest in music. So, we’re gonna go deeper on all these topics and highly recommend it and just want to say very quickly thank you to Daniel for even allowing us to take this opportunity on. It’s something that’s extremely unconventional and took a lot of conversation to even have the reality in the first place. And to Brett who’s always been a huge supporter and always been a huge advocate here. We could not have done this without him. And I think that it’s really essential that he gets recognized as a key contributor to this journey because he does so much behind the scenes that people don’t see. And I don’t think this would be possible without him.

Brett, where can we find you man?

BlockchainBrett: Not sweet. Thanks. Good. Yeah, just I mean huge congrats to Daniel. I’m super stoked to be a part of it. And you know, Cooper also is just absolutely crushing it in the weeds, high level all over the place. For me, BlockchainBrett, for the fun, palm tree crypto and then also we launched a newsletter called creator’s GMI, where we’re talking about the crypto in more detail. So, follow.

Let’s go guys. Thank you so much, until next time.