Background

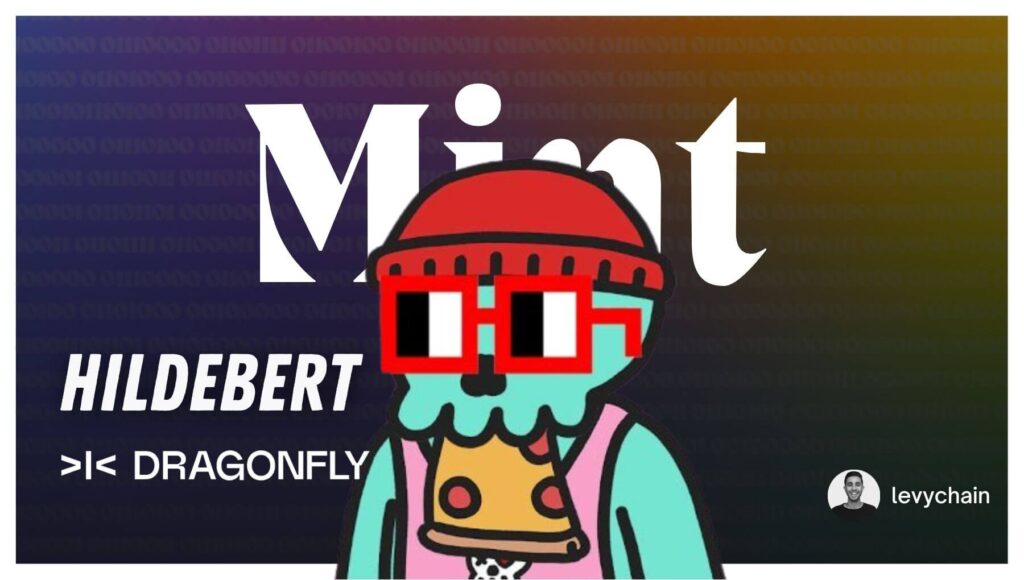

Mint Season 6 episode 21 welcomes Hildebert, the Dune Wizard and Data Analyst at Dragonfly Capital. Throughout the hour, we discuss blockchain data in the creator economy, metrics to measure the success of a crypto community, Hildebert’s perspective on royalties, the world of zero knowledge technology, trends that made on-chain data more favorable to analyze, and so much more.

I hope you guys enjoy our conversation.

Time Stamps

- 00:09 – Intro

- 04:21 – How Do People Use the Data You Provide?

- 06:17 – The Day to Day as Head of Data at a VC Fund

- 08:11 – Data Researching

- 08:59 – Thoughts Around Data in the Web3 Creator Economy

- 11:01 – Metrics to Measure the Success of a Crypto Community

- 13:46 – The Art Cobbler

- 14:18 – Hildebert’s Perspective On Royalties

- 18:07 – The Adoption of Analyzing On-Chain Data

- 19:41 – Tools For Understanding the Value Creators Generate

- 21:54 – Where Data Lies in the World of Anonymous Wallet Interactions

- 25:45 – What’s On Your List to Look into Right Now?

- 28:12 – Interesting Stats or Trends in the Bear Market

- 30:55 – What Are You Looking Forward to in Today’s Market?

- 31:47 – Outro

Support Season 6’s NFT Sponsors

🌿 Lens Protocol

Lens Protocol is a composable and decentralized social graph, ready for you to build on so you can focus on creating a great experience, not scaling your users.

Learn more by visiting: https://lens.xyz/

(🍄,🔍) Bello: The #1 for blockchain analytics tool for web3 creators

Bello is the no-code blockchain analytics tool that empowers web3 creators and communities with actionable insights on their collectors through a simple search.

Join private Beta: https://www.bello.lol/join

Hildebert, welcome to the podcast. Thank you for being on, a part of season six. How are you doing, man?

Hildebert: Great, great. Thank you for having me. It’s a pleasure.

Intro

It’s a pleasure to have you on, you’re destroying the streets of the on-chain data community. And when I did this season on on-chain data, I couldn’t really figure out who to bring on when I announced the season. But as I did more research, I found you and a few others from Dune, across crypto Twitter. So, I think a good place to start is who are you, man? What does the world need to know about you and how did you get your start into web three?

Hildebert: So, my name is Hildebert. I’m a French guy who, I got my start into crypto by doing an internship at a company called Keiko, which is an on chain, which is a data provider for central exchange data. So, trade data, Orderbook data or this and that also decentralized data, dec data. And then I went back to my master’s studies here in Amsterdam. And while we, I started my master’s studies, and alongside, eventually, I discovered dune and started to play around with it, to kind of understand the blockchain as a way to kind of fiddle and see, okay, how does this work and everything. And eventually, people started to take an interest from my work. And I get to realize, okay, this can be a lot bigger than just me like, getting interested into the data and, and digging in. And, yeah, so I started to take this more seriously. Eventually, I started in March 2021. And then I think, November, up until then, I was doing it just as a hobby on the side, then I started thinking more seriously then, and started to get some contract jobs, and basically started freelancing through the platform. I eventually dropped out of my studies in February, because I realized that at that point, I had gotten enough traction that basically my dune profile and building this out, as well as just my analytics career in crypto was more important probably than my actual CV, which I was never asked for in anything, in contrary to my dune profile. So yeah, from February, I took it seriously and I was like, okay, for now, I’m freelancing, but I’m waiting for the perfect opportunity. And what, and whatever job comes my way that I fully think is the right one for me. And that came out to be a data scientist position at dragonfly, a venture capital, pretty big one in the space, where I’m the first data scientist. And, yeah, it’s pretty cool. I get to do a lot of what I used to do in freelancing, but also a bit of working with portfolio companies or due diligence. And yeah, so it’s really a fun role.

So, when you started creating, I guess, charts, and web three, what were some of the graphs and areas of focus that you were known for?

Hildebert: At the very beginning, I started looking into defi, NFTs weren’t really a thing. Well, I mean, it was a thing, but it wasn’t as mainstream as it is now. And I looked into defi, I think I started with a crypto I was looking into, because I was investing and I couldn’t see any stats out there. So, I was like, okay, well, if no one has done it, maybe I can do it through dune, which was really cool. I learned basically, I didn’t realize SQL at all, at first, I just learned by forking other people’s queries and, and slowly building out some stats. So, I started there. And I also started kind of trend that I have, which is making Airdrop dashboards. So, whenever there’s a thing, I’ve done eight of them. Now, whenever there’s an airdrop coming, I’d say a notable Airdrop, from a notable protocol. I find it interesting too, because the only time I have to do it is whenever it drops. And I have to do it as soon as possible, so that it’s live as soon as possible. And I kind of like the challenge where each drop is slightly different in its mechanics. So, it’s a challenge of whenever it goes live, I have basically a timer and have to do the whole stats as quickly as possible, and then share it.

How Do People Use the Data You Provide?

Got it. That makes sense. So, of all these graphs that you’ve created, all these data points, metrics that you sort of analyzed, what sort of value does that bring to the end user? So, you’re the one creating it? How do people sort of interpret your data? Is it sort of to understand the market better, is it to sort of, is it to track what airdrops they get, like, how do they use your data? The people who have sort of fallen in love with your work?

Hildebert: Yeah, so I think airdrops is nice, but it’s not necessarily a big, it doesn’t bring a lot of value. It’s mostly to track how much has been claimed and stuff like this. It’s more of a fun challenge for me. The stats that people are more interested in from my profile are probably the micro stats on NFT marketplaces, which over the past summer, basically I took an interest for as the NFT started to explode, I guess. And at first yeah, there’s a lot of different sets. At first, it was global macro markets. So, comparing all the marketplaces and then looks rare came around and I did a lot of stats for looks rare, especially one dashboard that a lot of people were interested in, which is comparing looks rare to open sea. Because that’s it was trying to, the goal was to be competitors for open sea, so it was very interesting. So, it’s a lot of macro level statistics on a lot of NFTs. But there’s also, I did some gas, some stuff on gas, if you’re on gas, I did some stuff on staking. That’s one of my favorite dashboards I have. What else? I’ve done other. But yeah, I focus on a lot of things and whenever I have an interest, I’ll just look into it. If I can’t find the stats in a publicly and easily available way. I’ll make stat myself.

The Day to Day as Head of Data at a VC Fund

Makes sense. I know dragonfly has an extensive portfolio. And as the data scientist over there, I can’t imagine how closely maybe you work with the port COEs at dragonfly. I guess my question is like, what is the day to day look like, as a head of data at a VC fund? What are your jobs look like? What are your responsibilities look like? Are you trying to find alpha for the fund of new opportunities to sort of invest in like, walk me through that a bit.

Hildebert: So, I yeah, I’m not a partner, where my goal isn’t necessarily deal flow or stuff like this. But my main goal is still research. So, to like I used to surface stats and share them and share the first within the fun, but also afterwards, maybe to the public, if it’s relevant, then there is also often a partner is going to come and reach out to me and say, hey, could you help me look into this project? I mean, what they share with us looks good, but maybe the stats, the on-chain stats don’t line up or do line up but maybe you can give us a clearer picture on this. So that’s the whole due diligence. And then one of the most fun parts that I didn’t really foresee joining dragonfly was, is working with portfolio companies. There’s various really in what I do, but it can be research. So, working on a research piece with them. It can be, yeah; I don’t know anything. But the concept of having these new companies that I could definitely see as the future of the space. Seeing them early and working together in the nitty gritty parts of the project, I think is really interesting. So, it’s a, it brings, I guess there’s, I used to do a lot of data surfacing. But data researching is, I think, even more interesting and more engaging.

Data Researching

Can you, for those who don’t know what data, researching really means, can you go into that for a sec?

Hildebert: I mean, so I don’t know if data researching is a thing. It’s a term but I mean, researching, like, so that you can just surface that. So that’s relatively easy in that, okay, these number of transactions on open sea, and this is a factual stat, right. But then there’s some other pieces, which is more of a curation process. So, it can be trying to do some cluster analysis, some all kinds of different analysis that aren’t factual stats, but more of an interpretation of the stats and trying to make sense of them. And get out some information out of it. That’s yeah.

Thoughts Around Data in the Web3 Creator Economy

Makes sense. You know, that one of the main reasons why I wanted to have you on the podcast and for us to have this discussion is because, all of season six was centered around like audience interoperability and on like, as you build communities on chain, right, what does that mean? And also, the data availability that comes with sort of these communities forming and spawning, right and all these tokens that they’re issuing and these collective communities that they’re creating, right? What does that mean in the grand scheme of things in the context of the creator economy? And while I invited you on, I would love to sort of have a discussion on where does data fit in the web three, native creator economy? What is your overall thesis around that? Do you have thoughts around that concept?

Hildebert: I think data is a bit, in general in crypto is still a very new thing. If you look at the beginning of the fast bull market, it was not really much of a big interest as it was, as it is now, used to be mostly technical analysis. That was probably the only data you got but I think gets not really as relevant as the other data points you can get. And I think that going forward, that is going to be seen more and more as a goldmine for the creator economy in general, because you can, that way there’s a feedback loop. And you can actually see based on past events, past data, actually see what works, what doesn’t. It’s currently very under exploited, I would say, there’s very little data out there. For the same reason, probably that, you know, ads in crypto aren’t really a thing. I mean, they when they are, they’re terrible, and they’re on. Yeah, it’s not, it’s not really a thing. And I think it’s because we don’t have actually, any data, or no one has worked on data that shows what works and what does not. So, I think that is a big focus that I hope to see a lot of in the next bull market, next wave of projects that come out of the shadows.

Metrics to Measure the Success of a Crypto Community

So, let’s say a community surface during the bull market, there in the bear market now. It’s tough, like 1% of all these NFT collections are maybe going to last, 99% of them are maybe trash, right and don’t know really how to sustain, don’t know how to build and sustain communities. From your perspective, what metrics would you look at, as a way to determine the health of a crypto community? Whether an NFT community, a Dao, one that’s run, maybe offer social token, any sort of metrics that come to mind that you would consider like, these are the optimal metrics people should be measuring, as they sort of like conquer the bear market?

Hildebert: I guess it’s a case-by-case things because tokens are used differently for different protocols. But there’s some important ones like in terms of holder, whoever, how many people are actually holding, if it’s an NFT, or ERC 20 or whatever you want to see, how many are holding? Is it just two people holding the entire supply or more diverse set of people who are holding it? I think that’s very important. And then it’s a very tough question, what metrics? It depends. It really depends. If it’s if it’s solely an NFT, then probably, I would say some volume, some, yes, on volume in general is healthy. Dying volume is a thing of whatever markets are dying down. But you don’t want them to flatline. You think it’s a healthy thing for people, for new people to come in, and also other people to leave the project. So yeah, I think the volume that is holding steady is probably a good sign in general for a project. If it’s dying down it’s not as good of a sign. But also, I think the whole NFT space right now is a bit cluttered with a lot of the same things, the same, like the projects are, in terms of what they’re doing. There’s a lot of similarities, there’s not much diversification. And now we’re seeing the downfall of a lot of projects considering no royalties. And for many that was their sole source of revenue. So, I think, or I hope to see a lot of innovation coming our way. I really like for example, one of the things I’ve seen is paradigms, art cobbler, which they’re working on, I don’t know if you’ve seen it’s a project, it looks very innovative in it’s mechanics, and I kind of like that.

The Art Cobbler

What is the art cobbler? What are they doing over there?

Hildebert: It’s an NFT project. And there’s a whole mechanic with the ERC 20 tokens, as well as NFTs. And then you, I guess I’ll send it to you afterwards. But it’s okay, you can, yeah, I’m not gonna go, it’s more complex. But essentially, it’s more full-fledged of a project than a lot of just 10k PFP projects that are just that. Not much more.

Hildebert’s Perspective On Royalties

Okay. All right. Well, I’ll include the link in the show notes after this. Can you give me your perspective on the whole royalty debate? What are your thoughts around that?

Hildebert: Yeah. So, on a technical level, it’s really hard to enforce royalties. If you don’t have the main avenue for everyone to go and buy, sell your tokens, you can’t enforce, unless you have shown that the marketplace, you favor is also favored by the community and they have some probably incentive or some incentive to go back to this marketplace rather than other one. Because if you don’t go to this one, then the entire volume is going to go through a marketplace that has 0% royalty I think, that’s the future because it’s very hard to enforce on a smart contract level. So, I do think that a lot of projects can sustain the royalties, especially with the, lately there’s been reservoir which is a project that allows you to build your marketplace pretty easily through an API and have integrate basically all marketplaces. And I think through there, you can probably have your own royalties, and as long as you show to your community that this marketplace is better to be used than others. It could be other mechanics than just typical NFT marketplaces we see right now; I don’t know if some kind of necessarily rewards or I don’t know. But there’s there needs to be some innovation and to make sure that your community sticks to the marketplace you want, otherwise, the fees will be undercut.

Yeah, I remember, during the nifty gateway era, when a lot of these Instagram corporate artists were making their way into crypto, the royalty component was a very strong like selling point for them, right? Despite being able to make hundreds of thousands to millions of dollars on a drop, they accumulate a lot more value, maybe not a lot more, but sometimes it would over like supersede the value that they made on the primary sales through their secondary sales, right? And there’s this like whole, like wave of anger and like this angry mob, just like roaming crypto Twitter, and I’m imagining just like people with picks and shovels, just like chasing the people that are kind of like taking away the royalty and I’m curious sort of what happens down the line because I’m a big fan of creators getting the royalties, I think it’s a novel concept that’s unique to crypto, that you don’t really see anywhere else in the industry, outside of crypto at least. So, I’m curious how that sort of plays out, do you think it’s a sustainable model long term or is it just like experiments sort of surfacing?

Hildebert: I think as long as the user, the end user sees the value in giving you royalty, royalty to the creator, then it can be sustainable, in that I still foresee a large portion of traders to actually use the marketplace with royalties. But it really needs to be that actually the creator is probably giving extra value or has showcases something that warrants those royalties, I guess, you can’t just easily live off royalty and do nothing, which is a common problem with many NFT projects, just launch and then I guess, bail and don’t do anything and just benefit from royalties. So, I think it’s very tough to enforce but if you’re good, and you can show to your like your community, that is something that adds value and will enable you to create some more on top of this project or whatever, I think it can be sustained.

The Adoption of Analyzing On-Chain Data

Yeah, that was a little side tangent, I want to jump back into the data because that’s your core. And when we were talking in the green room preparing for the interview, you were telling me how like up to a year ago on chain analytics was extremely niche and the sector grew immensely during the recent market cycle. I’m curious to hear your perspective on what macro events you saw sort of motivate this further adoption, of analyzing on chain data, anything come to mind?

Hildebert: Yeah, so if you look back to early in the cycle, in this last cycle, there wasn’t as much to look into in general on chain, defi summer was the big defi boom. And it was really the first big thing I think, coming out of Ethereum and other EVMs. If you look before it was ICOs, but ICOs already, there’s not a lot to look into necessarily. So, I think the diversification of what’s going on chain led in general to more analytics. So now defi was much more of a niche before. It was interesting, but it was mostly there was like a uniswap V one, which was barely used compared to the volume of C now, similar to also NFTs which also exploded, and gave away to a new sector that people don’t want to dive into and analyze. So, I think the diversification of what is going on on-chain is what changed the public’s view on the need for analytics.

Tools For Understanding the Value Creators Generate

Do you think the industry is missing anything, in terms of empowering more web3 native users with on-chain data, so that they can become more informed? Because I argue like one of the biggest unlocks for creators and communities when they build in web three is the immutability, the transparency and the interoperability that comes with building on the blockchain. Yeah, I feel like a lot of these individuals, they don’t really have the right access to the right information, tools, infrastructure to really understand what’s happening from the value that they create, right? Do you feel the same way? Do you feel differently? What do you think?

Hildebert: I think, in general education for in crypto is a bit lacking. And when you start, I know I was a bit lost of, okay, what’s going on, there’s a lot going on. But you don’t necessarily know until you’ve been there for a bit what’s going on and what to use when. And that is, analytics is one piece of this whole puzzle that I think needs to be worked on. But I think it all comes with the lack right now focus on the UI and UX in general. You know, if you don’t use, if you don’t know how to use Meta mask, which for you is probably easy and trivial, like for me as well. But if you’ve never used it, it’s not intuitive, and you don’t necessarily understand it right away. So, it’s kind of a barrier to entry in the old space. And so yeah, I think, probably like the early ages, or the early age of the internet, where at first, it was really unusable for the average user. And no one knew what to do until nice interfaces came. And you could actually understand easily without necessarily, you know, I foresee a future where you don’t necessarily need to know what chain you’re on or what like the entire how route through what is routed your trade or whatever, you know, this will be hopefully abstracted away into the back end. And you will just know that, okay, you swapped this coin for this coin, or you bought this NFT or whatever. But you don’t necessarily need to deal with the underlying I don’t think.

Where Data Lies in the World of Anonymous Wallet Interactions

Makes sense. I also want to talk to you about sort of like the macro vision of where transparent data lies in the future of web three. There’s new technologies like ZKs, right, like kind of like popping up left and right. There are companies like Aztec popping up, right, and I am at the hackathon here at Eth, Bogota, there’s this group that built like a PFP project on Aztec, where that sort of information can’t really be traced and tracked and analyzed on Dune or Nansen. Because of the nature in which it’s built and launched. Also, if Vitalik, sort of proposed a new token standard, I think it’s like a new ERC 721 token standard, where sort of the interactions between wallet addresses are anonymous, right? And you can’t really tell it, like everything stays private, between everybody on chain. Where does data, like the value of data, the use of data sort of lie in a world like that, a privacy enforced world that people are, other groups are sort of building towards? What do you think?

Hildebert: So, first of all, I’m all for privacy, I think it’s really cool to finally have privacy layer built on top of the blockchain we have and I think it’s going to shift quite a bit how we analyze things, how we analyze these projects, in that we don’t necessarily know who owns it, but there’s still a lot to be looked into. And then there is the on-chain data but there is also not all the data, for example, listings on NFTs aren’t actually on chain, they need to be called through. It’s off chain data through an API, whether it’s open seas, looks rare or whoever’s API, we need to actually fetch that to obtain it. And I think all these privacy layers will feed some kind of data publicly into an API, not the part where it actually reveals who owns or who interacted whatever, but there’s a lot of data that is, I think the future is gonna be entangled between on chain and off chain data. Not everything needs to be on chain. There’s a lot of projects that if, especially if you want to scale and have more, technically advanced projects that have a lot more going on and a lot more transactions that needed, then you don’t necessarily need always to use the blockchain. It may not just make sense. So, proofs are submitted and often are sufficient. And in a way to analyze this, is to probably have the off-chain data available somewhere and have the ability for the end user check that proofs match with the off-chain data. And then you can essentially do just as much as you would have done with on chain data. In terms of privacy ones, obviously, that abstracts away anything on holders and whatever other privacy feature they want to add but there’s still a ton to be analyzed. Even now, as an analyst, I’m never bored, there’s always stuff to analyze this. I guess my backlog is more like constantly growing than shrinking, which is a good thing. There’s just loads of things to look into. And yeah, even in the privacy world, I think that’s gonna keep going up.

What’s On Your List to Look into Right Now?

What’s on your list to look into right now?

Hildebert: So, my list I have, so I have some, give me one second, I have like staging dashboards, which is dashboards I’m working on. And I only want to release the dashboard whenever it’s fully, once I’m very happy with it, I don’t want to have something incomplete. The main thing I’m working on right now is, we working my whole NFT markets, statistics. And because there’s, it’s been missed, interpreted lately, due to the fact that it’s missing some marketplaces. And also, by default, it’s not filtering out wash trading, which definitely should be by default. But it’s just I haven’t, last time I did, it was kind of right after looks rare, the whole looks rare thing in end of January, February, and since then, a lot more marketplaces have come up, like pseudo swap, X2Y2, and others. And so my stats have been misinterpreted. I think I’ve seen it on Bloomberg lately and a few other places and they use my stats with what’s trading, not unfiltered. As the thing,as a showcase that okay, the NFT market is down 97%, which when you look at the bigger picture, it really isn’t true. Like it’s way too soon, as well, I’ve had been gaining volume, especially lately, and taking market share from the open sea and other marketplaces. And also, they’re using raw trade data for looks rare I which isn’t really representative, because in January, it was huge volume if you look at raw volume, but if you filter, there’s actually a lot less so. But that’s a, general thing is one of my goals as an analyst is to surface data that is easily accessible and easy to understand. So that journals and any big, I guess publications, can understand and easily access it. There’s a lot of misinformation in data. And also, because it’s more click Beatty to have dooming titles. But I think I’m trying to do my part in making sure these medias have the right data to work with.

Interesting Stats or Trends in the Bear Market

Are there any interesting like stats or trends you noticed while kind of like surfacing data during the bear market? Anything you could share?

Hildebert: In terms of very interesting that I can share? I’m not sure there’s anything I can share that’s going to be something you don’t know or you haven’t seen. I’m looking into, I’ve looked into some staking data and trying to see how that evolved, postman merge, I wanted to see if the distribution of individual stakers was actually growing. Because I think once the merge has happened, there’s probably more confidence in the end user and that this staking system actually works and is more reliable than pre merge, a lot of you know, I was I guess a lot of people were probably expecting it to go wrong. And it has increased slightly in terms of share of people, who stake individually rather than going through liquid staking services or staking pools or stuff like this. But it’s a small amount, it’s not something that is yet to be huge. I think. Probably the Shango fork, when people will be able to withdraw their stake, will probably change that even further. But also give, I think, leeway for the liquid staking services to grow more as well because there’s a small period where you have to wait to get your stake in but also to stake and staking, liquid staking is going to help both on this front to have instance staking in and out at a small fee, of course, but also for whatever amount of Eth you want to stake, which is a big barrier to entry right now, not everyone has to Eth to stake. But yeah, I’m thinking that I guess the increase in confidence in the staking mechanism leads to more people staking individually but also through liquid staking.

Are you sticking yourself at the moment? Are you participating in that?

Hildebert: No, I am not. But I’m, I want to eventually stake, I will get my node up eventually.

What Are You Looking Forward to in Today’s Market?

I think I’m; I have a little bit of a problem to addicted on spending my Eth. So, I’m not staking. I just keep buying NFTs. One of the trends that I like to look at is, the rate of NFT collections, and how many there are in the market today. And there’s about a little over 180,000 NFT collections, as of what, Monday, October 10, 2022. And it’s been growing at like a 500% growth rate year over year. And despite the bear market, people are still creating, NFT sales are still increasing. And by the way, this data sort of source from into the block. Trade volume is still, it’s decreased by a lot but there’s still activity. And as someone who buys like a lot of music, NFTs, I’m also seeing a lot more activity kind of like happen on that niche factor. So, I’m noticing a lot more creators come into the space, I’m noticing a lot more web two native people kind of becoming more what web three native individuals, issuing NFT, social token Daos like, all very optimistic points of information for me to kind of like, continue my excitement of creating more content, right? Creating more of these episodes. And I’m curious how that sort of plays into effect a year from now, two years from now, I don’t know, the bear market is an interesting time. That’s all I’m saying. But I’m still optimistic. I’m still bullish, seeing NFT collections get created left and right, more and more and more. So yeah, I guess my last question to you, Hildebert is, what are you looking forward to in the bear market? What’s on your radar? And, yeah, we’ll end with that. And then we’ll let you go.

Hildebert: I’m kind of excited on what’s the whole scaling space that is growing, in terms of ZK, and all these filters that are being developed. ZK, in general, is a huge thing that is being worked on and a lot of protocols are coming out. I think today polygon announced their z k was beta, or staging, sorry, that’s what I mean. Sorry, that’s the word I was looking for. But and so I think that’s pretty exciting. Also, in terms of NFTs, I think it’s a very, very small market compared to probably what it will be in a few years, because right now they’re under exploited in their used case, they’re, by most not understood properly for what they are. And they can come into play for a lot of sectors that are yet to be looking into this. It could be music is still very small for NFTs and I think there’s an avenue where that grows. There’s in terms of, what else? There’s, yeah, there’s a lot of other markets. Of course, when I want to say this, I don’t have one in mind. But there’s a lot of other markets that can benefit from the technology that blockchains and NFTs help create.

Outro

Fantastic Hildebert before I let you go, where can we find you? Where can we find your work? Show it away.

Hildebert: Yeah, so I’m on Twitter as Hildebert, as well as on dune.com under the same name. And that’s the two biggest places where I at and I published my work, I will usually make all my dashboards available when it’s relevant. And also show them Twitter. Yeah, I think that’s it.

Amazing. Thank you so much for your time. Thank you for being on, we’ll have to do this again soon. But yeah, untill next time.

Hildebert: Thanks a lot for having me.